Your Dekalb county ga real estate taxes images are ready. Dekalb county ga real estate taxes are a topic that is being searched for and liked by netizens today. You can Download the Dekalb county ga real estate taxes files here. Find and Download all royalty-free vectors.

If you’re looking for dekalb county ga real estate taxes pictures information related to the dekalb county ga real estate taxes interest, you have pay a visit to the right blog. Our site always gives you suggestions for seeing the highest quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

Dekalb County Ga Real Estate Taxes. The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or fractional part of 100. Real estate Show Real Estate DeKalb County Missouri Property Taxes - 2021 11 days ago The median property tax in DeKalb County Missouri is 788 per year for a home worth the median value of 115100. 1410 Lavista Rd Atlanta 2500000. In 1997 DeKalb County started collecting a 1 sales tax that is used to reduce property taxes.

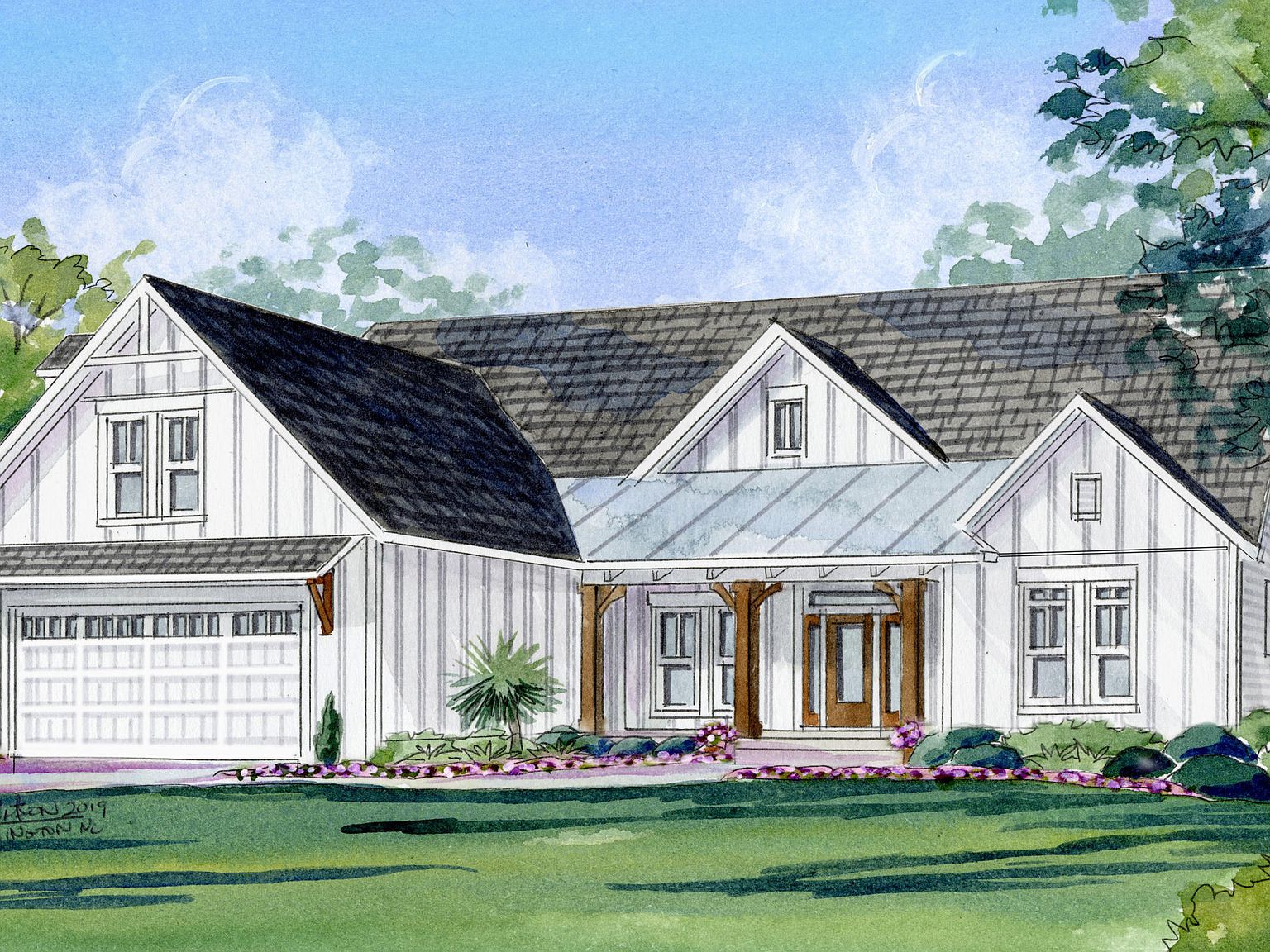

With Kitchen Island Homes For Sale In Lawrenceville Ga Realtor Com From realtor.com

With Kitchen Island Homes For Sale In Lawrenceville Ga Realtor Com From realtor.com

Real Estate Appraisal Process. Real estate Show Real Estate DeKalb County Missouri Property Taxes - 2021 11 days ago The median property tax in DeKalb County Missouri is 788 per year for a home worth the median value of 115100. Property Taxes are collected for Real Estate. They have to use at least 85 of the money collected in this sales tax to put towards increasing the homestead exemption. Pay My Property Taxes. Property Taxes.

Online applications are now open for the 2022 tax year.

In 1997 DeKalb County started collecting a 1 sales tax that is used to reduce property taxes. Online applications are now open for the 2022 tax year. City of Atlanta homeowners living in DeKalb have until June 1 to apply for a 2021 homestead exemption. A 395 convenience fee will apply. Cashiers checks money orders or cash are accepted any time through Friday October 23 2020. Personal Property 1234567.

Source: realtor.com

Source: realtor.com

DeKalb County Tax Commissioner Collections Division PO Box 100004 Decatur GA 30031-7004. Please contact the Treasurers Office if you have any questions. 8 days ago Property Tax Mailing Address. A 395 convenience fee will apply. Real Estate Appraisal Process.

Source: pinterest.com

Source: pinterest.com

No portion of the fee is paid to DeKalb County. Please contact the Treasurers Office if you have any questions. DeKalb County Tax Commissioner. Personal Property 1234567. Cashiers checks money orders or cash are accepted any time through Friday October 23 2020.

Source: realtor.com

Source: realtor.com

Modern-built with OPEN floor plan this Brookhaven luxury custom-built home is a dream come true - featuring a wine cellar theater room additional space for an office. Modern-built with OPEN floor plan this Brookhaven luxury custom-built home is a dream come true - featuring a wine cellar theater room additional space for an office. Business Personal Property Tax Return. They have to use at least 85 of the money collected in this sales tax to put towards increasing the homestead exemption. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note.

Source: realtor.com

Source: realtor.com

No portion of the fee is paid to DeKalb County. For more information on Dekalb County property information and tax payments please visit one of these County Departments. Personal Property 1234567. The Tax Payment Methods page has information about how you can conveniently pay your property taxes. A 395 convenience fee will apply.

Source:

Source:

Modern-built with OPEN floor plan this Brookhaven luxury custom-built home is a dream come true - featuring a wine cellar theater room additional space for an office. The deadline for DeKalb County homeowners to apply for a 2021 homestead exemption was April 1. DeKalb County Tax Commissioner Collections Division PO Box 100004 Decatur GA 30031-7004. You may pay in person at the DeKalb. The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or fractional part of 100.

Source: realtor.com

Source: realtor.com

Property Taxes. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Please go to our new Property Tax Inquiry Dashboard -wEdge. Online Property Tax Payments. Personal Property Appraisal Process.

Source: redfin.com

Source: redfin.com

The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. DeKalb County Clerk of Superior Court Real Estate Division Ground Floor 556 N. McDonough Street Decatur GA 30030 Contact Us 404-687. The Tax Payment Methods page has information about how you can conveniently pay your property taxes. Real Estate Appraisal Process.

Source: pinterest.com

Source: pinterest.com

Pay My Property Taxes. Modern-built with OPEN floor plan this Brookhaven luxury custom-built home is a dream come true - featuring a wine cellar theater room additional space for an office. McDonough Street Decatur GA 30030 Contact Us 404-687. Business Personal Property Tax Return. The deadline for DeKalb County homeowners to apply for a 2021 homestead exemption was April 1.

Source: realtor.com

Source: realtor.com

The deadline for DeKalb County homeowners to apply for a 2021 homestead exemption was April 1. Modern-built with OPEN floor plan this Brookhaven luxury custom-built home is a dream come true - featuring a wine cellar theater room additional space for an office. DeKalb County collects on average 068 of a propertys assessed fair market value as property tax. The average effective property tax rate in Dekalb County is 107. Property Taxes.

Source: realtor.com

Source: realtor.com

Any No HOA Fee 50month100month200month300. In-depth DeKalb County GA Property Tax Information In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. McDonough Street Decatur GA 30030 Contact Us 404-687. Real estate Show Real Estate DeKalb County Missouri Property Taxes - 2021 11 days ago The median property tax in DeKalb County Missouri is 788 per year for a home worth the median value of 115100. Personal Property 1234567.

Source: ar.pinterest.com

Source: ar.pinterest.com

McDonough Street Decatur GA 30030 Contact Us 404-687. The average effective property tax rate in Dekalb County is 107. Please contact the Treasurers Office if you have any questions. Online applications are now open for the 2022 tax year. Personal Property 1234567.

Source: realtor.com

Source: realtor.com

8 days ago Property Tax Mailing Address. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. Modern-built with OPEN floor plan this Brookhaven luxury custom-built home is a dream come true - featuring a wine cellar theater room additional space for an office. Real Estate Appraisal Process. Cashiers checks money orders or cash are accepted any time through Friday October 23 2020.

Source: pinterest.com

Source: pinterest.com

Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Property Taxes. DeKalb County Clerk of Superior Court Real Estate Division Ground Floor 556 N. Personal Property Appraisal Process. Real Estate 12 123 12 123.

Source: realtor.com

Source: realtor.com

The deadline for DeKalb County homeowners to apply for a 2021 homestead exemption was April 1. HOST Homestead Optional Sales Tax. Any No HOA Fee 50month100month200month300. Real estate Show Real Estate DeKalb County Missouri Property Taxes - 2021 11 days ago The median property tax in DeKalb County Missouri is 788 per year for a home worth the median value of 115100. Prior Years Tax Please note that payment posting information may be delayed due.

Source: nl.pinterest.com

Source: nl.pinterest.com

Only One Item Needed For Search. Only One Item Needed For Search. Online applications are now open for the 2022 tax year. Like property owners in other places around the country DeKalb County residents who own homes and other properties are required to pay property taxes. Please go to our new Property Tax Inquiry Dashboard -wEdge.

Source: realtor.com

Source: realtor.com

Real Estate Appraisal Process. No portion of the fee is paid to DeKalb County. For more information on Dekalb County property information and tax payments please visit one of these County Departments. The Tax Payment Methods page has information about how you can conveniently pay your property taxes. DeKalb County collects on average 068 of a propertys assessed fair market value as property tax.

Source: realtor.com

Source: realtor.com

Like property owners in other places around the country DeKalb County residents who own homes and other properties are required to pay property taxes. DeKalb County Tax Commissioner. In-depth DeKalb County GA Property Tax Information In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. The Property Tax Division of the Tax Commissioners Office is responsible for the billing and collecting of property taxes and the processing of Homestead Exemptions. The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or fractional part of 100.

Source: realtor.com

Source: realtor.com

Pay My Property Taxes. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. 8 days ago Property Tax Mailing Address. Please go to our new Property Tax Inquiry Dashboard -wEdge. For more information on Dekalb County property information and tax payments please visit one of these County Departments.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title dekalb county ga real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.