Your Fluvanna county real estate tax assessment images are ready. Fluvanna county real estate tax assessment are a topic that is being searched for and liked by netizens now. You can Find and Download the Fluvanna county real estate tax assessment files here. Download all free images.

If you’re looking for fluvanna county real estate tax assessment images information linked to the fluvanna county real estate tax assessment interest, you have pay a visit to the ideal site. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

Fluvanna County Real Estate Tax Assessment. Locally your real estate assessment is the value determined by a city or countys real estate assessor to be. While lower than the FY21 tax rate of 0952 most homes have increased in value in the most recent assessment so the average homeowner will see an increase of 219 percent in their annual tax bill. 07 Monday Apr 2014. The Fluvanna County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Fluvanna County.

While lower than the FY21 tax rate of 0952 most homes have increased in value in the most recent assessment so the average homeowner will see an increase of 219 percent in their annual tax bill. Fluvanna County VA Geographic Information System. Fluvanna County Property Records are real estate documents that contain information related to real property in Fluvanna County Virginia. It is assessed as of January 1st of each year by the Commissioner of Revenue and payments are made in two installments which are June 5th and December 5th. Posted by cvillechoicehomes in Fluvanna County. Virginia is ranked 1181st of the 3143 counties in the United States in order of the median amount of property taxes collected.

0884 per 10000 of assessed.

House Street leave off Rd St Dr etc Record Types. Fluvanna County VA Geographic Information System. Free Fluvanna County Recorder Of Deeds Property Records Search. Fluvanna County -Home- -Legal-. Public Service Corporations Real Estate. The Fluvanna County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

Source: city-data.com

Source: city-data.com

These records can include Fluvanna County property tax assessments and assessment challenges appraisals and income taxes. 800am - 430pm Monday-Friday excluding Holidays. Assessment Values effective date. Public Service Corporations Real Estate. The Fluvanna County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

The Fluvanna County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. 34 Palmyra Way Post Office Box 124 Palmyra VA 22963. While lower than the FY21 tax rate of 0952 most homes have increased in value in the most recent assessment so the average homeowner will see an increase of 219 percent in their annual tax bill. Leave a comment. Box 299 Palmyra VA 22963 Number.

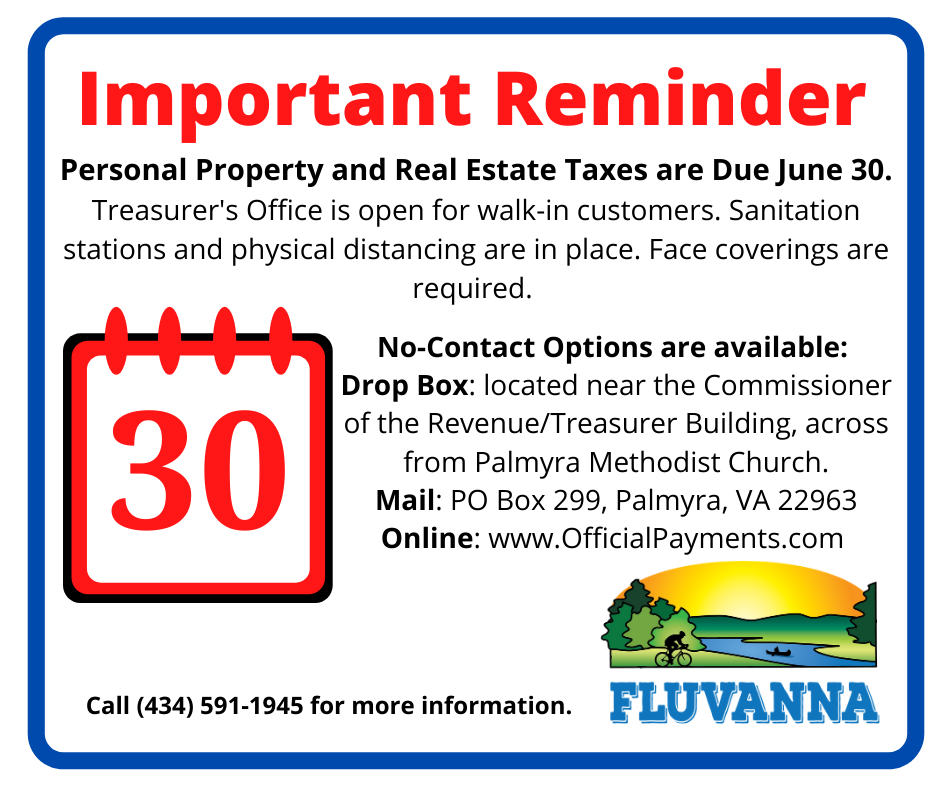

Source: fluvannacounty.org

Source: fluvannacounty.org

The median property tax also known as real estate tax in Fluvanna County is 119300 per year based on a median home value of 24610000 and a median. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Lease Alert Virginia Fluvanna County PO. Public Service Corporations Personal Property. It is assessed as of January 1st of each year by the Commissioner of Revenue and payments are made in two installments which are June 5th and December 5th.

Source: fluvannacounty.org

Source: fluvannacounty.org

Select ONE of the following methods Order. Clerk of Circuit Court. 34 Palmyra Way Post Office Box 124 Palmyra VA 22963. It is assessed as of January 1st of each year by the Commissioner of Revenue and payments are made in two installments which are June 5th and December 5th. Virginia is ranked 1181st of the 3143 counties in the United States in order of the median amount of property taxes collected.

While lower than the FY21 tax rate of 0952 most homes have increased in value in the most recent assessment so the average homeowner will see an increase of 219 percent in their annual tax bill. Search tips If you encounter any difficulties with this site please. Locally your real estate assessment is the value determined by a city or countys real estate assessor to be. Fluvanna County Tax Rate Real Estate Assessments. Find Fluvanna County residential property records including deed records titles mortgages sales transfers ownership history parcel land zoning structural descriptions valuations tax assessments more.

Source: city-data.com

Source: city-data.com

Charlottesville Area Real Estate Tax Assessments Are in the Mail Its the beginning of the year and time again for the City of Charlottesville and the surrounding counties to provide their citizenry with real estate assessments. Fluvanna County collects on average 048 of a propertys assessed fair market value as property tax. 07 Monday Apr 2014. Posted by cvillechoicehomes in Fluvanna County. Charlottesville Area Real Estate Tax Assessments Are in the Mail Its the beginning of the year and time again for the City of Charlottesville and the surrounding counties to provide their citizenry with real estate assessments.

Source: city-data.com

Source: city-data.com

These records can include Fluvanna County property tax assessments and assessment challenges appraisals and income taxes. Fluvanna County Property Records are real estate documents that contain information related to real property in Fluvanna County Virginia. Select ONE of the following methods Order. 34 Palmyra Way Post Office Box 299 Palmyra VA 22963. The Fluvanna County Tax Rate for 2013 is set at 0795 per 100 of assessed value of the property.

Source: city-data.com

Source: city-data.com

Locally your real estate assessment is the value determined by a city or countys real estate assessor to be. 34 Palmyra Way Post Office Box 299 Palmyra VA 22963. Deed and Lien Run Sheet. Residential Commercial Vacant Land All Types Number of Records. If a property has an assessed value of 200000 then the annual tax bill would be 1590.

Assessment Values effective date. 800am - 430pm Monday-Friday excluding Holidays. Search tips If you encounter any difficulties with this site please. It is assessed as of January 1st of each year by the Commissioner of Revenue and payments are made in two installments which are June 5th and December 5th. House Street leave off Rd St Dr etc Record Types.

Source:

Source:

Clerk of Circuit Court. All real estate property is subject to taxation except that specifically exempt. 34 Palmyra Way Post Office Box 124 Palmyra VA 22963. Fluvanna County Tax Rate Real Estate Assessments. These records can include Fluvanna County property tax assessments and assessment challenges appraisals and income taxes.

Search tips If you encounter any difficulties with this site please. Public Service Corporations Real Estate. Fluvanna County Tax Rate Real Estate Assessments. The office of the Commissioner of the Revenue is responsible for the assessment of new homes additions to homes and lots of new subdivisions. 200000 100 2000.

Keeping current the ownership transfers of real estate by deed andor will. 800am - 430pm Monday-Friday excluding Holidays. Box 299 Palmyra VA 22963 Number. Assessment Values effective date. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

435 per 10000 of assessed value. Public Service Corporations Personal Property. The office of the Commissioner of the Revenue is responsible for the assessment of new homes additions to homes and lots of new subdivisions. All real estate property is subject to taxation except that specifically exempt. Vehicles boats trailers and mobile homes and business property and equipment.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. All real estate property is subject to taxation except that specifically exempt. While lower than the FY21 tax rate of 0952 most homes have increased in value in the most recent assessment so the average homeowner will see an increase of 219 percent in their annual tax bill. Search tips If you encounter any difficulties with this site please. The average yearly property tax paid by Fluvanna County residents amounts to about 167 of their yearly income.

Fluvanna County -Home- -Legal-. 290 per 10000 of assessed value. Search tips If you encounter any difficulties with this site please. Fluvanna County -Home- -Legal-. House Street leave off Rd St Dr etc Record Types.

Source: point2homes.com

Source: point2homes.com

Fluvanna County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Fluvanna County Virginia. Fluvanna County collects on average 048 of a propertys assessed fair market value as property tax. The annual assessment of taxable personal properties ie. Assessment Values effective date. Public Service Corporations Real Estate.

Source: city-data.com

Source: city-data.com

Lease Alert Virginia Fluvanna County PO. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Search tips If you encounter any difficulties with this site please. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. 290 per 10000 of assessed value.

Source: realtor.com

Source: realtor.com

It is assessed as of January 1st of each year by the Commissioner of Revenue and payments are made in two installments which are June 5th and December 5th. The real estate tax rate was set at 0884 per 100 with an equalized rate of 0865. The office of the Commissioner of the Revenue is responsible for the assessment of new homes additions to homes and lots of new subdivisions. Fluvanna County collects on average 048 of a propertys assessed fair market value as property tax. Select ONE of the following methods Order.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fluvanna county real estate tax assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.