Your Fairfax county real estate tax payment images are available. Fairfax county real estate tax payment are a topic that is being searched for and liked by netizens today. You can Download the Fairfax county real estate tax payment files here. Get all royalty-free vectors.

If you’re searching for fairfax county real estate tax payment images information linked to the fairfax county real estate tax payment interest, you have pay a visit to the ideal blog. Our website frequently provides you with hints for seeing the maximum quality video and image content, please kindly surf and find more informative video content and images that match your interests.

Fairfax County Real Estate Tax Payment. Payment services on this site offer a convenient and secure option to pay your taxes. Click on the link for Personal PropertyMVLT and Real Estate. To use the online service a convenience fee will be charged. Fairfax County extends tax filing and real estate property tax payment deadlines The Fairfax County Board of Supervisors has approved an extension of the countys tax deadlines for personal property and real estate property taxes.

Pay Taxes Fees Tax Administration From fairfaxcounty.gov

Pay Taxes Fees Tax Administration From fairfaxcounty.gov

Fairfax County Real Estate Tax Payment Record 23 days ago Payment Options Tax Administration - Fairfax County. Select the Tax Bill Payment option which is the 6 th option. View Real Estate Taxes currently due on the parcel s you own in the County of Fairfax. The City of Fairfax does NOT receive any of these fees. Fairfax County Reduces Penalties for Late Car and Real Estate Tax Payments. 2021 Real Estate Assessment Notices Mailed Feb.

As a move to help taxpayers during the ongoing pandemic Fairfax County significantly reduced penalties for late personal property and real estate tax payments this year.

Steps to viewprint property tax payment information. You will need to have your account number and payment amount ready. Participation in this program authorizes Fairfax County to deduct funds directly from a. Each year the Real Estate Assessment Office appraises all real estate property in the City to determine its value for tax purposes. The tax balances on the online search system may not reflect adjustments or payments that are in transit. The real estate tax is determined by dividing the assessed value by 10000 and multiplying that result by the tax rate as established by the Fairfax County Board of Supervisors.

Using this system you may securely. All assessments of real property which includes land and permanently affixed structures are based on 100 of fair market value and are. The tax payment information on this site may not reflect recent payments or adjustments. Each year the Real Estate Assessment Office appraises all real estate property in the City to determine its value for tax purposes. Department of Tax Administration.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

Houses 5 months ago For real estate taxes you will need this years stub number from your real estate tax bill. WHAT WE DO. Payment services on this site offer a convenient and secure option to pay your taxes. Select the Tax Bill Payment option which is the 6 th option. Using this system you may securely.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

As a move to help taxpayers during the ongoing pandemic Fairfax County significantly reduced penalties for late personal property and real estate tax payments this year. You will need to have your account number and payment amount ready. The tax balances on the online search system may not reflect adjustments or payments that are in transit. In fact Fairfax County holds a moderate average effective property tax rate of 103 which compares well to the 107 national average. Fairfax County provides the option to pay most of your tax bills online.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

The real estate tax is determined by dividing the assessed value by 10000 and multiplying that result by the tax rate as established by the Fairfax County Board of Supervisors. With over 1 million homes for salefor rent available on the website. Pay online with e-check or creditdebit card. You will need to have your account number and payment amount ready. Welcome to the Department of Tax Administration DTA Real Estate tax payment system.

Source: wilesgroup.com

Source: wilesgroup.com

The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax County. Taxpayers are solely responsible for making payment by the required payment due date. Applications are sent out in February and must be completed and returned to the Finance Department no later than April 15 of that year. 56 people watched The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2021 real estate assessment notices to County taxpayers today. If you wish to pay now and do not have a current bill please call DTA at 703-222-8234 to obtain your stub number.

Penalty for late payment PLP of real estate taxes is normally 10 of the amount due and is applied automatically after the due date. The tax balances on the online search system may not reflect adjustments or payments that are in transit. Welcome to the Department of Tax Administration DTA Real Estate tax payment system. The tax payment information on this site may not reflect recent payments or adjustments. Steps to viewprint property tax payment information.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

View Real Estate Taxes currently due on the parcel s you own in the County of Fairfax. Welcome to the Department of Tax Administration DTA Real Estate tax payment system. Click on the link for Personal PropertyMVLT and Real Estate. If you wish to pay now and do not have a current bill please call DTA at 703-222-8234 to obtain your stub number. With over 1 million homes for salefor rent available on the website.

Fairfax County currently offers an automated payment program for the payment of vehicle real estate taxes and business tangible property. The City of Fairfax does NOT receive any of these fees. Houses 5 months ago For real estate taxes you will need this years stub number from your real estate tax bill. Participation in this program authorizes Fairfax County to deduct funds directly from a. On June 23 the Fairfax County Board of Supervisors approved these changes that will.

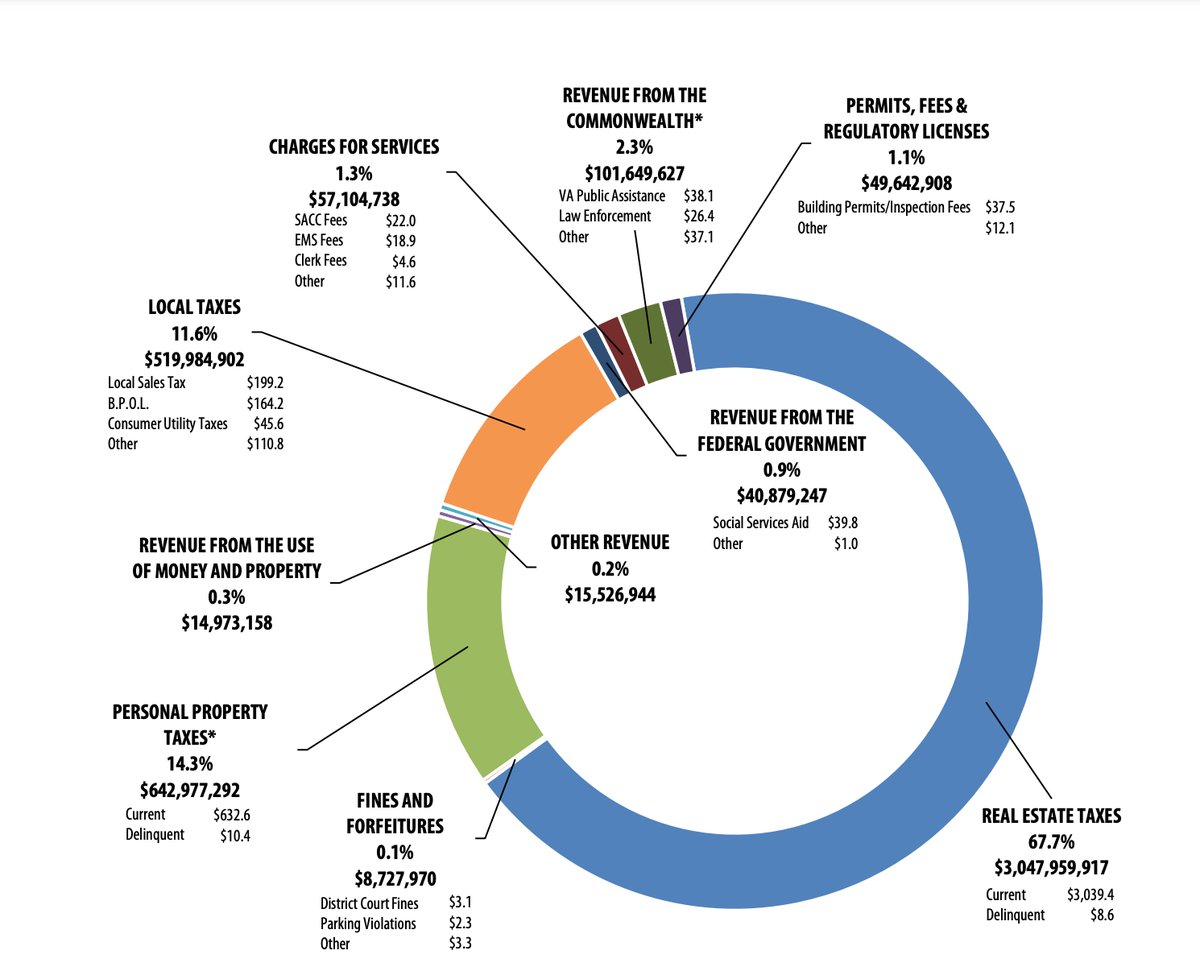

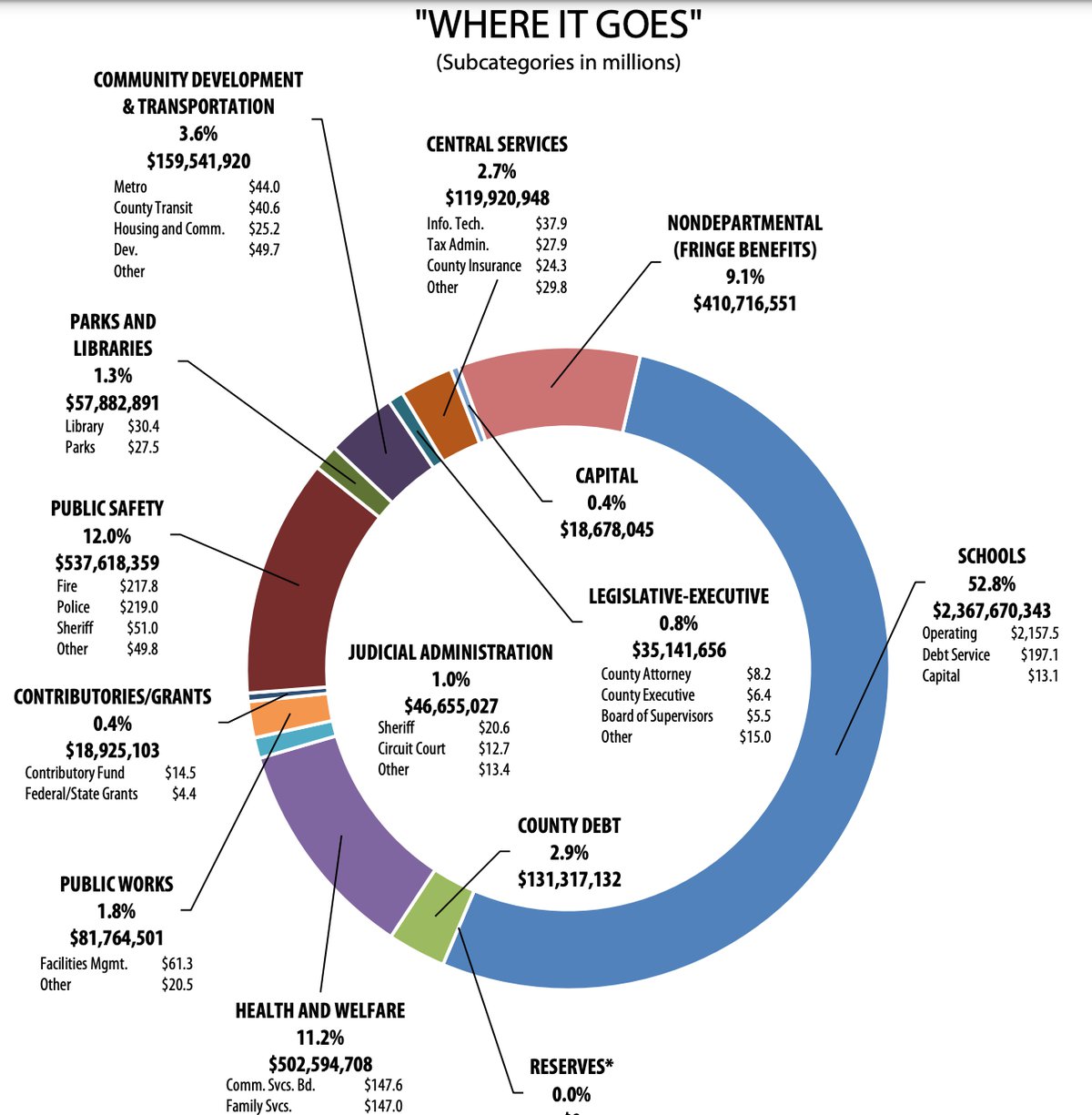

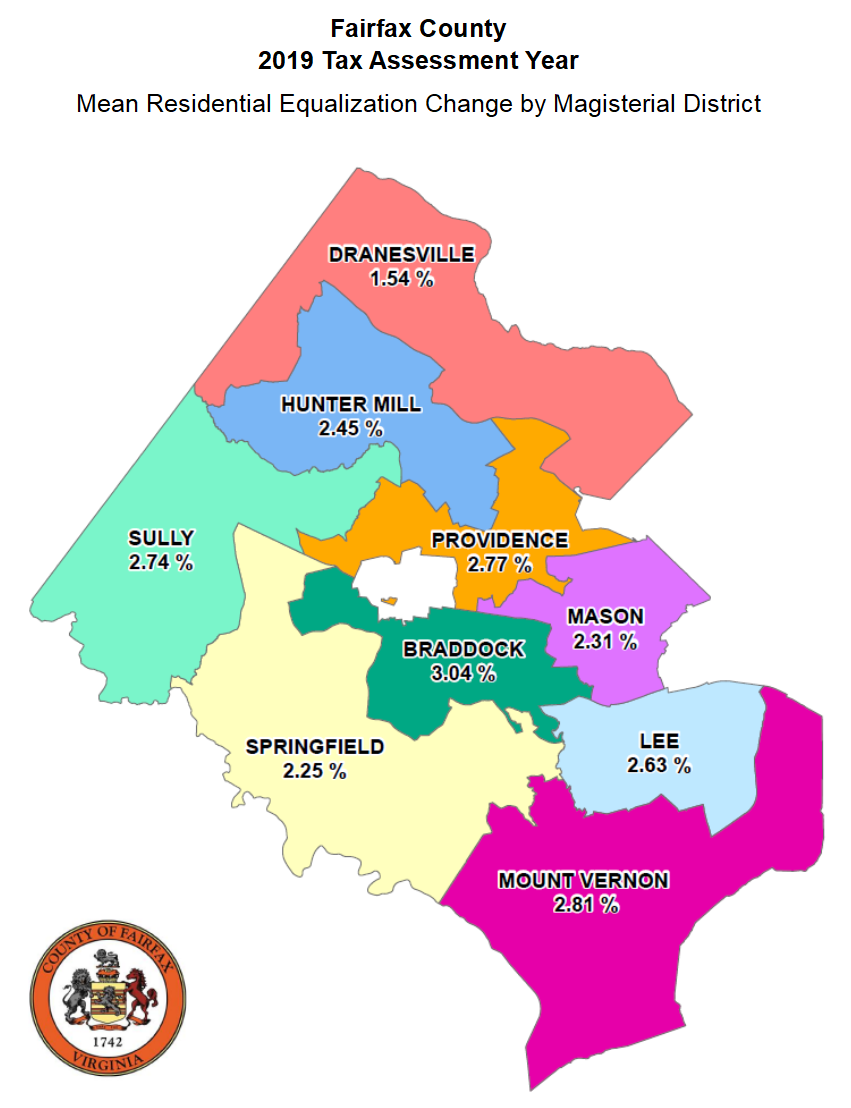

Source: fairfaxcountyeda.org

Source: fairfaxcountyeda.org

Information provided herein may not constitute grounds for waiver or abatement of any penalties or interest due to late payments. Simply input information from your bill and you will be able to pay online. Pay online with e-check or creditdebit card. The tax payment information on this site may not reflect recent payments or adjustments. On June 23 2020 the Board of Supervisors reduced that rate to 5 for tax year 2020.

Source: smartsettlements.com

Source: smartsettlements.com

The real estate tax is determined by dividing the assessed value by 10000 and multiplying that result by the tax rate as established by the Fairfax County Board of Supervisors. Pay online with e-check or creditdebit card. Using this system you may securely. Information provided herein may not constitute grounds for waiver or abatement of any penalties or interest due to late payments. The tax balances on the online search system may not reflect adjustments or payments that are in transit.

A third-party processing fee is assessed. Department of Tax Administration. As a move to help taxpayers during the ongoing pandemic Fairfax County significantly reduced penalties for late personal property and real estate tax payments this year. By Fort Hunt Herald March 26 2020. Applications are sent out in February and must be completed and returned to the Finance Department no later than April 15 of that year.

2021 Real Estate Assessment Notices Mailed Feb. 2021 Real Estate Assessment Notices Mailed Feb. Taxpayers are solely responsible for making payment by the required payment due date. Click on the Online Services tab at the top of the website. DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year.

Each year the Real Estate Assessment Office appraises all real estate property in the City to determine its value for tax purposes. On June 23 2020 the Board of Supervisors reduced that rate to 5 for tax year 2020. Click on the link for Personal PropertyMVLT and Real Estate. A third-party processing fee is assessed. Pay Real Estate Taxes by e-Check or credit carddebit card using our online payment vendor NIC Virginia.

On June 23 the Fairfax County Board of Supervisors approved these changes that will. As a move to help taxpayers during the ongoing pandemic Fairfax County significantly reduced penalties for late personal property and real estate tax payments this year. A third-party processing fee is assessed. Simply input information from your bill and you will be able to pay online. If you wish to pay now and do not have a current bill please call DTA at 703-222-8234 to obtain your stub number.

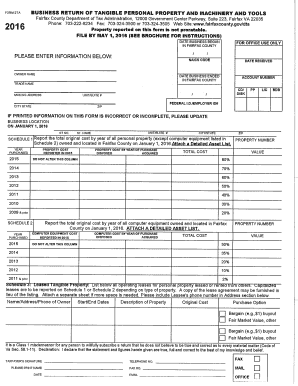

Source: signnow.com

Source: signnow.com

DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. Payment services on this site offer a convenient and secure option to pay your taxes. The tax payment information on this site may not reflect recent payments or adjustments. In fact Fairfax County holds a moderate average effective property tax rate of 103 which compares well to the 107 national average. By Fort Hunt Herald March 26 2020.

All assessments of real property which includes land and permanently affixed structures are based on 100 of fair market value and are. Fairfax County Reduces Penalties for Late Car and Real Estate Tax Payments. Applications are sent out in February and must be completed and returned to the Finance Department no later than April 15 of that year. On June 23 2020 the Board of Supervisors reduced that rate to 5 for tax year 2020. Pay Real Estate Taxes by e-Check or credit carddebit card using our online payment vendor Govolution.

Source: testfairfaxcounty.gov

Source: testfairfaxcounty.gov

Fairfax County extends tax filing and real estate property tax payment deadlines The Fairfax County Board of Supervisors has approved an extension of the countys tax deadlines for personal property and real estate property taxes. Pay online with e-check or creditdebit card. Information provided herein may not constitute grounds for waiver or abatement of any penalties or interest due to late payments. Taxpayers are solely responsible for making payment by the required payment due date. Houses 5 months ago For real estate taxes you will need this years stub number from your real estate tax bill.

The real estate tax is determined by dividing the assessed value by 10000 and multiplying that result by the tax rate as established by the Fairfax County Board of Supervisors. Payment services on this site offer a convenient and secure option to pay your taxes. Click on the Online Services tab at the top of the website. Steps to viewprint property tax payment information. Fairfax County Real Estate Tax Payment Record 23 days ago Payment Options Tax Administration - Fairfax County.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fairfax county real estate tax payment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.