Your Currituck county real estate tax rate images are available. Currituck county real estate tax rate are a topic that is being searched for and liked by netizens today. You can Get the Currituck county real estate tax rate files here. Find and Download all free images.

If you’re searching for currituck county real estate tax rate images information connected with to the currituck county real estate tax rate topic, you have visit the right site. Our website always gives you suggestions for viewing the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

Currituck County Real Estate Tax Rate. The Currituck County Tax Administrators Office makes every effort to produce and publish the most accurate information possible. Owners of such property are required by law to submit an annual personal property listing with the County Assessor during the listing period of. North Carolina is ranked 1665th of the 3143 counties in. 038 of home value.

3165 Caratoke Hwy Currituck Nc 27929 Realtor Com From realtor.com

3165 Caratoke Hwy Currituck Nc 27929 Realtor Com From realtor.com

3 days ago Currituck County Property Taxes The tax rate for any given area of the county is the same for all types of taxable property. Currituck County collects on average 038 of a propertys assessed fair market value as property tax. 7 days ago The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038. 048 100 Valuation Special Districts - Individual Carova Beach Road Service District Corolla Fire Protection Service District Guinea Mill Watershed. Currituck county tax assessment Verified 9 days ago. Town tax billed on all real and personal properties is approximately 38000.

Currituck Countys property tax rate will remain at 48 cents for the upcoming 2018 fiscal year if the Board of Commissioners approves the 2018.

A majority of Currituck Countys general fund comes from property taxes. North Carolina is ranked 1665th of the 3143 counties in. A majority of Currituck Countys general fund comes from property taxes. 038 of home value. Currituck County collects on average 038 of a propertys assessed fair market value as property tax. Contact the Tax Office.

Source: city-data.com

Source: city-data.com

048 100 Valuation Special Districts - Individual Carova Beach Road Service District Corolla Fire Protection Service District Guinea Mill Watershed. The median property tax in Currituck County North Carolina is 900 per year for a home worth the median value of 240000. For example the tax rate is the same for land buildings mobile homes boats vehicles farm. The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038 of property value. Currituck county tax assessment Verified 9 days ago.

Source: realtor.com

Source: realtor.com

Value of land buildings and personal property. Currituck county tax assessment Verified 9 days ago. The Currituck County Tax Administrators Office makes every effort to produce and publish the most accurate information possible. Contact the Tax Office. The median property tax in Currituck County North Carolina is 900 per year for a home worth the median value of 240000.

Source: city-data.com

Source: city-data.com

Yearly median tax in Currituck County. 2019 Schedule of Tax Rates in Currituck County County-Wide Tax Rate. Gates County Tax Department 200 Court Street P. Currituck County North Carolina - Property Tax Rates 5 days ago The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038 of property value. Town tax billed on all real and personal properties is approximately 38000.

Source: realtor.com

Source: realtor.com

The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038. Currituck Countys property tax rate will remain at 48 cents for the upcoming 2018 fiscal year if the Board of Commissioners approves the 2018. Currituck County collects on average 038 of a propertys assessed fair market value as property tax. A majority of Currituck Countys general fund comes from property taxes. Currituck County collects on average 038 of a propertys assessed fair market value as property tax.

Source: realtor.com

Source: realtor.com

Value of land buildings and personal property. Currituck County collects on average 038 of a propertys assessed fair market value as property tax. Currituck County NC - Real Estate Tax Bill File Layout Author Cheryl Boisvert Created Date 20090921145410Z. The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038 of property value. If you have additional questions contact the Currituck County Tax Department at 252-232-3005.

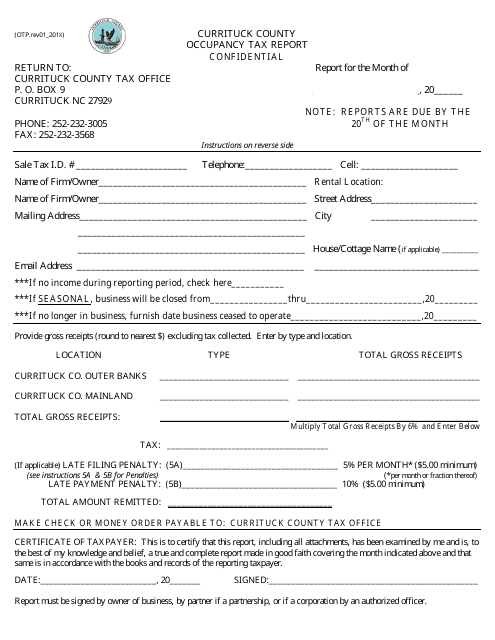

Source: templateroller.com

Source: templateroller.com

Currituck County collects on average 038 of a propertys assessed fair market value as property tax. If you have additional questions contact the Currituck County Tax Department at 252-232-3005. Currituck County collects on average 038 of a propertys assessed fair market value as property tax. The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038 of property value. Currituck County Property Taxes The tax rate for any given area of the county is the same for all types of taxable property.

Source: realtor.com

Source: realtor.com

Currituck county tax assessment Verified 9 days ago. Currituck county tax assessment Verified 9 days ago. Houses 5 days ago The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038 of property. A majority of Currituck Countys general fund comes from property taxes. To access this information start by performing a search of the property records data.

Source: issuu.com

Source: issuu.com

Town tax billed on all real and personal properties is approximately 38000. The median property tax in Currituck County North Carolina is 900 per year for a home worth the median value of 240000. Town tax billed on all real and personal properties is approximately 38000. Yearly median tax in Currituck County. Owners of such property are required by law to submit an annual personal property listing with the County Assessor during the listing period of.

Source: city-data.com

Source: city-data.com

7 days ago The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038. Owners of such property are required by law to submit an annual personal property listing with the County Assessor during the listing period of. Currituck County North Carolina Property Taxes Just Now The median property tax in Currituck County North Carolina is 900 per year for a home worth the median value of 240000. Property taxes are based on the assessed. Currituck County North Carolina - Property Tax Rates 5 days ago The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038 of property value.

Source: city-data.com

Source: city-data.com

2019 Schedule of Tax Rates in Currituck County County-Wide Tax Rate. The median property tax in Currituck County North Carolina is 900 per year for a home worth the median value of 240000. This site provides access to property assessment and tax record information for Currituck County North Carolina. Property taxes are based on the assessed. Currituck county tax assessment Verified 9 days ago.

Source: co.currituck.nc.us

Source: co.currituck.nc.us

The median property tax in Currituck County North Carolina is 900 per year for a home worth the median value of 240000. A majority of Currituck Countys general fund comes from property taxes. Yearly median tax in Currituck County. The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038. Property owners each pay a share of the cost of County services by paying taxes proportional to the value of their property.

Source: realtor.com

Source: realtor.com

Town tax billed on all real and personal properties is approximately 38000. For example the tax rate is the same for land buildings mobile homes boats vehicles farm. 7 days ago The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038. A majority of Currituck Countys general fund comes from property taxes. To access this information start by performing a search of the property records data.

Source: coastalreview.org

Source: coastalreview.org

For example the tax rate is the same for land buildings mobile homes boats vehicles farm. 038 of home value. For example the tax rate is the same for land buildings mobile homes boats vehicles farm and 6 1. The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038 of property value. The Currituck County Tax Administrators Office makes every effort to produce and publish the most accurate information possible.

Source: realtor.com

Source: realtor.com

Currituck County North Carolina - Property Tax Rates 5 days ago The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038 of property value. Currituck County collects on average 038 of a propertys assessed fair market value as property tax. The Department also bills and collects for the Town of Gatesville. North Carolina is ranked 1665th of the 3143 counties in. Currituck County NC - Real Estate Tax Bill File Layout Author Cheryl Boisvert Created Date 20090921145410Z.

Source: currituckncgov.com

Source: currituckncgov.com

Gates County Tax Department 200 Court Street P. 7 days ago The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038. 2019 Schedule of Tax Rates in Currituck County County-Wide Tax Rate. Town tax billed on all real and personal properties is approximately 38000. The median property tax in Currituck County North Carolina is 900 per year for a home worth the median value of 240000.

Source: city-data.com

Source: city-data.com

The median property tax in Currituck County North Carolina is 900 per year for a home worth the median value of 240000. However Currituck County makes no warranties express or implied concerning the accuracy completeness reliability suitability or interpretation of this data. The Currituck County Tax Administrators Office makes every effort to produce and publish the most accurate information possible. Town tax billed on all real and personal properties is approximately 38000. North Carolina is ranked 1665th of the 3143 counties in.

Source: realtor.com

Source: realtor.com

TO CURRITUCK COUNTY REAL ESTATE RECORDS. The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038 of property value. 2019 Schedule of Tax Rates in Currituck County County-Wide Tax Rate. This site provides access to property assessment and tax record information for Currituck County North Carolina. However Currituck County makes no warranties express or implied concerning the accuracy completeness reliability suitability or interpretation of this data.

Source: city-data.com

Source: city-data.com

However Currituck County makes no warranties express or implied concerning the accuracy completeness reliability suitability or interpretation of this data. Owners of such property are required by law to submit an annual personal property listing with the County Assessor during the listing period of. Yearly median tax in Currituck County. The median property tax also known as real estate tax in Currituck County is 90000 per year based on a median home value of 24000000 and a median effective property tax rate of 038 of property value. TO CURRITUCK COUNTY REAL ESTATE RECORDS.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title currituck county real estate tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.