Your Federal tax rate on real estate sale images are available. Federal tax rate on real estate sale are a topic that is being searched for and liked by netizens today. You can Find and Download the Federal tax rate on real estate sale files here. Get all royalty-free photos.

If you’re searching for federal tax rate on real estate sale images information linked to the federal tax rate on real estate sale interest, you have visit the ideal site. Our site always gives you suggestions for seeing the maximum quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

Federal Tax Rate On Real Estate Sale. So to get a complete tax picture contact the tax department of the state in which your property. Tax issues when it comes to real estate sales can be rather complex. Long and short term Federal capital gains tax its rates and when its applied or not applied. For example maybe youre having a difficult time figuring out your cost basis or cant determine if your second home.

Act 22 Tax Exemption Javi Rodriguez Act 20 Tax Exemption For Non Residents Of Puerto Rico Puerto Rico San Juan San Juan Puerto Rico From pinterest.com

Act 22 Tax Exemption Javi Rodriguez Act 20 Tax Exemption For Non Residents Of Puerto Rico Puerto Rico San Juan San Juan Puerto Rico From pinterest.com

The calculator based on your input calculates both short term capital gains as well as long term capital gains tax. Also if you owned the property for one year or less any taxable gain will be treated as ordinary income for both Federal and state tax purposes. Ownership and Use Tests To claim the exclusion you must meet the. Lets look at real estate agent taxes salaries and commission. You may qualify to exclude from your income all or part of any gain from the sale of your main home. So to get a complete tax picture contact the tax department of the state in which your property.

What is an average real estate agent salary.

A real estate agents salary will depend on a lot of things. Tax rules governing US real property ownership are insufferably complex and can have different implications for residents and non-residents. North Carolina does not have a separate capital gains tax rate like the US. This tax rate is the same as your income tax rate at the time of the sale. So to get a complete tax picture contact the tax department of the state in which your property. You may be looking to buy a holiday home near Disneyland or have your eye on a potentially lucrative real estate investment opportunity.

Source: br.pinterest.com

Source: br.pinterest.com

Properties that are sold at a loss are subject to few if any taxes. In this article we outline some key considerations for prospective and existing US property owners. Your basis in property. You may be looking to buy a holiday home near Disneyland or have your eye on a potentially lucrative real estate investment opportunity. 15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital gains tax rate.

Source: pinterest.com

Source: pinterest.com

From the following article you will learn about the tax treatment of selling commercial real estate in the USA and ways to legally reduce your tax liabilities. If you sell the home in which you reside there is a chance you can take advantage of the tax break provided to homeowners who have lived in the property and met certain qualifications. Your gain or loss for tax purposes is determined by subtracting your propertys adjusted basis on the date of sale from the sales price you receive plus sales expenses such as real estate commissions. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. That also means nobody is withholding earnings for the self-employment taxes.

Source: pinterest.com

Source: pinterest.com

Ownership and Use Tests To claim the exclusion you must meet the. The amount of tax you pay when you sell real estate varies depending on how much money you make when you sell the property. Home sales being a specific type of capital gains have their own set of rules. Profitable sales though can be subject to many different taxes. Your basis in property.

Source: pinterest.com

Source: pinterest.com

Home sales being a specific type of capital gains have their own set of rules. If the real estate a capital asset is held for longer than one year then the highest US. A Complete Guide to Capital Gains Tax on Real Estate Sales If you recently sold a property or are planning to heres what you need to know about the potential tax implications. In this article we outline some key considerations for prospective and existing US property owners. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset.

Source: pinterest.com

Source: pinterest.com

Profitable sales though can be subject to many different taxes. Most real estate agents are self-employed. At 22 your capital gains tax on this real estate sale would be 3300. Either way tax. Your income and filing.

Source: pinterest.com

Source: pinterest.com

Federal tax system has. Long and short term Federal capital gains tax its rates and when its applied or not applied. What Percent of Taxes Do You Pay for Selling Real Estate. The region you operate in the market and. The calculator based on your input calculates both short term capital gains as well as long term capital gains tax.

Source: pinterest.com

Source: pinterest.com

In this article we outline some key considerations for prospective and existing US property owners. Rather capital gains are taxable as ordinary income the same as any other income you have. For example maybe youre having a difficult time figuring out your cost basis or cant determine if your second home. Well get deeper into state estate and inheritance taxes later. Either way tax.

Source: pinterest.com

Source: pinterest.com

Income Tax The proceeds from the sale of real properties held primarily for sale to customers in the ordinary course of trade or business or sale of real properties classified as ordinary assets of the seller who is not habitually engaged in real estate business shall be included in. Dont forget your state may have its own tax on income from capital gains. You may qualify to exclude from your income all or part of any gain from the sale of your main home. That also means nobody is withholding earnings for the self-employment taxes. Tax rate is the long term capital gain rate of twenty 20 percent with a large portion of the gain generally taxed at fifteen 15 percent.

Source: pinterest.com

Source: pinterest.com

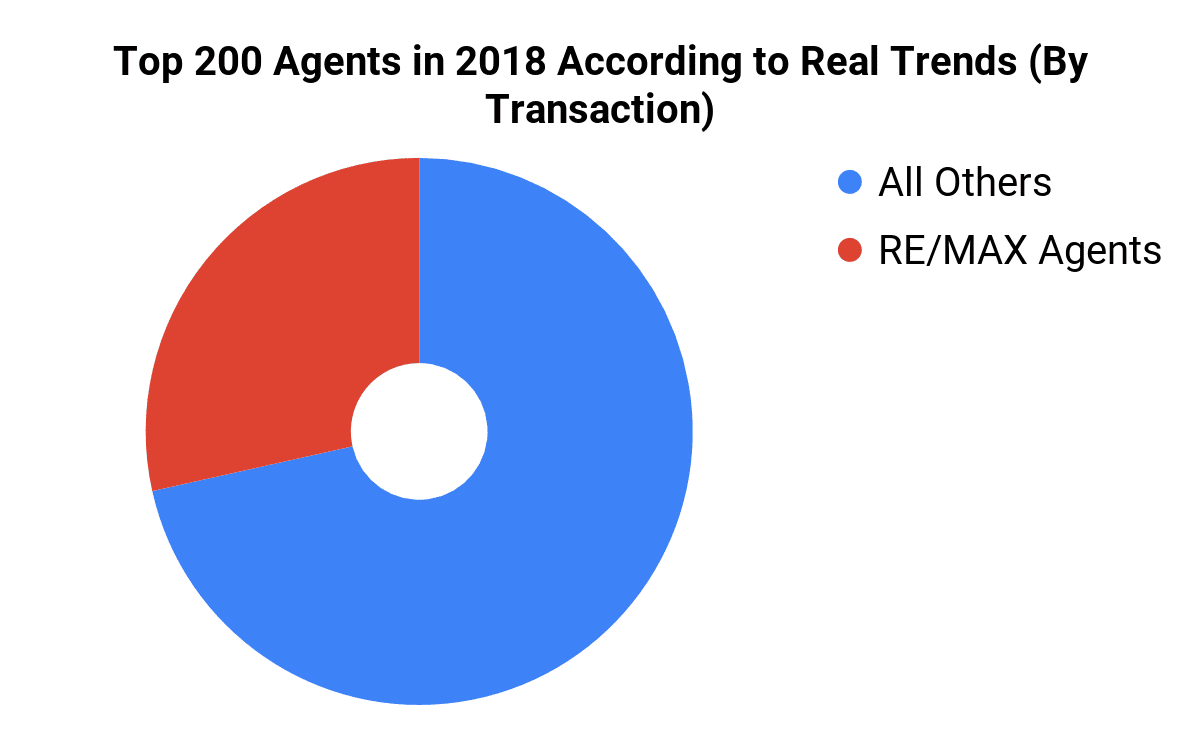

Tax rules governing US real property ownership are insufferably complex and can have different implications for residents and non-residents. You may qualify to exclude from your income all or part of any gain from the sale of your main home. A Complete Guide to Capital Gains Tax on Real Estate Sales If you recently sold a property or are planning to heres what you need to know about the potential tax implications. So to get a complete tax picture contact the tax department of the state in which your property. Lets look at real estate agent taxes salaries and commission.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

There is no estate tax on the federal level but a few states have an inheritance tax that you may have to pay. Ownership and Use Tests To claim the exclusion you must meet the. From the following article you will learn about the tax treatment of selling commercial real estate in the USA and ways to legally reduce your tax liabilities. That also means nobody is withholding earnings for the self-employment taxes. Properties that are sold at a loss are subject to few if any taxes.

Source: pinterest.com

Source: pinterest.com

Your main home is the one in which you live most of the time. Your income and filing. You may be looking to buy a holiday home near Disneyland or have your eye on a potentially lucrative real estate investment opportunity. There is no estate tax on the federal level but a few states have an inheritance tax that you may have to pay. Lets look at real estate agent taxes salaries and commission.

Source: pinterest.com

Source: pinterest.com

Dont forget your state may have its own tax on income from capital gains. What Percent of Taxes Do You Pay for Selling Real Estate. Also if you owned the property for one year or less any taxable gain will be treated as ordinary income for both Federal and state tax purposes. Home sales being a specific type of capital gains have their own set of rules. This tax rate is the same as your income tax rate at the time of the sale.

Source: pinterest.com

Source: pinterest.com

If you sell property more than two years after buying youll be charged for a long-term capital gain. Dont forget your state may have its own tax on income from capital gains. Most real estate agents are self-employed. Your basis in property. So to get a complete tax picture contact the tax department of the state in which your property.

Source: nl.pinterest.com

Source: nl.pinterest.com

15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital gains tax rate. This type of tax occurs when real property is sold and a profit is realized. Long and short term Federal capital gains tax its rates and when its applied or not applied. Tax issues when it comes to real estate sales can be rather complex. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset.

Source: pinterest.com

Source: pinterest.com

Your income and filing. If the real estate a capital asset is held for longer than one year then the highest US. Most state real estate tax laws follow the same basic rules as the federal tax code said Dr. What Percent of Taxes Do You Pay for Selling Real Estate. If you sell the home in which you reside there is a chance you can take advantage of the tax break provided to homeowners who have lived in the property and met certain qualifications.

Source: br.pinterest.com

Source: br.pinterest.com

Properties that are sold at a loss are subject to few if any taxes. From the following article you will learn about the tax treatment of selling commercial real estate in the USA and ways to legally reduce your tax liabilities. In this article we outline some key considerations for prospective and existing US property owners. Capital gains tax on the sale of a piece of real estate can be difficult to figure out. Rather capital gains are taxable as ordinary income the same as any other income you have.

Source: pinterest.com

Source: pinterest.com

If you sell the home in which you reside there is a chance you can take advantage of the tax break provided to homeowners who have lived in the property and met certain qualifications. Tax rate is the long term capital gain rate of twenty 20 percent with a large portion of the gain generally taxed at fifteen 15 percent. Properties that are sold at a loss are subject to few if any taxes. The tax rate for long-term capital gains is significantly lower than the rate for short-term gains and will depend on the specifics of your sale. If you sell the home in which you reside there is a chance you can take advantage of the tax break provided to homeowners who have lived in the property and met certain qualifications.

Source: ar.pinterest.com

Source: ar.pinterest.com

You may qualify to exclude from your income all or part of any gain from the sale of your main home. Tax rate is the long term capital gain rate of twenty 20 percent with a large portion of the gain generally taxed at fifteen 15 percent. Tax rules governing US real property ownership are insufferably complex and can have different implications for residents and non-residents. A Complete Guide to Capital Gains Tax on Real Estate Sales If you recently sold a property or are planning to heres what you need to know about the potential tax implications. Your gain or loss for tax purposes is determined by subtracting your propertys adjusted basis on the date of sale from the sales price you receive plus sales expenses such as real estate commissions.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title federal tax rate on real estate sale by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.