Your Fluvanna county va real estate tax rate images are available in this site. Fluvanna county va real estate tax rate are a topic that is being searched for and liked by netizens today. You can Find and Download the Fluvanna county va real estate tax rate files here. Get all royalty-free photos and vectors.

If you’re looking for fluvanna county va real estate tax rate images information linked to the fluvanna county va real estate tax rate interest, you have come to the right blog. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

Fluvanna County Va Real Estate Tax Rate. Certain types of Tax Records are available to the general public while some Tax Records are only. Property Taxes No Mortgage 4729300. The median property tax also known as real estate tax in Fluvanna County is 119300 per year based on a median home value of 24610000 and a median effective property tax rate of 048. If there is a change in ownership billing address or other change pertaining to your taxes please notify this office immediately.

Fluvanna County Virginia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More From city-data.com

Fluvanna County Virginia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More From city-data.com

The median property tax also known as real estate tax in Fluvanna County is 119300 per year based on a median home value of 24610000 and a median effective property tax rate of 048. Charlottesville VA Real Estate Choice Homes Real Estate and Neighborhood Info for Charlottesville Virginia. Tax Rates for Fluvanna VA. Fluvanna County Alleghany County Augusta County Caroline County City of Covington Fluvanna County City of Franklin Giles County Lexington Madison County Southampton County Tazewell County. 500 The total of all sales taxes for an area including state county and local taxes Income Taxes. Fluvanna County Property Tax Collections Total Fluvanna County Virginia.

View Full Contact Details.

Fluvanna County Tax Rate Real Estate Assessments. The Fluvanna County Tax Assessor can provide you with an application form for the Fluvanna County homestead exemption which can provide a modest property tax break for properties which are used as the primary residence of their owners. Call the Assessors Office and ask for details. Fluvanna County Property Tax Collections Total Fluvanna County Virginia. The average yearly property tax paid by Fluvanna County residents amounts to about 167 of their yearly income. We appreciate the opportunity to serve you.

Source: city-data.com

Source: city-data.com

061 per 10000 of assessed valuation subject to County land use tax ordinance and ordinance granting tax relief for the elderly. If there is a change in ownership billing address or other change pertaining to your taxes please notify this office immediately. Charlottesville VA Real Estate Choice Homes Real Estate and Neighborhood Info for Charlottesville Virginia. REAL ESTATE pursuant to 581-3000 VA Code Ann including equalized public service corporation real estate as defined by 581-2605 VA Code Ann including a manufactured home as defined by 36-853 VA Code Ann. 061 per 10000 of assessed valuation subject to County land use tax ordinance and ordinance granting tax relief for the elderly.

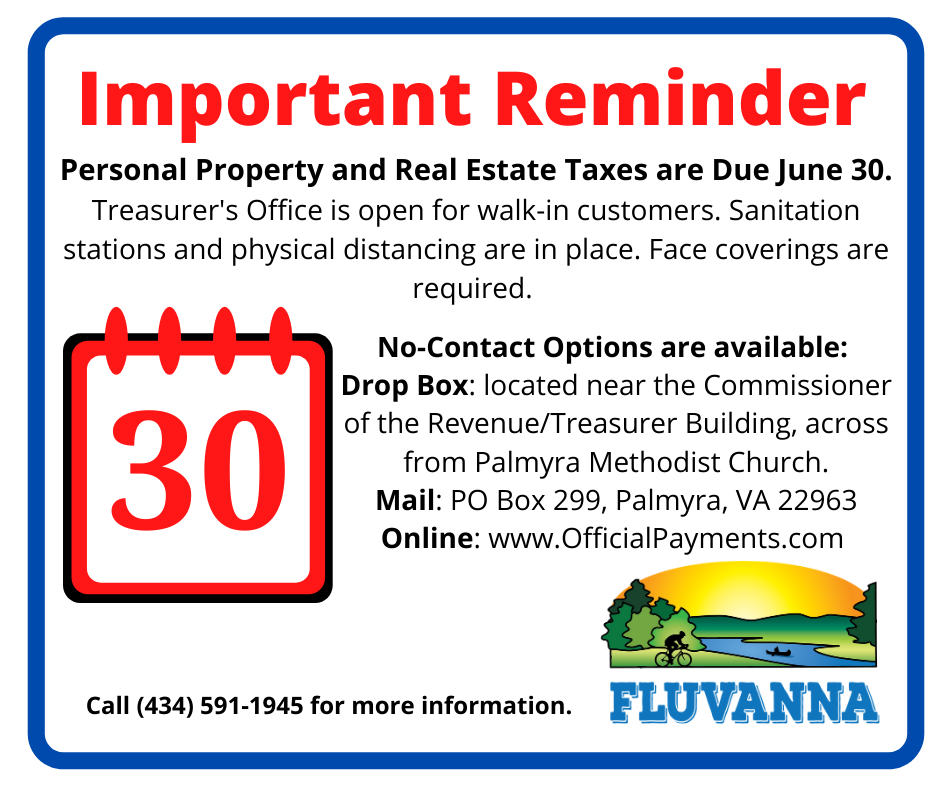

Source: fluvannacounty.org

Source: fluvannacounty.org

If there is a change in ownership billing address or other change pertaining to your taxes please notify this office immediately. We appreciate the opportunity to serve you. Tax Rates for Fluvanna VA. Charlottesville VA Real Estate Choice Homes Real Estate and Neighborhood Info for Charlottesville Virginia. Property Taxes Mortgage 10811700.

Source: city-data.com

Source: city-data.com

575 The total of all income taxes for an area including state county and local taxes. All of the Fluvanna County information on this page has been verified and checked for accuracy. Property Taxes No Mortgage 4729300. Box 540 132 Main Street Palmyra VA 22963 434 591-1910. REAL ESTATE pursuant to 581-3000 VA Code Ann including equalized public service corporation real estate as defined by 581-2605 VA Code Ann including a manufactured home as defined by 36-853 VA Code Ann.

Source: fluvannacounty.org

Source: fluvannacounty.org

The median property tax also known as real estate tax in Fluvanna County is 119300 per year based on a median home value of 24610000 and a median effective property tax rate of 048. Posted by cvillechoicehomes in Fluvanna County. REAL ESTATE pursuant to 581-3000 VA Code Ann including equalized public service corporation real estate as defined by 581-2605 VA Code Ann including a manufactured home as defined by 36-853 VA Code Ann. Leave a comment. Call the Assessors Office and ask for details.

Source: city-data.com

Source: city-data.com

The Fluvanna County Tax Rate for 2013 is set at 0795 per 100 of assessed value of the. 0884 per 10000 of assessed value. Fluvanna County Property Tax Collections Total Fluvanna County Virginia. Certain types of Tax Records are available to the general public while some Tax Records are only. 602 The property tax rate shown here is the rate per 1000 of home value.

Source: city-data.com

Source: city-data.com

Fluvanna County Property Tax Collections Total Fluvanna County Virginia. Property Taxes Mortgage 10811700. Fluvanna County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Fluvanna County Virginia. Tax Rates for Fluvanna VA. Find the tax assessor for a different Virginia county.

Source: city-data.com

Source: city-data.com

602 The property tax rate shown here is the rate per 1000 of home value. Property Taxes No Mortgage 4729300. If the tax rate is 1400 and the home value is 250000 the property tax. Additional exemptions might be available for farmland green space veterans or others. It is assessed as of January 1st of each year by the Commissioner of Revenue and payments are made in two installments which are June 5th and December 5th.

Source: city-data.com

Source: city-data.com

The average yearly property tax paid by Fluvanna County residents amounts to about 167 of their yearly income. Property Taxes Mortgage 10811700. It is assessed as of January 1st of each year by the Commissioner of Revenue and payments are made in two installments which are June 5th and December 5th. Federal income taxes are not included Property Tax Rate. View Full Contact Details.

Source: realtor.com

Source: realtor.com

290 per 10000 of assessed value. Steve Nichols proposed a 0939 tax rate for. REAL ESTATE pursuant to 581-3000 VA Code Ann including equalized public service corporation real estate as defined by 581-2605 VA Code Ann including a manufactured home as defined by 36-853 VA Code Ann. Tax relief is based on the prior years income and financial worth at prior years end. 602 The property tax rate shown here is the rate per 1000 of home value.

Source: realtor.com

Source: realtor.com

Property Taxes No Mortgage 4729300. It included just over a three cent increase in the real estate tax rate. The Fluvanna County Tax Assessor can provide you with an application form for the Fluvanna County homestead exemption which can provide a modest property tax break for properties which are used as the primary residence of their owners. The current real estate tax rate is 0907 per 100 assessed. Property Taxes Mortgage 10811700.

Source: city-data.com

Source: city-data.com

575 The total of all income taxes for an area including state county and local taxes. Tax relief is based on the prior years income and financial worth at prior years end. 290 per 10000 of assessed value. Leave a comment. Box 540 132 Main Street Palmyra VA 22963 434 591-1910.

Source: city-data.com

Source: city-data.com

Additional exemptions might be available for farmland green space veterans or others. Certain types of Tax Records are available to the general public while some Tax Records are only. 575 The total of all income taxes for an area including state county and local taxes. The Fluvanna County Tax Assessor can provide you with an application form for the Fluvanna County homestead exemption which can provide a modest property tax break for properties which are used as the primary residence of their owners. Box 540 132 Main Street Palmyra VA 22963 434 591-1910.

Source: city-data.com

Source: city-data.com

Fluvanna County Alleghany County Augusta County Caroline County City of Covington Fluvanna County City of Franklin Giles County Lexington Madison County Southampton County Tazewell County. Financial worth of the applicant and all other persons living in the home must be under 160000 excluding the value of the dwelling and five acres of land. View Full Contact Details. Find property records for Fluvanna County. Public Service Corporations Personal Property.

Source: zillow.com

Source: zillow.com

The average yearly property tax paid by Fluvanna County residents amounts to about 167 of their yearly income. It included just over a three cent increase in the real estate tax rate. The current real estate tax rate is 0907 per 100 assessed. Fluvanna County Tax Rate Real Estate Assessments. Call the Assessors Office and ask for details.

Source: zillow.com

Source: zillow.com

The median property tax also known as real estate tax in Fluvanna County is 119300 per year based on a median home value of 24610000 and a median effective property tax rate of 048. If the tax rate is 1400 and the home value is 250000 the property tax. Tax Rates for Fluvanna VA. Fluvanna County collects on average 048 of a propertys assessed fair market value as property tax. Find the tax assessor for a different Virginia county.

Source: city-data.com

Source: city-data.com

The median property tax in Fluvanna County Virginia is 119300. The average yearly property tax paid by Fluvanna County residents amounts to about 167 of their yearly income. These records can include Fluvanna County property tax assessments and assessment challenges appraisals and income taxes. Steve Nichols proposed a 0939 tax rate for. Fluvanna County Property Tax Collections Total Fluvanna County Virginia.

Source: realtor.com

Source: realtor.com

If there is a change in ownership billing address or other change pertaining to your taxes please notify this office immediately. We appreciate the opportunity to serve you. Box 540 132 Main Street Palmyra VA 22963 434 591-1910. 0884 per 10000 of assessed value. Fluvanna County Tax Rate Real Estate Assessments.

Source: realtor.com

Source: realtor.com

Property Taxes No Mortgage 4729300. Certain types of Tax Records are available to the general public while some Tax Records are only. The Fluvanna County Tax Assessor can provide you with an application form for the Fluvanna County homestead exemption which can provide a modest property tax break for properties which are used as the primary residence of their owners. 500 The total of all sales taxes for an area including state county and local taxes Income Taxes. Steve Nichols proposed a 0939 tax rate for.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fluvanna county va real estate tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.