Your Fairfax county real estate tax due dates images are ready. Fairfax county real estate tax due dates are a topic that is being searched for and liked by netizens today. You can Download the Fairfax county real estate tax due dates files here. Find and Download all royalty-free photos and vectors.

If you’re searching for fairfax county real estate tax due dates images information linked to the fairfax county real estate tax due dates keyword, you have come to the right blog. Our website always gives you hints for downloading the highest quality video and image content, please kindly surf and find more informative video content and images that match your interests.

Fairfax County Real Estate Tax Due Dates. Click on one of the property search links above to search by address by tax map reference number or by doing a map search. For information pertaining to the calculation of supplemental assessments please call the Real Estate Assessment Office at 7033857840. 4 days ago. Our tax specialists can provide assistance with county tax-related issues including payments refunds payment plans.

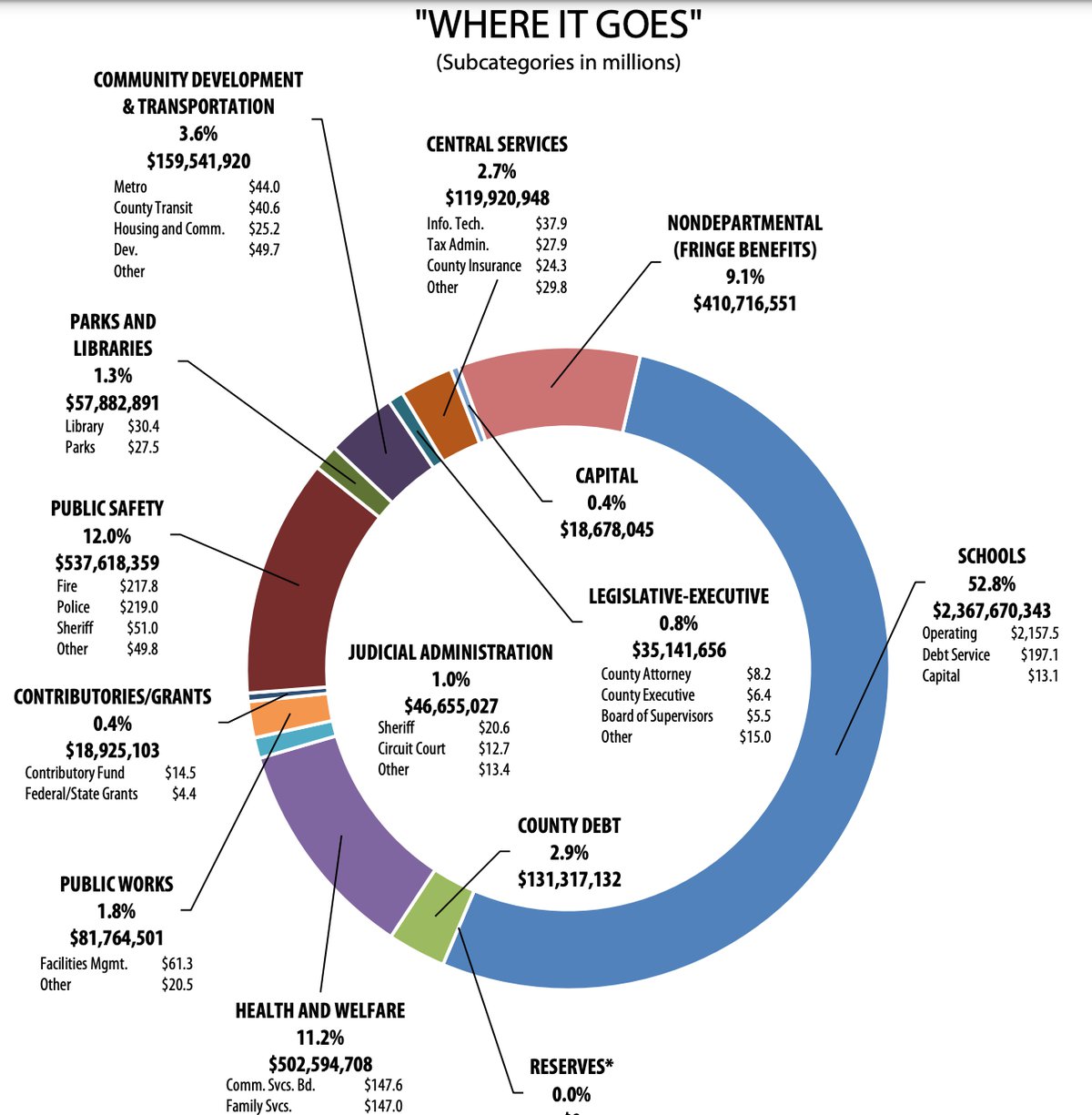

Proposed Fairfax County Budget Reduces Real Estate Tax Rate By A Cent Alexandria Living Magazine From alexandrialivingmagazine.com

Proposed Fairfax County Budget Reduces Real Estate Tax Rate By A Cent Alexandria Living Magazine From alexandrialivingmagazine.com

The deadline to report changes in personal property ownership was also extended to June 1. In its abbreviated session on Tuesday March 24 2020. Real estate taxes are paid annually in two installments due July 28 and December 5. 2021 Real Estate Assessment Notices Mailed Feb. As required by section 581-3924 of the Virginia Code notice is hereby given of delinquent real estate accounts as of December 7 2020 and personal property accounts as of December 7. The Department of Tax Administrations DTA Revenue Collection Division is responsible for collecting taxes fees and miscellaneous revenues for Fairfax County.

Real estate taxes are paid in two installments due July 28 and December 5.

The original deadline was May 1 and the consequence for. You can also view residential sales within a propertys assessment neighborhood. This payment is normally due a month earlier on July 28. The tax rate set by the Board of Supervisors is applied to that value to determine the tax amount due. The median property tax also known as real estate tax in Fairfax County is 454300 per year based on a median home value of 50780000 and a median effective property tax rate of 089 of property value. Real Estate tax bills are due in two installments on July 28 and December 5 of each calendar year.

Source: smartsettlements.com

Source: smartsettlements.com

The Fairfax County Board of Supervisors voted Tuesday to delay the deadline for individuals and businesses to file property tax returns. Real estate assessments are released in February and notices are mailed to every property in the county. If you have a mortgage but would like to see a copy of your bills please sign up for our MyFairfax Portal. Of the Countys 356171 taxable parcels 326263 experienced a value change for Tax. These lists will be updated quarterly.

Source: testfairfaxcounty.gov

Source: testfairfaxcounty.gov

Personal Property Tax and Motor Vehicle Tax decal Due. As required by section 581-3924 of the Virginia Code notice is hereby given of delinquent real estate accounts as of December 7 2020 and personal property accounts as of December 7. Our tax specialists can provide assistance with county tax-related issues including payments refunds payment plans. 3 rd quarter Virginia Estimated Income Tax. The first real estate tax payment deadline has changed from July 28 to Aug.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

The Department of Tax Administrations DTA Revenue Collection Division is responsible for collecting taxes fees and miscellaneous revenues for Fairfax County. The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2021 real estate assessment notices to County taxpayers today. Real estate taxes are paid annually in two installments due July 28 and December 5. This payment is normally due a month earlier on July 28. 4 days ago.

Source: pinterest.com

Source: pinterest.com

The original deadline was May 1 and the consequence for. The original deadline was May 1 and the consequence for. DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. Real Estate tax bills are due in two installments on July 28 and December 5 of each calendar year. Fairfax County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Source: pinterest.com

Source: pinterest.com

On Fairfax County extends tax filing and real estate property tax payment deadlines. In its abbreviated session on Tuesday March 24 2020. Failure of a taxpayer to understand any information provided herein will not constitute grounds for the wavier of any penalties or interest due to late payments. If your mortgage holder does not commit to pay your Real Estate taxes the tax bills will be mailed to your current mailing address. 2021 Real Estate Assessment Notices Mailed Feb.

Source: in.pinterest.com

Source: in.pinterest.com

This site provides assessed values and physical characteristics for all residential and commercial properties. The original deadline was May 1 and the consequence for. Click on one of the property search links above to search by address by tax map reference number or by doing a map search. The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax County. The deadline to report changes in personal property ownership was also extended to June 1.

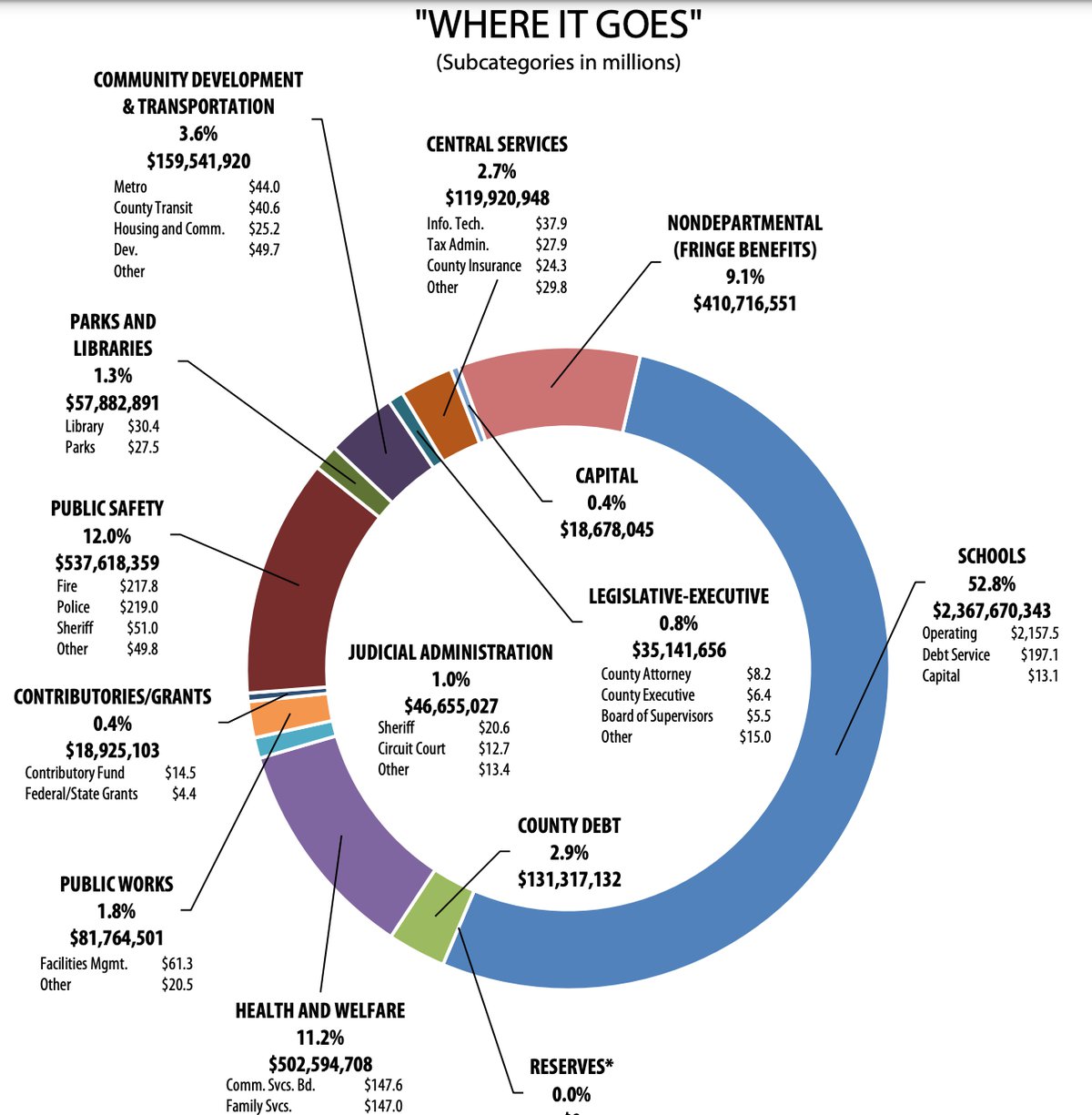

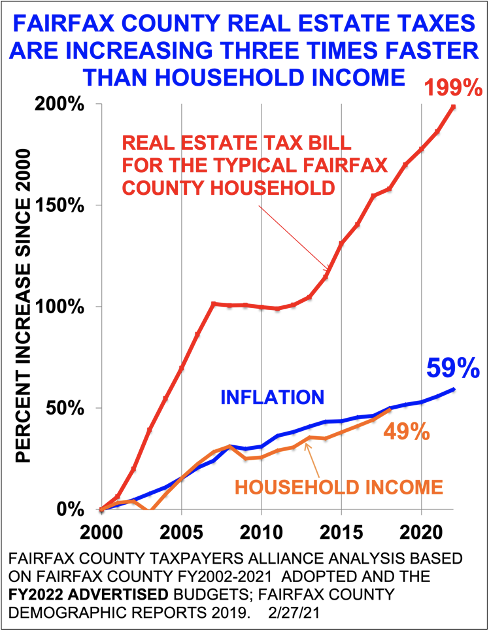

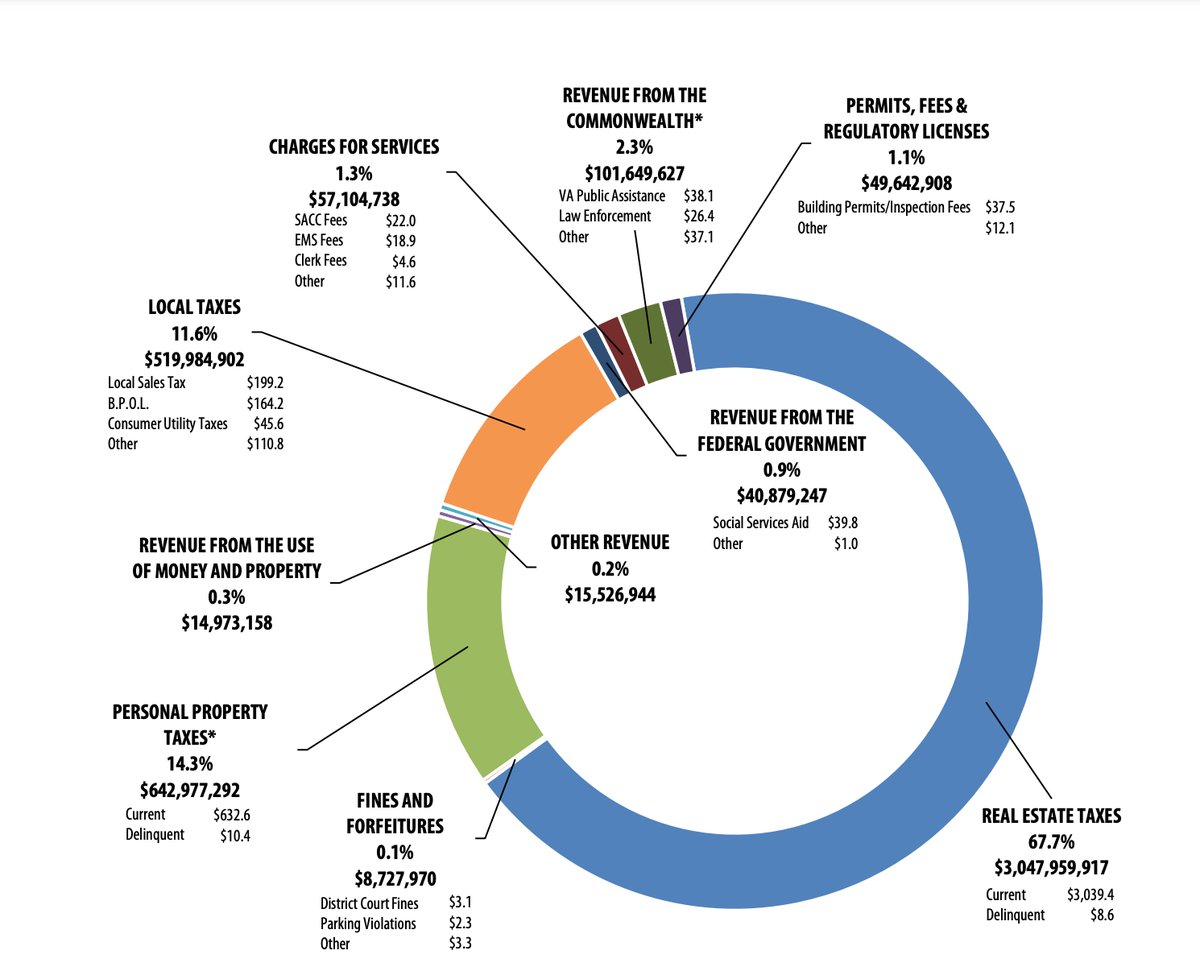

Source: fcta.org

Source: fcta.org

The deadline gives more time to homeowners who pay real estate. The tax rate set by the Board of Supervisors is applied to that value to determine the tax amount due. In late March the board extended the due date to pay the first half of real estate taxes until Aug. Personal Property Tax and Motor Vehicle Tax decal Due. Real estate taxes are paid annually in two installments due July 28 and December 5.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

In late March the board extended the due date to pay the first half of real estate taxes until Aug. Tax Relief Program City of Fairfaxs Finance Office administers this program. Of the Countys Countys. Interest accrues on the 15th of each month on any balance. The first real estate tax payment deadline has changed from July 28 to Aug.

Source: testfairfaxcounty.gov

Source: testfairfaxcounty.gov

You can also view residential sales within a propertys assessment neighborhood. The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2021 real estate assessment notices to County taxpayers today. Failure of a taxpayer to understand any information provided herein will not constitute grounds for the wavier of any penalties or interest due to late payments. 3 rd quarter Virginia Estimated Income Tax. Real estate taxes are paid annually in two installments due July 28 and December 5.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

Welcome to Fairfax Countys Real Estate Assessment Site. Real Estate tax bills are due in two installments on July 28 and December 5 of each calendar year. The tax rate set by the Board of Supervisors is applied to that value to determine the tax amount due. Real Estate Taxes Tax Administration. The deadline gives more time to homeowners who pay real estate.

3 rd quarter Virginia Estimated Income Tax. The Fairfax County Board of Supervisors has approved an extension of the countys tax deadlines for personal property and real estate property taxes. You can also view residential sales within a propertys assessment neighborhood. If you have a mortgage but would like to see a copy of your bills please sign up for our MyFairfax Portal. Taxpayers who missed this deadline are subject to the normal 10 penalty however.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. Tax Relief Program City of Fairfaxs Finance Office administers this program. As required by section 581-3924 of the Virginia Code notice is hereby given of delinquent real estate accounts as of December 7 2020 and personal property accounts as of December 7. Real Estate Taxes Tax Administration. Only the first owner is listed in cases of multiple ownership.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

The median property tax also known as real estate tax in Fairfax County is 454300 per year based on a median home value of 50780000 and a median effective property tax rate of 089 of property value. As required by section 581-3924 of the Virginia Code notice is hereby given of delinquent real estate accounts as of December 7 2020 and personal property accounts as of December 7. The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2021 real estate assessment notices to County taxpayers today. In late March the board extended the due date to pay the first half of real estate taxes until Aug. 2 nd quarter Virginia Estimated Income Tax.

Source: testfairfaxcounty.gov

Source: testfairfaxcounty.gov

DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. These lists will be updated quarterly. Personal Property Tax and Motor Vehicle Tax decal Due. Only the first owner is listed in cases of multiple ownership. The Department of Tax Administrations DTA Revenue Collection Division is responsible for collecting taxes fees and miscellaneous revenues for Fairfax County.

Taxpayers who missed this deadline are subject to the normal 10 penalty however. Real Estate Assessments Taxes. Interest accrues on the 15th of each month on any balance. 3 rd quarter Virginia Estimated Income Tax. The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2021 real estate assessment notices to County taxpayers today.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

Of the one-hundred-thirty-four counties in Virginia Fairfax County is ranked 4th by median property taxes and 16th by median tax. Fairfax County Government Center Credit. The notices will be sent to all County real estate owners. The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax County. It is our goal to achieve the full collection of all current and delinquent charges while providing quality customer service.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

The median property tax also known as real estate tax in Fairfax County is 454300 per year based on a median home value of 50780000 and a median effective property tax rate of 089 of property value. A supplemental tax bill based on this assessment is then issued by the Treasurers Office and due 30 days following receipt. For information pertaining to the calculation of supplemental assessments please call the Real Estate Assessment Office at 7033857840. Taxpayers who missed this deadline are subject to the normal 10 penalty however. 4 days ago.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

A supplemental tax bill based on this assessment is then issued by the Treasurers Office and due 30 days following receipt. Welcome to Fairfax Countys Real Estate Assessment Site. A supplemental tax bill based on this assessment is then issued by the Treasurers Office and due 30 days following receipt. Taxpayers who missed this deadline are subject to the normal 10 penalty however. The tax rate set by the Board of Supervisors is applied to that value to determine the tax amount due.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fairfax county real estate tax due dates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.