Your Douglas county real estate taxes images are available. Douglas county real estate taxes are a topic that is being searched for and liked by netizens now. You can Download the Douglas county real estate taxes files here. Find and Download all free vectors.

If you’re looking for douglas county real estate taxes images information linked to the douglas county real estate taxes keyword, you have pay a visit to the right blog. Our site always gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that match your interests.

Douglas County Real Estate Taxes. Douglas County Treasurers Office 1313 Belknap Street Room 102 Superior Wisconsin 54880. The Douglas County Treasurers Office offers two convenient pay options. Receiving all money from all sources belonging to the County. The primary function of the County Collector is the collection of personal and real estate taxes for the various taxing entities of the county.

Douglas County Co Recently Sold Homes Realtor Com From realtor.com

Douglas County Co Recently Sold Homes Realtor Com From realtor.com

Real estate taxes are based on real property assessments and the real property tax rate which is set annually by the Board of County Commissioners. Collecting real estate property taxes. Douglas County does not collect personal property tax. Douglas County Treasurers Office 1313 Belknap Street Room 102 Superior Wisconsin 54880. Please pay these to your local municipal treasurer at the address shown on the bill. The Douglas County Treasurers Office offers two convenient pay options.

The Douglas County Treasurers Office offers two convenient pay options.

Rather the taxable value is a percentage of the actual value. Receiving all money which by statute or County ordinance are directed to be paid to the Treasurer. Pay Real Estate Taxes - Drop Box. Real property land The Office processes homestead exemptions prepares the annual tax digest and conducts tax sales. Delinquent real property taxes are paid in inverse order starting with the most recent year of delinquency. Real estate taxes are based on real property assessments and the real property tax rate which is set annually by the Board of County Commissioners.

Source: douglastax.org

Source: douglastax.org

The County Treasurer is responsible for. Please pay these to your local municipal treasurer at the address shown on the bill. Real Estate residential commercial agricultural. Redeeming land subject to a tax certificate. The County Treasurer is responsible for.

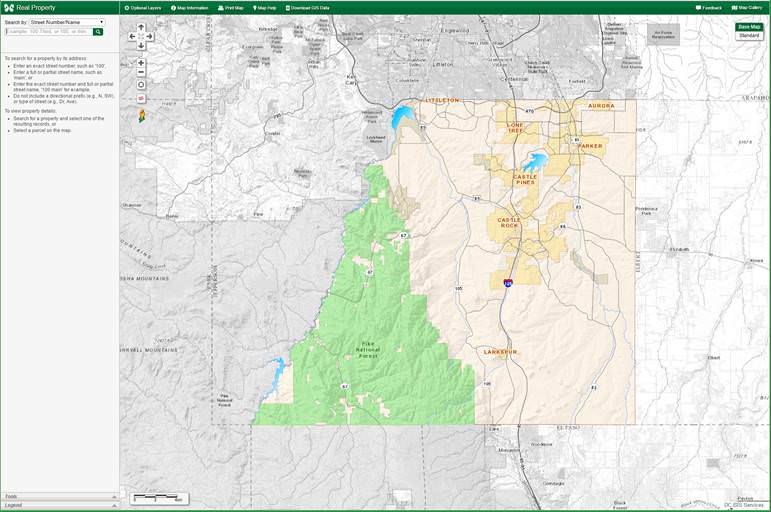

Source: douglas.co.us

Source: douglas.co.us

2021 Douglas County Tax. How to Calculate Taxes Statute provides that the actual value of property is not the taxable value. Douglas County Courthouse 1313 Belknap Street Superior Wisconsin 54880 Phone. Rather the taxable value is a percentage of the actual value. Real Estate Recording Document Recording Information Electronic Recording Examiner of Titles Recorders Fee Schedule Subscriptions Services - Landshark Taxes Parcel Info Lookup Tax Forfeited Land Law Public Safety.

Source: douglascountyks.org

Source: douglascountyks.org

How to Calculate Taxes Statute provides that the actual value of property is not the taxable value. The primary function of the County Collector is the collection of personal and real estate taxes for the various taxing entities of the county. Welcome to the Douglas County Treasurers Webpage. Property taxes can be paid in one payment by April 30 or in two EQUAL payments the first half payment is due by the last day of February and the second half payment due by June 15. Receiving payment of delinquent property taxes.

Source: lawrenceks.org

Source: lawrenceks.org

Douglas County Treasurers Office does not mail property tax notices to mortgage companies. 2021 Douglas County Tax. All Rights Reserved Disclaimer Privacy Statement. Personal Property cars trucks boats etc. Real estate taxes are based on real property assessments and the real property tax rate which is set annually by the Board of County Commissioners.

Source: omaha.com

Source: omaha.com

How to Calculate Taxes Statute provides that the actual value of property is not the taxable value. Real estate taxes can be paid by mail. Real Estate residential commercial agricultural. The median property tax in Douglas County Nebraska is 2784 per year for a home worth the median value of 141400. If you should have any questions regarding the above statements or the information contained within the delinquent tax list please contact the Auditors Office.

Source: douglastax.org

Source: douglastax.org

Real Estate residential commercial agricultural. Receiving all money which by statute or County ordinance are directed to be paid to the Treasurer. Redeeming land subject to a tax certificate. The County Treasurer is responsible for. 2021 Douglas County Tax.

Source: douglas.co.us

Source: douglas.co.us

Please pay these to your local municipal treasurer at the address shown on the bill. The primary function of the County Collector is the collection of personal and real estate taxes for the various taxing entities of the county. If you should have any questions regarding the above statements or the information contained within the delinquent tax list please contact the Auditors Office. Fiscal Year 2020-21 Property Taxes 3rd Installment due January 4 2021 12312020 NOTICE TO TAXPAYERS OF DOUGLAS COUNTY NEVADA The third installment of the 2020-2021 property tax is due and payable on January 4 2021. Pay Real Estate Taxes - Drop Box.

Source: douglas.co.us

Source: douglas.co.us

How to Calculate Taxes Statute provides that the actual value of property is not the taxable value. Real property land The Office processes homestead exemptions prepares the annual tax digest and conducts tax sales. Colorado Revised Statutes require the Douglas County Treasurer to mail a tax statement or notice of electronic statement availability of property taxes to each owner of record even though a mortgage company may be responsible for making payment. Please pay these to your local municipal treasurer at the address shown on the bill. The Douglas County Treasurers Office offers two convenient pay options.

Source: douglas.co.us

Source: douglas.co.us

Fiscal Year 2020-21 Property Taxes 3rd Installment due January 4 2021 12312020 NOTICE TO TAXPAYERS OF DOUGLAS COUNTY NEVADA The third installment of the 2020-2021 property tax is due and payable on January 4 2021. How to Calculate Taxes Statute provides that the actual value of property is not the taxable value. Douglas County Treasurers Office does not mail property tax notices to mortgage companies. Real property land The Office processes homestead exemptions prepares the annual tax digest and conducts tax sales. Check out our CreditDebit Card page for details.

Source: realtor.com

Source: realtor.com

Douglas County does not collect personal property tax. Receiving all money from all sources belonging to the County. Property taxes can be paid in one payment by April 30 or in two EQUAL payments the first half payment is due by the last day of February and the second half payment due by June 15. Check out our CreditDebit Card page for details. Real property land The Office processes homestead exemptions prepares the annual tax digest and conducts tax sales.

Source: realtor.com

Source: realtor.com

The Douglas County Treasurers Office offers two convenient pay options. Douglas County Treasurers Office does not mail property tax notices to mortgage companies. Colorado Revised Statutes require the Douglas County Treasurer to mail a tax statement or notice of electronic statement availability of property taxes to each owner of record even though a mortgage company may be responsible for making payment. Douglas County Treasurers Office 1313 Belknap Street Room 102 Superior Wisconsin 54880. Real estate taxes are based on real property assessments and the real property tax rate which is set annually by the Board of County Commissioners.

Source: douglas.co.us

Source: douglas.co.us

All Rights Reserved Disclaimer Privacy Statement. The primary function of the County Collector is the collection of personal and real estate taxes for the various taxing entities of the county. Receiving all money which by statute or County ordinance are directed to be paid to the Treasurer. Get Taxes Due A link to the Douglas County Treasurer. All Rights Reserved Disclaimer Privacy Statement.

Source: douglas.co.us

Source: douglas.co.us

Welcome to the Douglas County Treasurers Webpage. Real Estate Recording Document Recording Information Electronic Recording Examiner of Titles Recorders Fee Schedule Subscriptions Services - Landshark Taxes Parcel Info Lookup Tax Forfeited Land Law Public Safety. Real estate taxes can be paid by mail. The Douglas County Tax Commissioner collects taxes on behalf of Douglas County the City of Douglasville and the Douglas County portion of the cities of Austell and Villa Rica. Douglas County Treasurers Office 1313 Belknap Street Room 102 Superior Wisconsin 54880.

Source: realtor.com

Source: realtor.com

Please pay these to your local municipal treasurer at the address shown on the bill. Real estate taxes are assessed once a year in Douglas County. The primary function of the County Collector is the collection of personal and real estate taxes for the various taxing entities of the county. Collecting real estate property taxes. If you should have any questions regarding the above statements or the information contained within the delinquent tax list please contact the Auditors Office.

Source: douglas.co.us

Source: douglas.co.us

Receiving payment of delinquent property taxes. 2021 Douglas County Tax. Receiving payment of delinquent property taxes. Real estate taxes are assessed once a year in Douglas County. Get Taxes Due A link to the Douglas County Treasurer.

Source: douglas.co.us

Source: douglas.co.us

Douglas County does not collect personal property tax. Welcome to the Douglas County Treasurers Webpage. Personal Property cars trucks boats etc. Colorado Revised Statutes require the Douglas County Treasurer to mail a tax statement or notice of electronic statement availability of property taxes to each owner of record even though a mortgage company may be responsible for making payment. Collecting real estate property taxes.

Source: dcassessor.org

Source: dcassessor.org

Real property land The Office processes homestead exemptions prepares the annual tax digest and conducts tax sales. Check out our CreditDebit Card page for details. How to Calculate Taxes Statute provides that the actual value of property is not the taxable value. Real Estate Recording Document Recording Information Electronic Recording Examiner of Titles Recorders Fee Schedule Subscriptions Services - Landshark Taxes Parcel Info Lookup Tax Forfeited Land Law Public Safety. Please pay these to your local municipal treasurer at the address shown on the bill.

Source: omaha.com

Source: omaha.com

Please pay these to your local municipal treasurer at the address shown on the bill. Welcome to the Douglas County Treasurers Webpage. Colorado Revised Statutes require the Douglas County Treasurer to mail a tax statement or notice of electronic statement availability of property taxes to each owner of record even though a mortgage company may be responsible for making payment. Real property land The Office processes homestead exemptions prepares the annual tax digest and conducts tax sales. How to Calculate Taxes Statute provides that the actual value of property is not the taxable value.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title douglas county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.