Your Fulton county ga real estate taxes images are ready. Fulton county ga real estate taxes are a topic that is being searched for and liked by netizens now. You can Download the Fulton county ga real estate taxes files here. Get all free photos.

If you’re searching for fulton county ga real estate taxes images information connected with to the fulton county ga real estate taxes interest, you have come to the right blog. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

Fulton County Ga Real Estate Taxes. The tax applies to realty that is sold granted assigned transferred or conveyed. Must be age 62 on or before January 1. A property selling for 55000000 would incur a 55000 State of Georgia Transfer Tax. This selection must be made at the time of your appeal and will not be changed after the appeal is submitted.

Approved and adopted September 2 2020. Applies to Fulton Operating Atlanta General Atlanta School Atlanta Parks in the amount of 30000. The City of South Fulton property taxes also known as ad valorem taxes are billed and collected through Fulton County Tax Commissioners office. The 2020 Millage Rate is 12899 0012899. Statements are mailed August 15th and are due by October 15th of each year. View photos see new listings compare properties and get information on open houses.

Must be a legal resident in the City of Atlanta.

The 2020 Millage Rate is 12899 0012899. However you may elect to be billed at 100 of the current years assessed value instead. Must be age 62 on or before January 1. A property selling for 55000000 would incur a 55000 State of Georgia Transfer Tax. Applies to Fulton Operating Atlanta General Atlanta School Atlanta Parks in the amount of 30000. The City of South Fulton property taxes also known as ad valorem taxes are billed and collected through Fulton County Tax Commissioners office.

Source: atlanta.curbed.com

Source: atlanta.curbed.com

See sample report. Applies to Fulton Operating Atlanta General Atlanta School Atlanta Parks in the amount of 30000. Search for Tax Bill. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of. Must be age 62 on or before January 1.

Source: 11alive.com

Source: 11alive.com

You may select from parcel ID account number or street address. Multiply that by the millage rate and. Income based reduction at 62. Taxes are due 252021. The City of South Fulton property taxes also known as ad valorem taxes are billed and collected through Fulton County Tax Commissioners office.

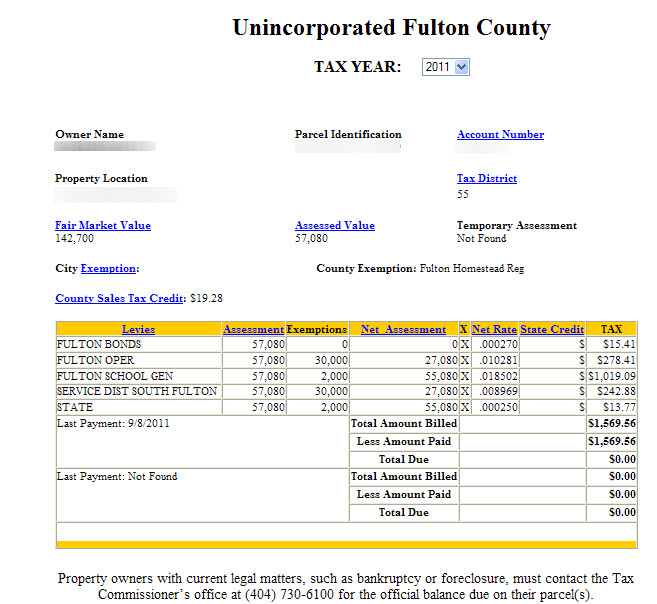

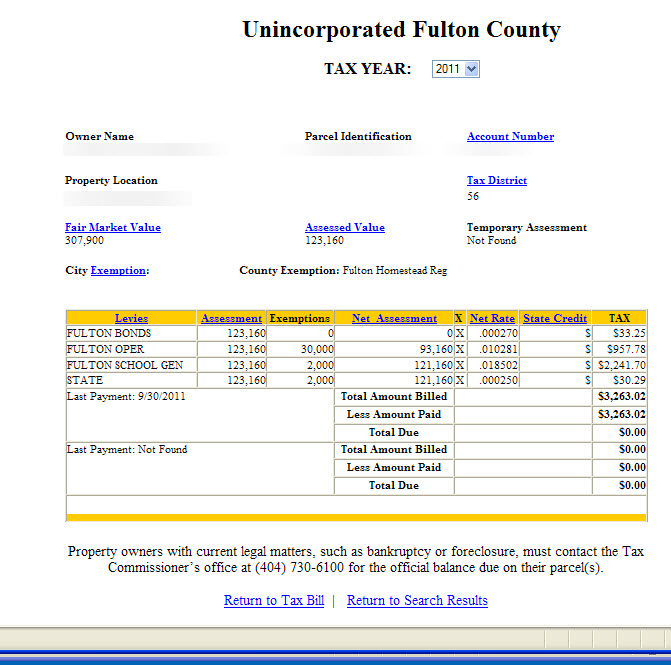

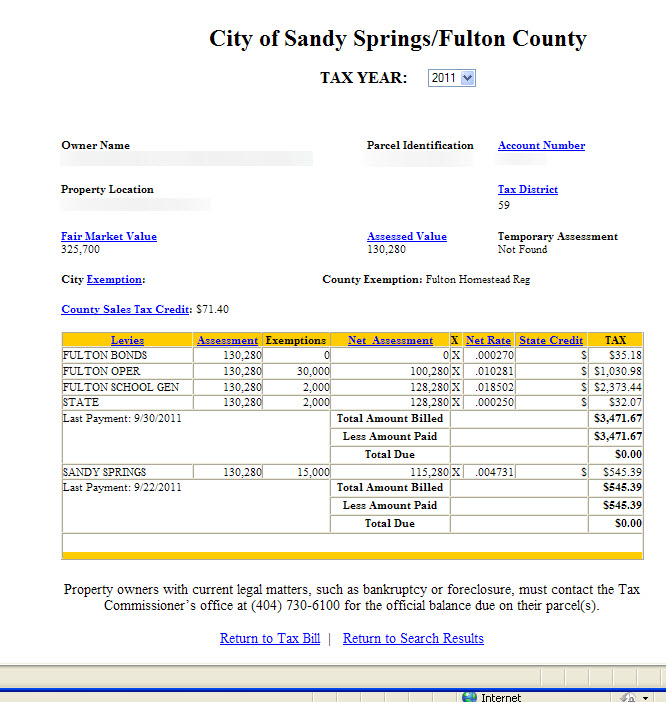

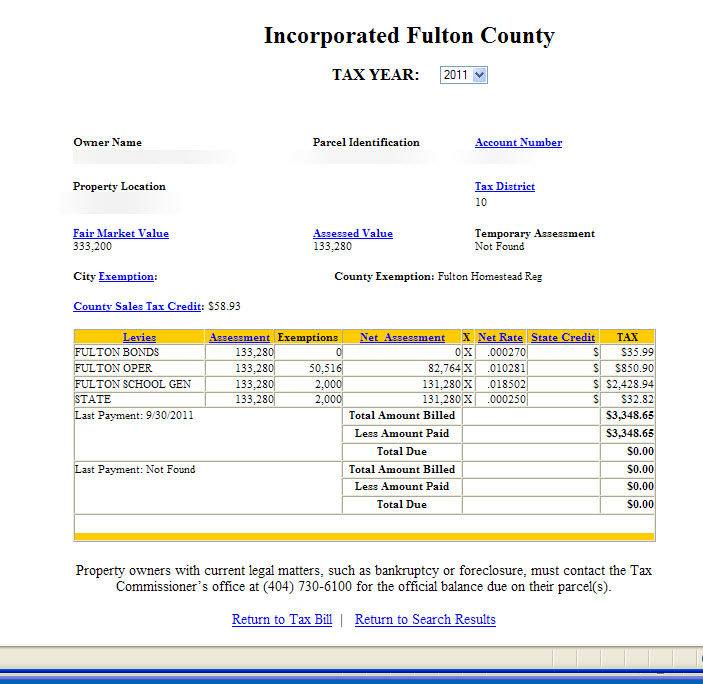

SEE Detailed property tax report for 2478 Ozark Trl SW Fulton County GA. This selection must be made at the time of your appeal and will not be changed after the appeal is submitted. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Must be a legal resident in the City of Atlanta. The county has provided a.

Source: truesquarefinancial.com

Source: truesquarefinancial.com

Approved and adopted September 2 2020. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the full property report. Must be age 62 on or before January 1. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Georgia does not have a statewide property tax.

![]() Source: homeatlanta.com

Source: homeatlanta.com

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of. 6622 homes for sale in Fulton County GA priced from 33239 to 21683600. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. However you may elect to be billed at 100 of the current years assessed value instead. View photos see new listings compare properties and get information on open houses.

Source: fultoncountytaxes.org

Source: fultoncountytaxes.org

Multiply that by the millage rate and. Bartow County Home Exemptions. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. Must be a legal resident in the City of Atlanta.

Source: chatthillsga.us

Source: chatthillsga.us

The tax applies to realty that is sold granted assigned transferred or conveyed. However you may elect to be billed at 100 of the current years assessed value instead. Multiply that by the millage rate and. Search for Tax Bill. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

Source: fultoncountytaxes.org

Source: fultoncountytaxes.org

For more information you may contact the Tax Assessors Office at 404 612-6440 option 1. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Multiply that by the millage rate and. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Must own and occupy your home as of January 1.

Source: homeatlanta.com

Source: homeatlanta.com

Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Taxes are due 252021. The tax applies to realty that is sold granted assigned transferred or conveyed. Fulton County Districts Fulton County is in the north-central portion of Georgia. The county has provided a.

Source: homeatlanta.com

Source: homeatlanta.com

We have received the rates from the state and the property taxes have been calculated 2020P2021. View photos see new listings compare properties and get information on open houses. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or fractional part of 100. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the full property report.

Source: homeatlanta.com

Source: homeatlanta.com

Fulton County Districts Fulton County is in the north-central portion of Georgia. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the full property report. To search for a tax bill select your property type personal property or real estate then select the information you want to enter. The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or fractional part of 100. FULTON COUNTY GA Fulton County voters in November 2018 approved a series of new homestead exemptions providing property owners with considerable tax relief for 2019.

This selection must be made at the time of your appeal and will not be changed after the appeal is submitted. We have received the rates from the state and the property taxes have been calculated 2020P2021. To search for a tax bill select your property type personal property or real estate then select the information you want to enter. Taxes are due 252021. View photos see new listings compare properties and get information on open houses.

Source: iaspublicaccess.fultoncountyga.gov

Source: iaspublicaccess.fultoncountyga.gov

We have received the rates from the state and the property taxes have been calculated 2020P2021. The tax applies to realty that is sold granted assigned transferred or conveyed. Must be a legal resident in the City of Atlanta. Search for Tax Bill. FULTON COUNTY GA Fulton County voters in November 2018 approved a series of new homestead exemptions providing property owners with considerable tax relief for 2019.

Source:

Source:

We have received the rates from the state and the property taxes have been calculated 2020P2021. Multiply that by the millage rate and. Verify accuracy directly with the county and your tax accountant. For more information you may contact the Tax Assessors Office at 404 612-6440 option 1. We have received the rates from the state and the property taxes have been calculated 2020P2021.

Source: homeatlanta.com

Source: homeatlanta.com

Georgia does not have a statewide property tax. Multiply that by the millage rate and. Calculating property taxes for Fulton County Non-owner occupied homes. Statements are mailed August 15th and are due by October 15th of each year. Complete exemption from school taxes at age 62 on the first 377750 of homes value with additional exemptions based on income.

The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or fractional part of 100. As of 2017 estimates the population was 1041423 making it the states most populous county and its only one with over one million inhabitants. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Must own and occupy your home as of January 1. However you may elect to be billed at 100 of the current years assessed value instead.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

School tax exemption of 40K at age 65. You may select from parcel ID account number or street address. The tax applies to realty that is sold granted assigned transferred or conveyed. Complete exemption from school taxes at age 62 on the first 377750 of homes value with additional exemptions based on income. For more information you may contact the Tax Assessors Office at 404 612-6440 option 1.

Fulton County Districts Fulton County is in the north-central portion of Georgia. As of 2017 estimates the population was 1041423 making it the states most populous county and its only one with over one million inhabitants. The county has provided a. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. The City of South Fulton property taxes also known as ad valorem taxes are billed and collected through Fulton County Tax Commissioners office.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fulton county ga real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.