Your Fir tree real estate opportunity fund images are ready. Fir tree real estate opportunity fund are a topic that is being searched for and liked by netizens now. You can Find and Download the Fir tree real estate opportunity fund files here. Find and Download all royalty-free photos and vectors.

If you’re searching for fir tree real estate opportunity fund images information linked to the fir tree real estate opportunity fund topic, you have pay a visit to the right site. Our website frequently provides you with hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

Fir Tree Real Estate Opportunity Fund. Oaktree Real Estate Opportunities Fund Vii is based out of Los Angeles. With the funds final close it now has a total 628 million in commitments and has surpassed its. It was founded in 1994. Fir Trees first real estate opportunity fund was formed in 2008 to provide the Firms existing investors with more concentrated real estate exposure.

Dubai Christmas Tree Sellers Brace For Last Minute Rush Uae Gulf News From gulfnews.com

Dubai Christmas Tree Sellers Brace For Last Minute Rush Uae Gulf News From gulfnews.com

They hold 130 billion in assets under management as of August 23 2017. FIR Tree Capital Management is a hedge fund with 22 clients and discretionary assets under management AUM of 4374618648 Form ADV from 2020-11-18. Fir Tree manages assets on behalf of leading endowments foundations pension funds and sovereign wealth funds. Fir Tree Partners is a private equity general partner firm headquartered in New York NY United States and has other offices in United States. Invest in Fir Tree Partners funds. Fir Tree Partners is a hedge fund based in New York with offices in Miami.

With the funds final close it now has a total 628 million in commitments and has surpassed its.

Credit Hedge Fund Strategies Fortress credit hedge fund strategies focus on investments in both private and public credit across loans corporate debt and securities portfolios and orphaned assets real estate and structured finance. It was founded in 1994. Fir Tree Partners is a hedge fund based in New York with offices in Miami. The Fir Tree proposals align with the objectives of Japans Corporate Governance Code for improved corporate oversight and greater alignment of interests. Fir Tree which has been managing money since 1994 began raising money for its Capital Opportunity Dislocation Fund and Value Dislocation Fund in 2013 and 2014 years before other investment firms. Their last reported 13F filing for Q3 2020 included 1983535000 in managed 13F securities and a top 10 holdings concentration of 457.

Source: nl.pinterest.com

Source: nl.pinterest.com

The filing was for a pooled investment fund. Fir Tree was founded in 1994 and is a New York based private investment firm that invests worldwide in public and private companies real estate and sovereign debt. Fortress real estate focus on primarily opportunistic investments in commercial real estate across the United States Europe and Japan. FIR Tree Capital Management is a hedge fund with 22 clients and discretionary assets under management AUM of 4374618648 Form ADV from 2020-11-18. Hundreds of fund managers are currently fundraising on Palico.

With the funds final close it now has a total 628 million in commitments and has surpassed its. Since 2010 Cohen has overseen numerous investments at Fir Tree in both equity and debt of real estate-related assets and in companies across traditional and alternative real estate sectors. Private investment firm Fir Tree Partners has closed its Real Estate Opportunity Fund II. Where shareholder engagement could be value-accretive for its investors. With the funds final close it now has a total 628 million in commitments and has surpassed its.

Source: mentalfloss.com

Source: mentalfloss.com

FIR Tree Capital Managements largest holding is Edison. Industry expertise in real estate and corporate finance. Fund II seeks to create a strategic advantage for existing and new Fir Tree. Credit Hedge Fund Strategies Fortress credit hedge fund strategies focus on investments in both private and public credit across loans corporate debt and securities portfolios and orphaned assets real estate and structured finance. About Fir Tree Partners Fir Tree was founded in 1994 and is a New York-based private investment firm that invests worldwide in public and private companies real estate.

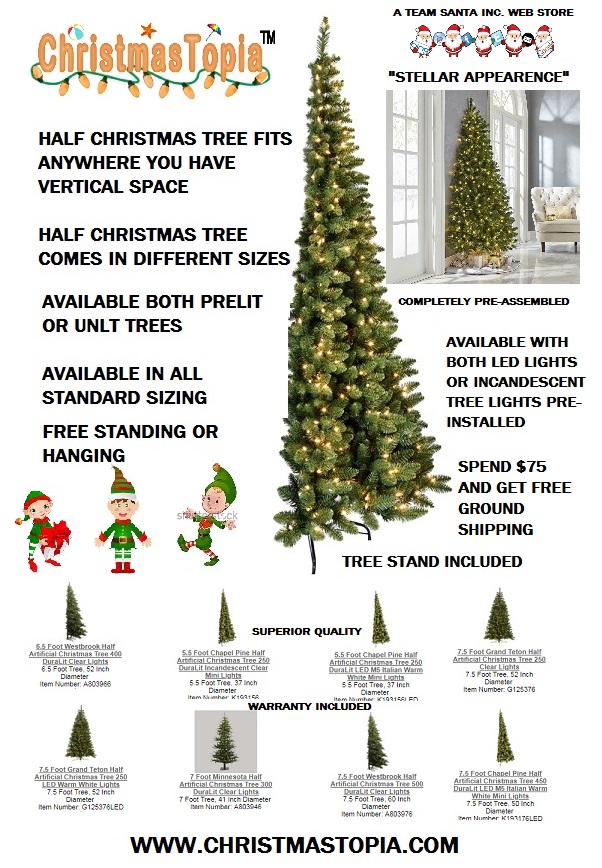

Source: teamsanta.com

Source: teamsanta.com

Nov 8 Reuters - Fir Tree Partners a private investment firm closed on its Real Estate Opportunity Fund II with 628 million exceeding its target of 500 million. Fir Trees first real estate opportunity fund was formed in 2008 to provide the Firms existing investors with more concentrated real estate exposure. Fir Tree Real Estate Fund III has a broad real estate mandate investing in assets loans and companies. Oaktree Real Estate Opportunities Fund Vii is based out of Los Angeles. The filing was for a pooled investment fund.

Source: thezebra.org

Source: thezebra.org

The firm last filed a Form D notice of exempt offering of securities on 2016-11-22. Fir Tree manages assets on behalf of leading endowments foundations pension funds and sovereign wealth funds. Fir Trees real estate funds invest in assets and companies through. Credit Hedge Fund Strategies Fortress credit hedge fund strategies focus on investments in both private and public credit across loans corporate debt and securities portfolios and orphaned assets real estate and structured finance. Since 2010 Cohen has overseen numerous investments at Fir Tree in both equity and debt of real estate-related assets and in companies across traditional and alternative real estate sectors.

Source: clermontcountyohio.gov

Source: clermontcountyohio.gov

Fir Tree launched its first real estate fund Fir Tree Mortgage Opportunity Fund in 2008 and raised approximately 400 million in commitments for the vehicle. The filing was for a pooled investment fund. With the funds final close it now has a total 628 million in commitments and has surpassed its. Oaktree Real Estate Opportunities Fund Vii is based out of Los Angeles. Since 2010 Cohen has overseen numerous investments at Fir Tree in both equity and debt of real estate-related assets and in companies across traditional and alternative real estate sectors.

Source: gulfnews.com

Source: gulfnews.com

Hundreds of fund managers are currently fundraising on Palico. Hundreds of fund managers are currently fundraising on Palico. Fund II seeks to create a strategic advantage for existing and new Fir Tree. Fir Tree manages assets on behalf of leading endowments foundations pension funds and sovereign wealth funds. The value-addedopportunistic fund was launched on Feb.

Source: northernwoodlands.org

Source: northernwoodlands.org

He also co-founded Fir Trees capital opportunity funds alongside Jim Walker. The firm last filed a Form D notice of exempt offering of securities on 2016-11-22. Read their Plain English Brochure. Fir Tree launched its first real estate fund Fir Tree Mortgage Opportunity Fund in 2008 and raised approximately 400 million in commitments for the vehicle. Nov 8 Reuters - Fir Tree Partners a private investment firm closed on its Real Estate Opportunity Fund II with 628 million exceeding its target of 500 million.

Source: larchmontbuzz.com

Source: larchmontbuzz.com

Jim co-managed Fir Tree and was jointly responsible for building Fir Tree into a top global alternative investment firm. Oaktree Real Estate Opportunities Fund Vii is based out of Los Angeles. Where shareholder engagement could be value-accretive for its investors. Private investment firm Fir Tree Partners has closed its Real Estate Opportunity Fund II. Fir Tree Real Estate Fund III has a broad real estate mandate investing in assets loans and companies.

Source: dgwgo.com

Source: dgwgo.com

Fortress real estate focus on primarily opportunistic investments in commercial real estate across the United States Europe and Japan. The filing was for a pooled investment fund. Where shareholder engagement could be value-accretive for its investors. The value-addedopportunistic fund was launched on Feb. They hold 130 billion in assets under management as of August 23 2017.

Source: ptmoney.com

Source: ptmoney.com

Jim co-managed Fir Tree and was jointly responsible for building Fir Tree into a top global alternative investment firm. Fir Tree which has been managing money since 1994 began raising money for its Capital Opportunity Dislocation Fund and Value Dislocation Fund in 2013 and 2014 years before other investment firms. The firm last filed a Form D notice of exempt offering of securities on 2016-11-22. Private equity fund The notice included securities offered of EquityPooled Investment Fund. FIR Tree Capital Management is a hedge fund with 22 clients and discretionary assets under management AUM of 4374618648 Form ADV from 2020-11-18.

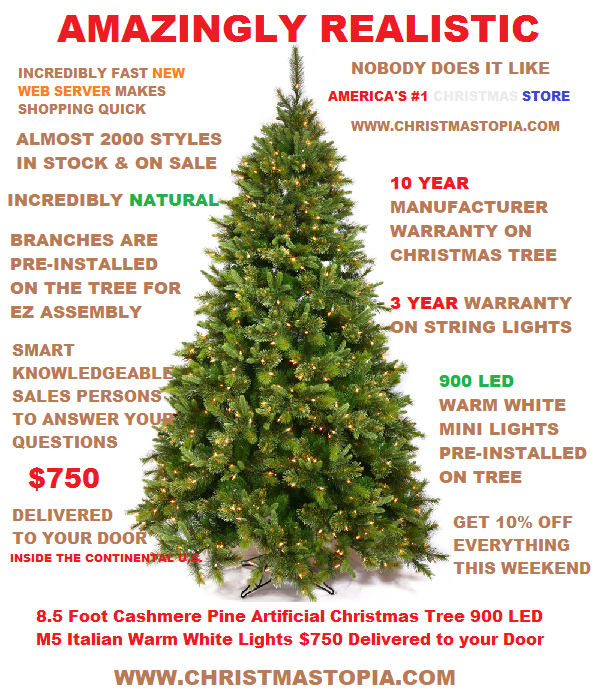

Source: teamsanta.com

Source: teamsanta.com

Fir Tree manages assets on behalf of leading endowments foundations pension funds and sovereign wealth funds. Fund II seeks to create a strategic advantage for existing and new Fir Tree. The value-addedopportunistic fund was launched on Feb. Fir Tree Partners is a hedge fund based in New York with offices in Miami. Credit Hedge Fund Strategies Fortress credit hedge fund strategies focus on investments in both private and public credit across loans corporate debt and securities portfolios and orphaned assets real estate and structured finance.

Source: gulfnews.com

Source: gulfnews.com

FIR Tree Capital Management is a hedge fund with 22 clients and discretionary assets under management AUM of 4374618648 Form ADV from 2020-11-18. Fund II seeks to create a strategic advantage for existing and new Fir Tree. Credit Hedge Fund Strategies Fortress credit hedge fund strategies focus on investments in both private and public credit across loans corporate debt and securities portfolios and orphaned assets real estate and structured finance. Jim co-managed Fir Tree and was jointly responsible for building Fir Tree into a top global alternative investment firm. Their last reported 13F filing for Q3 2020 included 1983535000 in managed 13F securities and a top 10 holdings concentration of 457.

Source: toledoblade.com

Source: toledoblade.com

Fir Tree launched its first real estate fund Fir Tree Mortgage Opportunity Fund in 2008 and raised approximately 400 million in commitments for the vehicle. About Fir Tree Partners Fir Tree was founded in 1994 and is a New York-based private investment firm that invests worldwide in public and private companies real estate. With the funds final close it now has a total 628 million in commitments and has surpassed its. Andrew was a proven innovator and oversaw Fir Trees residential mortgage investment platform which generated multi-billion dollar profits for Fir Trees. Hundreds of fund managers are currently fundraising on Palico.

Jim and Andrew Fredman co-founded Fir Trees real estate opportunity funds which significantly outperformed their targeted returns during their tenure. Oaktree Real Estate Opportunities Fund Vii is based out of Los Angeles. About Fir Tree Partners. They hold 130 billion in assets under management as of August 23 2017. Fir Trees first real estate opportunity fund was formed in 2008 to provide the Firms existing investors with more concentrated real estate exposure.

Source: teamsanta.com

Source: teamsanta.com

Fir Tree launched its first real estate fund Fir Tree Mortgage Opportunity Fund in 2008 and raised approximately 400 million in commitments for the vehicle. Fir Trees first real estate opportunity fund was formed in 2008 to provide the Firms existing investors with more concentrated real estate exposure. Fir Tree Real Estate Fund III has a broad real estate mandate investing in assets loans and companies. FIR Tree Capital Management is a hedge fund with 22 clients and discretionary assets under management AUM of 4374618648 Form ADV from 2020-11-18. The value-addedopportunistic fund was launched on Feb.

Source: pinterest.com

Source: pinterest.com

Their last reported 13F filing for Q3 2020 included 1983535000 in managed 13F securities and a top 10 holdings concentration of 457. The Fir Tree proposals align with the objectives of Japans Corporate Governance Code for improved corporate oversight and greater alignment of interests. Andrew was a proven innovator and oversaw Fir Trees residential mortgage investment platform which generated multi-billion dollar profits for Fir Trees. Credit Hedge Fund Strategies Fortress credit hedge fund strategies focus on investments in both private and public credit across loans corporate debt and securities portfolios and orphaned assets real estate and structured finance. Since 2010 Cohen has overseen numerous investments at Fir Tree in both equity and debt of real estate-related assets and in companies across traditional and alternative real estate sectors.

Nov 8 Reuters - Fir Tree Partners a private investment firm closed on its Real Estate Opportunity Fund II with 628 million exceeding its target of 500 million. Fir Tree manages assets on behalf of leading endowments foundations pension funds and sovereign wealth funds. Hundreds of fund managers are currently fundraising on Palico. Fortress real estate focus on primarily opportunistic investments in commercial real estate across the United States Europe and Japan. Private investment firm Fir Tree Partners has closed its Real Estate Opportunity Fund II.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fir tree real estate opportunity fund by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.