Your Fairfax real estate tax assessment images are available in this site. Fairfax real estate tax assessment are a topic that is being searched for and liked by netizens now. You can Download the Fairfax real estate tax assessment files here. Download all royalty-free photos.

If you’re searching for fairfax real estate tax assessment pictures information linked to the fairfax real estate tax assessment interest, you have come to the right blog. Our website always provides you with suggestions for seeking the highest quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

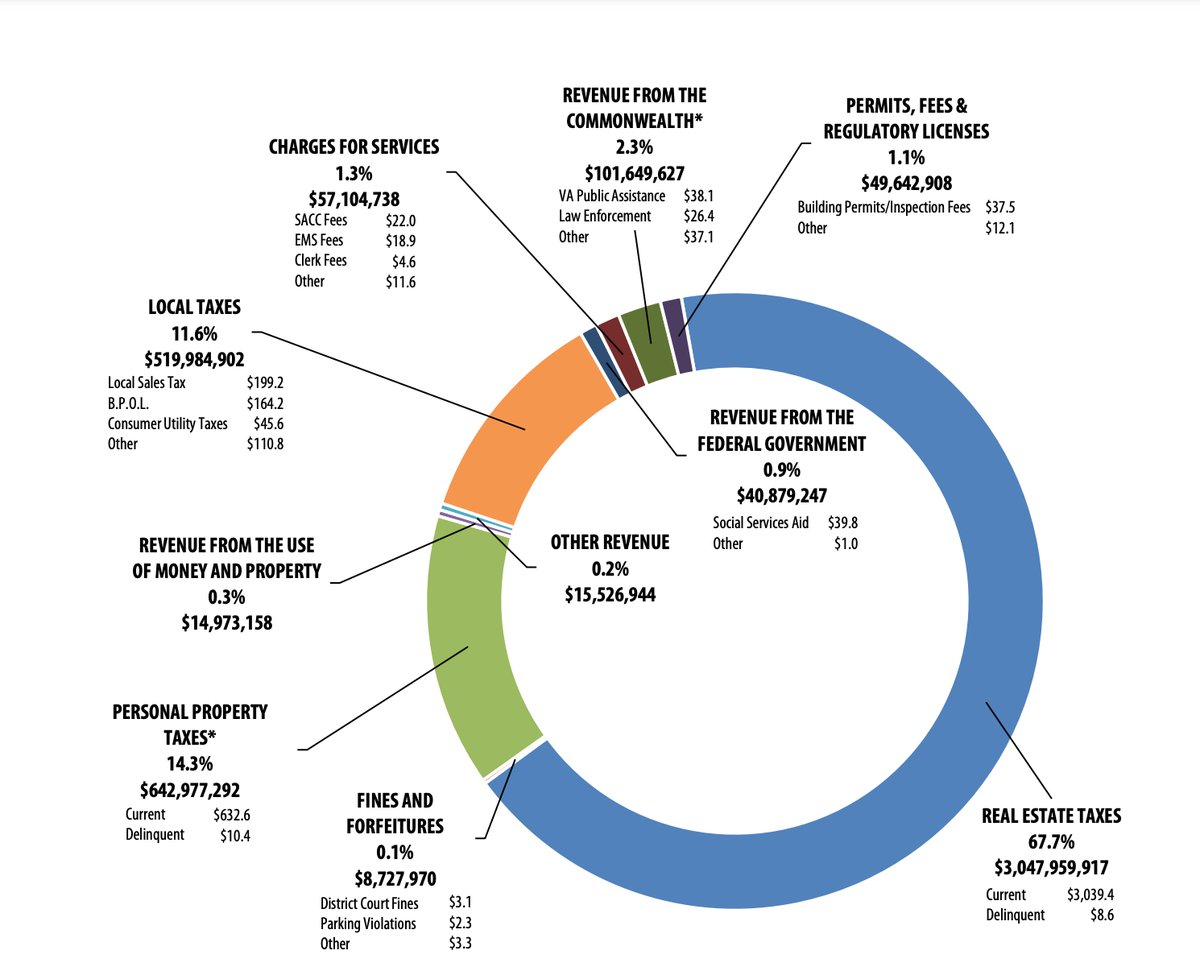

Fairfax Real Estate Tax Assessment. 2021 Real Estate Assessment Notices Mailed Feb. With over 1 million homes for salefor rent available on the website. For questions concerning the assessed value of your property contact Fairfax County. Houses 3 days ago The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800.

Virginia real estate tax bill. 56 people watched The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2021 real estate assessment notices to County taxpayers today. For questions concerning the assessed value of your property contact Fairfax County Tax. Assessments are based on large numbers of sales that are analyzed to determine values for large groups of similar properties. With over 1 million homes for salefor rent available on the website. Most homeowners pay real estate tax as part of a monthly mortgage payment.

Virginia real estate tax bill.

3 days ago The Real Estate tax rate is 0265 per 10000 of assessed value. However some homeowners pay their real estate taxes directly due July 28 and Dec. The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800 Fairfax County collects on average 089 of a propertys assessed fair market value as property tax. 4 days ago. When Ted started to dig into his assessment comparing his home to comparable homes nearby that had sold to builders he recognized that the values werent accurate and were often unverified and he really should appeal to the tax office. Houses 3 days ago The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800.

Source: smartsettlements.com

Source: smartsettlements.com

As part of the Fairfax County annual assessment program the Department of Tax Administration DTA reviews the assessed values for all real property each year with January 1 as the effective date of the assessments. Those of you who live in Fairfax County should be receiving your real estate tax assessment shortly. Houses 3 days ago The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800. Fairfax County uses actual real estate market sales prices when determining your annual tax assessment. The City of Fairfax Treasurers office makes every effort to produce and publish the most current and accurate tax information possible.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

Fairfax County uses actual real estate market sales prices when determining your annual tax assessment. Just Now The Real Estate tax rate is 0265 per 10000 of assessed value. Fairfax County Virginia Real Estate Tax Assessment - Mar 2021. See Understanding Real Estate Assessments for more information. Virginia real estate tax bill.

Source: testfairfaxcounty.gov

Source: testfairfaxcounty.gov

The real estate assessment notice is not a bill. Assessments are based on large numbers of sales that are analyzed to determine values for large groups of similar properties. Fairfax County is the assessing office for all town properties. 23 Tax 4 days ago. Virginia real estate tax bill.

Source: wtop.com

Source: wtop.com

DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. Those of you who live in Fairfax County should be receiving your real estate tax assessment shortly. Fairfax County Virginia Real Estate Tax Assessment - Mar 2021. The real estate assessment notice is not a bill. The Constitution of Virginia Article X Section 2 and the Code of Virginia 581-3201 require real estate assessments to.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

For questions concerning the assessed value of your property contact Fairfax County Tax. For a large number of you 88 the assessment went up. Virginia real estate tax bill. 4 days ago. Assessments are based on large numbers of sales that are analyzed to determine values for large groups of similar properties.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax County. An Assessment is a mass appraisal of property as of January 1 each year for tax purposes. When Ted started to dig into his assessment comparing his home to comparable homes nearby that had sold to builders he recognized that the values werent accurate and were often unverified and he really should appeal to the tax office. Find Perfect Real Estate Tax Statement Fairfax County. 23 Tax 4 days ago.

Source: reonomy.com

Source: reonomy.com

Click on one of the property search links above to search by address by tax map reference number or by doing a. 23 Tax 4 days ago. Those of you who live in Fairfax County should be receiving your real estate tax assessment shortly. Houses 3 days ago The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800. For a large number of you 88 the assessment went up.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

As part of the Fairfax County annual assessment program the Department of Tax Administration DTA reviews the assessed values for all real property each year with January 1 as the effective date of the assessments. This site contains basic information for all properties located in the City of Fairfax including tax map and account numbers property owners names and addresses the propertys legal description land size zoning building areas sales history current assessment and multiyear assessment history. Fairfax County is the assessing office for all town properties. For questions concerning the assessed value of your property contact Fairfax County. Find Perfect Real Estate Tax Statement Fairfax County.

Welcome to Fairfax Countys Real Estate Assessment Site This site provides assessed values and physical characteristics for all residential and commercial properties. Your mortgage company then sends the taxes directly to Fairfax County. Fairfax City Resolve Health and Human Services Income Tax Assistance Inspection Requests Limited DMV Services Real Estate Assessment Database Refuse Recycling Tax Bill Payment Vehicle Registration Personal. When Ted started to dig into his assessment comparing his home to comparable homes nearby that had sold to builders he recognized that the values werent accurate and were often unverified and he really should appeal to the tax office. See Understanding Real Estate Assessments for more information.

Source: testfairfaxcounty.gov

Source: testfairfaxcounty.gov

4 days ago. The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800 Fairfax County collects on average 089 of a propertys assessed fair market value as property tax. Real Estate Tax Statement Fairfax County Houses 9 days ago 2021 Real Estate Assessment Notices Mailed Feb. 2021 Real Estate Assessment Notices Mailed Feb. Fairfax County uses actual real estate market sales prices when determining your annual tax assessment.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Fairfax County Virginia Real Estate Tax Assessment - Mar 2021. For questions concerning the assessed value of your property contact Fairfax County Tax. For questions concerning the assessed value of your property contact Fairfax County. Houses 3 days ago The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800. Virginia real estate tax bill.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

The Department of Tax Administration DTA is charged with uniformly assessing and collecting taxes and fees for Fairfax County including Real Estate tax Vehicle Car tax Vehicle Registration fees Business taxes Dog Licenses and Parking Tickets. Fairfax County uses actual real estate market sales prices when determining your annual tax assessment. Each year the Real Estate Assessment Office appraises all real estate property in the City to determine its value for tax purposes. No warranties expressed or implied are provided for the data herein its use or its interpretation. Click on one of the property search links above to search by address by tax map reference number or by doing a.

This site contains basic information for all properties located in the City of Fairfax including tax map and account numbers property owners names and addresses the propertys legal description land size zoning building areas sales history current assessment and multiyear assessment history. An Assessment is a mass appraisal of property as of January 1 each year for tax purposes. Any errors or omissions should be reported for review. Fairfax County uses actual real estate market sales prices when determining your annual tax assessment. Assessments are based on large numbers of sales that are analyzed to determine values for large groups of similar properties.

Fairfax City Resolve Health and Human Services Income Tax Assistance Inspection Requests Limited DMV Services Real Estate Assessment Database Refuse Recycling Tax Bill Payment Vehicle Registration Personal. Fairfax City Resolve Health and Human Services Income Tax Assistance Inspection Requests Limited DMV Services Real Estate Assessment Database Refuse Recycling Tax Bill Payment Vehicle Registration Personal. The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800 Fairfax County collects on average 089 of a propertys assessed fair market value as property tax. The Department of Tax Administration DTA is charged with uniformly assessing and collecting taxes and fees for Fairfax County including Real Estate tax Vehicle Car tax Vehicle Registration fees Business taxes Dog Licenses and Parking Tickets. Virginia real estate tax bill.

Source: testfairfaxcounty.gov

Source: testfairfaxcounty.gov

3 days ago The Real Estate tax rate is 0265 per 10000 of assessed value. However some homeowners pay their real estate taxes directly due July 28 and Dec. For questions concerning the assessed value of your property contact Fairfax County. Real Estate Assessment Database. No warranties expressed or implied are provided for the data herein its use or its interpretation.

Source: reonomy.com

Source: reonomy.com

Fairfax County uses actual real estate market sales prices when determining your annual tax assessment. Virginia real estate tax bill. 4 days ago. The real estate assessment notice is not a bill. 23 Tax 4 days ago.

Source: testfairfaxcounty.gov

Source: testfairfaxcounty.gov

Assessments are based on large numbers of sales that are analyzed to determine values for large groups of similar properties. Fairfax County uses actual real estate market sales prices when determining your annual tax assessment. Find Perfect Real Estate Tax Statement Fairfax County. Fairfax County Virginia Real Estate Tax Assessment - Mar 2021. Fairfax County is the assessing office for all town properties.

Each year the Real Estate Assessment Office appraises all real estate property in the City to determine its value for tax purposes. The real estate assessment notice is not a bill. The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax County. The Department of Tax Administration DTA is charged with uniformly assessing and collecting taxes and fees for Fairfax County including Real Estate tax Vehicle Car tax Vehicle Registration fees Business taxes Dog Licenses and Parking Tickets. Those of you who live in Fairfax County should be receiving your real estate tax assessment shortly.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fairfax real estate tax assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.