Your Franklin county real estate taxes ohio images are ready. Franklin county real estate taxes ohio are a topic that is being searched for and liked by netizens now. You can Find and Download the Franklin county real estate taxes ohio files here. Find and Download all free photos and vectors.

If you’re looking for franklin county real estate taxes ohio images information connected with to the franklin county real estate taxes ohio topic, you have visit the ideal blog. Our website always provides you with hints for seeking the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Franklin County Real Estate Taxes Ohio. Address Franklin County Treasurer 373 South High Street 17th floor Columbus OH 43215-6306 Office hours are Monday through Friday 800 AM. Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property. Assessed value in Franklin County is usually calculated by multiplying market value by the countys predetermined ratio which currently is. The Treasurer is the chief investment officer of the county responsible for the management of more than 1 billion in revenue annually.

Ohio Property Tax Calculator Smartasset From smartasset.com

Ohio Property Tax Calculator Smartasset From smartasset.com

Debit card Visa will be a flat fee of 350. Address Franklin County Treasurer 373 South High Street 17th floor Columbus OH 43215-6306 Office hours are Monday through Friday 800 AM. Certain items may be deducted such as debts administration expenses and charitable gifts as well as other deductions and exemptions. Prior to 2013 estates that have a value in excess of 338333 or real estate will file an Ohio estate tax return. Ohio law mandates a general reappraisal every six. Real Estate Tax Attorney in Franklin County Ohio The Columbus Ohio real estate tax lawyer at Porter Law Office LLC has significant experience in helping taxpayers reduce their Ohio.

Real Estate Taxes for 2nd Half 2016 Due Date 6202017 Parcel No.

Real Estate Tax Payments may be made in-person at our office. Certain items may be deducted such as debts administration expenses and charitable gifts as well as other deductions and exemptions. To redeem after the purchaser starts the foreclosure you must pay the certificate price plus 18 interest per year attorneys fees costs and other fees Ohio Rev. The County assumes no responsibility for errors in the information and does not guarantee that the data is free from errors or inaccuracies. Franklin County Real Estate Tax Payment. Assessed value in Franklin County is usually calculated by multiplying market value by the countys predetermined ratio which currently is.

Source: coronavirus.kjk.com

Source: coronavirus.kjk.com

The Treasurer is the chief investment officer of the county responsible for the management of more than 1 billion in revenue annually. The only changes to a propertys value outside of the three year cycle. There is no convenience fee for. Pay your real estate taxes online by clicking on the link below. The median property tax on a 15530000 house is 211208 in Ohio.

Source: hrblock.com

Source: hrblock.com

The median property tax on a 15530000 house is 163065 in the United States. Fees are 230 of total transaction for all credit cards Visa MasterCard Discover and American Express or 200 minimum. Ohio law requires counties to revalue all real property every six years with an update at the three year midpoint as ordered by the Tax Commissioner of the State of Ohio. The median property tax on a 15530000 house is 211208 in Ohio. HAGAN FRANKLIN COUNTY TREASURER 373 S HIGH ST 17th FLOOR COLUMBUS OH 43215-6306 PATSY D.

Source: dispatch.com

Source: dispatch.com

There is no convenience fee for. The Franklin County Board of Revision hears complaints against the valuations of manufactured or mobile home taxed like real property. Ohio law requires counties to revalue all real property every six years with an update at the three year midpoint as ordered by the Tax Commissioner of the State of Ohio. To redeem after the purchaser starts the foreclosure you must pay the certificate price plus 18 interest per year attorneys fees costs and other fees Ohio Rev. Pay your real estate taxes online by clicking on the link below.

Source: fclawlib.libguides.com

Source: fclawlib.libguides.com

Address Franklin County Treasurer 373 South High Street 17th floor Columbus OH 43215-6306 Office hours are Monday through Friday 800 AM. Address Franklin County Treasurer 373 South High Street 17th floor Columbus OH 43215-6306 Office hours are Monday through Friday 800 AM. The only changes to a propertys value outside of the three year cycle. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work conducted by each County Auditor. Real Estate Tax Payments.

Source: loc.gov

Source: loc.gov

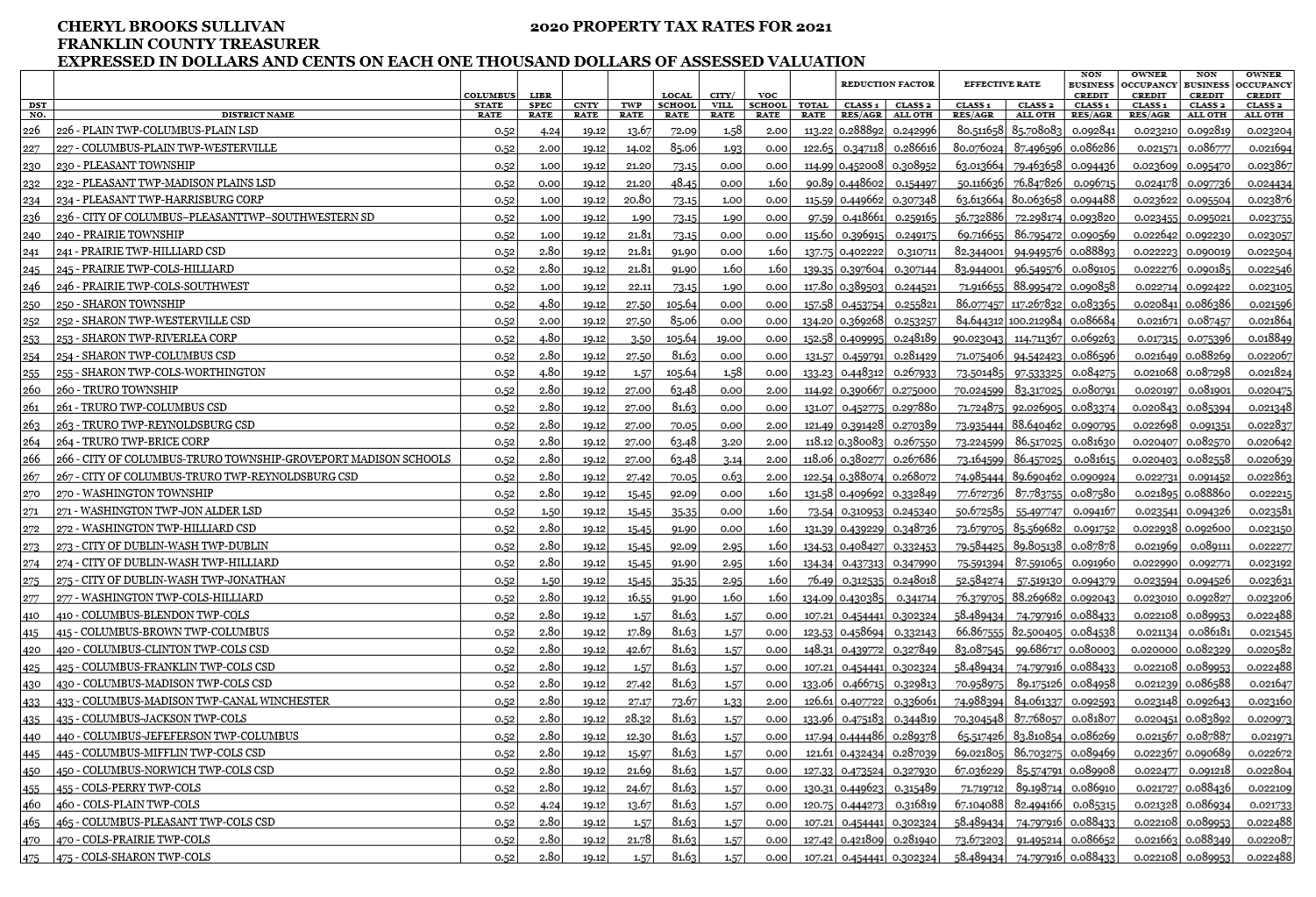

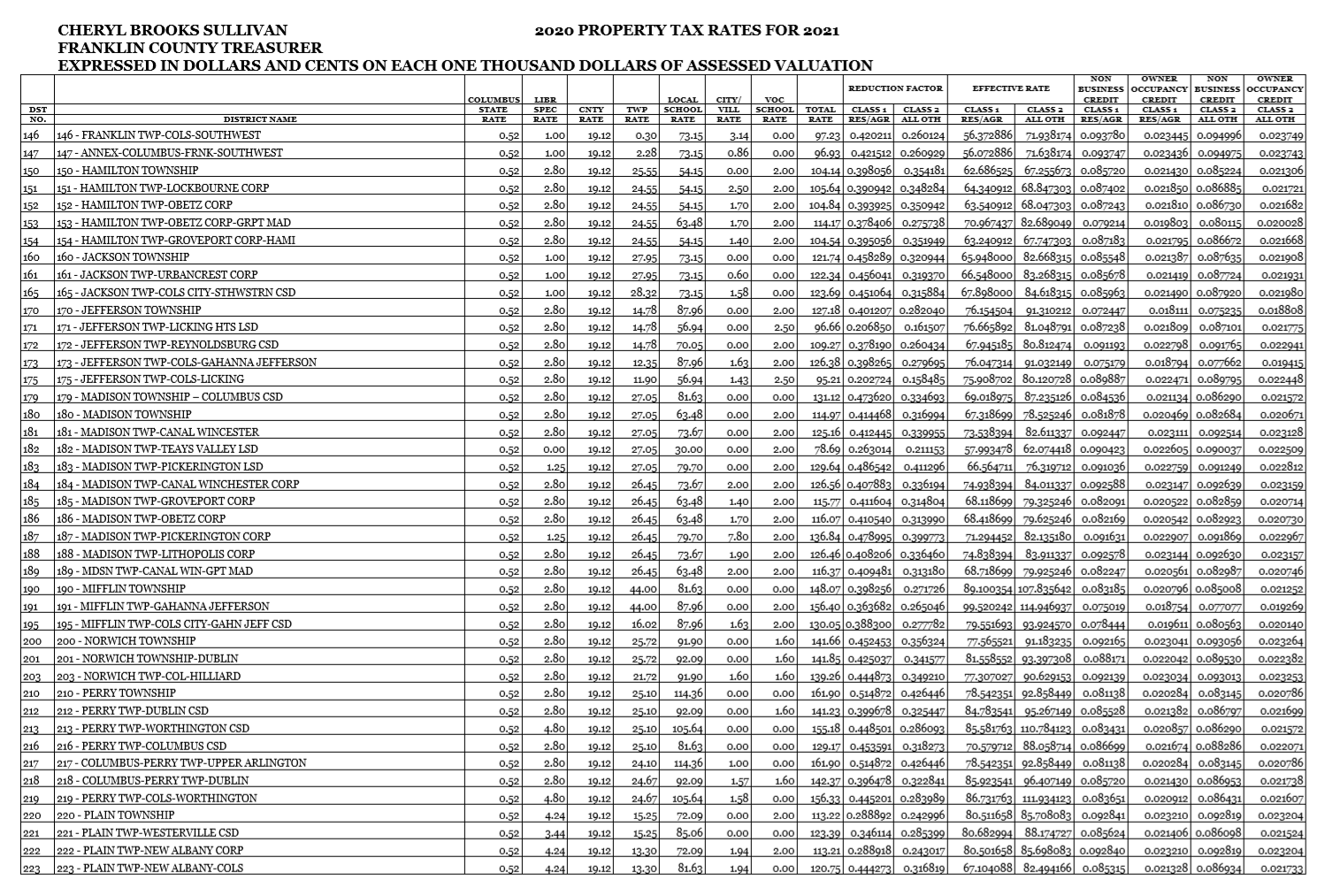

The real estate tax collection begins with the assessment of the real estate parcels in Franklin County. To redeem after the purchaser starts the foreclosure you must pay the certificate price plus 18 interest per year attorneys fees costs and other fees Ohio Rev. The Franklin County Board of Revision hears complaints against the valuations of manufactured or mobile home taxed like real property. Tax rates are established for the next year by the State of Ohio Department of Taxation. Ohio law requires counties to revalue all real property every six years with an update at the three year midpoint as ordered by the Tax Commissioner of the State of Ohio.

Source: dispatch.com

Source: dispatch.com

Ohio law mandates a general reappraisal every six. The Franklin County Board of Revision hears complaints against the valuations of manufactured or mobile home taxed like real property. This estimator is provided to assist taxpayers in making informed decisions about real estate taxes and to anticipate the impact of property value fluctuations. Franklin County Real Estate Tax Payment. The median property tax on a 15530000 house is 259351 in Franklin County.

Source: dispatch.com

Source: dispatch.com

Real Estate Tax Payments. Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work conducted by each County Auditor. The Franklin County Auditors Office maintains the most comprehensive set of real estate records available in Franklin County. The median property tax on a 15530000 house is 259351 in Franklin County.

Source: treasurer.franklincountyohio.gov

Source: treasurer.franklincountyohio.gov

Real Estate Tax Payments may be made in-person at our office. The median property tax on a 15530000 house is 163065 in the United States. Assessed value in Franklin County is usually calculated by multiplying market value by the countys predetermined ratio which currently is. This fee does not come back to the county in any way. Similarly the County assumes no responsibility for the consequences of inappropriate.

Source: apps.franklincountyauditor.com

Source: apps.franklincountyauditor.com

Real Estate Tax Payments. The Franklin County Auditors Office maintains the most comprehensive set of real estate records available in Franklin County. Yearly median tax in Franklin County The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300. Fees are 230 of total transaction for all credit cards Visa MasterCard Discover and American Express or 200 minimum. Debit card Visa will be a flat fee of 350.

Source: treasurer.franklincountyohio.gov

Source: treasurer.franklincountyohio.gov

Prior to 2013 estates that have a value in excess of 338333 or real estate will file an Ohio estate tax return. The median property tax on a 15530000 house is 211208 in Ohio. The only changes to a propertys value outside of the three year cycle. Real Estate Tax Payments. Franklin County Real Estate Tax Payment.

Source: blog.jasonopland.com

Source: blog.jasonopland.com

Assessed value in Franklin County is usually calculated by multiplying market value by the countys predetermined ratio which currently is. Similarly the County assumes no responsibility for the consequences of inappropriate. The real estate divisions employees oversee the appraisal of 434001 parcels. Tax rates are established for the next year by the State of Ohio Department of Taxation. Real Estate Taxes for 2nd Half 2016 Due Date 6202017 Parcel No.

Source: porter-law.com

Source: porter-law.com

The Franklin County Auditors Office maintains the most comprehensive set of real estate records available in Franklin County. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. 213018 parcels are mailed out to the owner for payment. To redeem after the purchaser starts the foreclosure you must pay the certificate price plus 18 interest per year attorneys fees costs and other fees Ohio Rev. There is no convenience fee for.

Source: treasurer.franklincountyohio.gov

Source: treasurer.franklincountyohio.gov

Fees are 230 of total transaction for all credit cards Visa MasterCard Discover and American Express or 200 minimum. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work conducted by each County Auditor. Debit card Visa will be a flat fee of 350. Real Estate Tax Attorney in Franklin County Ohio The Columbus Ohio real estate tax lawyer at Porter Law Office LLC has significant experience in helping taxpayers reduce their Ohio. Assessed value in Franklin County is usually calculated by multiplying market value by the countys predetermined ratio which currently is.

![]() Source: wcauditor.org

Source: wcauditor.org

Similarly the County assumes no responsibility for the consequences of inappropriate. Franklin County collects on average 167 of a propertys assessed fair market value as property tax. The Franklin County Board of Revision hears complaints against the valuations of manufactured or mobile home taxed like real property. The County assumes no responsibility for errors in the information and does not guarantee that the data is free from errors or inaccuracies. 213018 parcels are mailed out to the owner for payment.

Source: propertyshark.com

Source: propertyshark.com

Safety liquidity and earning a market rate of return on the countys money are primary responsibilities of the Treasurer. Franklin County collects on average 167 of a propertys assessed fair market value as property tax. Ohio law mandates a general reappraisal every six. Tax rates are established for the next year by the State of Ohio Department of Taxation. The real estate tax collection begins with the assessment of the real estate parcels in Franklin County.

Source: treasurer.franklincountyohio.gov

Source: treasurer.franklincountyohio.gov

Real Estate Taxes for 2nd Half 2016 Due Date 6202017 Parcel No. Fees are 230 of total transaction for all credit cards Visa MasterCard Discover and American Express or 200 minimum. The real estate tax collection begins with the assessment of the real estate parcels in Franklin County. Assessed value in Franklin County is usually calculated by multiplying market value by the countys predetermined ratio which currently is. The real estate divisions employees oversee the appraisal of 434001 parcels.

Source: smartasset.com

Source: smartasset.com

Real Estate Taxes for 2nd Half 2016 Due Date 6202017 Parcel No. HAGAN FRANKLIN COUNTY TREASURER 373 S HIGH ST 17th FLOOR COLUMBUS OH 43215-6306 PATSY D. Certain items may be deducted such as debts administration expenses and charitable gifts as well as other deductions and exemptions. Franklin County Real Estate Tax Payment. Address Franklin County Treasurer 373 South High Street 17th floor Columbus OH 43215-6306 Office hours are Monday through Friday 800 AM.

Source: propertyshark.com

Source: propertyshark.com

HAGAN FRANKLIN COUNTY TREASURER 373 S HIGH ST 17th FLOOR COLUMBUS OH 43215-6306 PATSY D. There are 427110 parcels in Franklin County. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. This fee does not come back to the county in any way. Users of this data are notified that the primary information source should be consulted for verification of.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title franklin county real estate taxes ohio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.