Your Fulton county real estate taxes images are ready. Fulton county real estate taxes are a topic that is being searched for and liked by netizens now. You can Find and Download the Fulton county real estate taxes files here. Get all free photos.

If you’re looking for fulton county real estate taxes images information connected with to the fulton county real estate taxes interest, you have visit the right site. Our website always gives you suggestions for seeing the highest quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

Fulton County Real Estate Taxes. The median property tax in Fulton County Pennsylvania is 1627 per year for a home worth the median value of 157500. Any No HOA Fee 50month100month200month300. Please DO NOT send cash through the mail. After entering your information click Search.

Ireig8vxianqzm From

Ireig8vxianqzm From

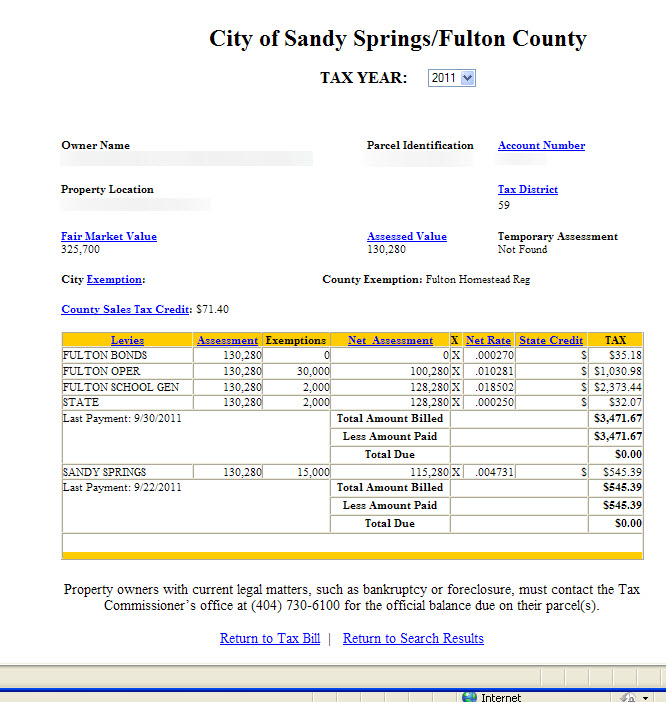

To search for a tax bill select your property type personal property or real estate then select the information you want to enter. Real estate taxes are generally due on February 5 for the first half billing and July 20 for the second half billing. The assessed value is 40 of the fair market value. Fulton County Property Tax Payments Annual Fulton County Indiana Median Property Taxes 559 1164 Median Property Taxes Mortgage 531 1233 Median Property Taxes. Real estate taxes are mailed out semi-annually and are always one year in arrears. Multiply that by the millage rate and.

Box 128 Johnstown NY 12095.

To search for a tax bill select your property type personal property or real estate then select the information you want to enter. First as an advocate for and support agency to County Government. Box 128 Johnstown NY 12095. You may select from parcel ID account number or street address. We have received the rates from the state and the property taxes have been calculated 2020P2021. Please DO NOT send cash through the mail.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of. After entering your information click Search. We have received the rates from the state and the property taxes have been calculated 2020P2021. If using express mail. The median property tax also known as real estate tax in Fulton County is 162700 per year based on a median home value of 15750000 and a median effective property tax rate of 103 of property value.

Source: fair-assessments.com

Source: fair-assessments.com

223 W Main St Johnstown NY 12095. After entering your information click Search. Any No HOA Fee 50month100month200month300. To process an online payment please use the link above. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

Source: homeatlanta.com

Source: homeatlanta.com

Counties cities towns villages school districts and special districts each raise money through the real property tax. On and after January 1 1991 taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from January 1 through May 31 ACA 26-26-1408. The median property tax also known as real estate tax in Fulton County is 162700 per year based on a median home value of 15750000 and a median effective property tax rate of 103 of property value. Real estate taxes are mailed out semi-annually and are always one year in arrears. Box 128 Johnstown NY 12095.

Source: fair-assessments.com

Source: fair-assessments.com

Search for Tax Bill. We have received the rates from the state and the property taxes have been calculated 2020P2021. In New York State the real property tax is a tax based on the value of real property. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Third as an advocate and resource in real property.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Third as an advocate and resource in real property. Real estate taxes are mailed out semi-annually and are always one year in arrears. To process an online payment please use the link above. To search for a tax bill select your property type personal property or real estate then select the information you want to enter.

Source: zillow.com

Source: zillow.com

Fulton County IN Map. Fulton County collects on average 103 of. To process an online payment please use the link above. In New York State the real property tax is a tax based on the value of real property. To search for a tax bill select your property type personal property or real estate then select the information you want to enter.

Source: minervaplanninggroup.com

Source: minervaplanninggroup.com

We have received the rates from the state and the property taxes have been calculated 2020P2021. On and after January 1 1991 taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from January 1 through May 31 ACA 26-26-1408. Fulton County Property Tax Payments Annual Fulton County Indiana Median Property Taxes 559 1164 Median Property Taxes Mortgage 531 1233 Median Property Taxes. Box 128 Johnstown NY 12095. Fulton County Treasurer PO.

![]() Source: homeatlanta.com

Source: homeatlanta.com

Taxes are due 252021. Please DO NOT send cash through the mail. We have received the rates from the state and the property taxes have been calculated 2020P2021. Multiply that by the millage rate and. Calculating property taxes for Fulton County Non-owner occupied homes.

We have received the rates from the state and the property taxes have been calculated 2020P2021. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of. After entering your information click Search. Search for Tax Bill. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Source:

Source:

Fulton County IN Map. If you have questions do not hesitate to contact our office. The median property tax also known as real estate tax in Fulton County is 162700 per year based on a median home value of 15750000 and a median effective property tax rate of 103 of property value. 223 W Main St Johnstown NY 12095. After entering your information click Search.

Source: chatthillsga.us

Source: chatthillsga.us

In New York State the real property tax is a tax based on the value of real property. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. First as an advocate for and support agency to County Government. SEE Detailed property tax report for 1082 Cohwy 125 Fulton County NY. After entering your information click Search.

On and after January 1 1991 taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from January 1 through May 31 ACA 26-26-1408. Third as an advocate and resource in real property. First as an advocate for and support agency to County Government. Real estate taxes are mailed out semi-annually and are always one year in arrears. Search for Tax Bill.

Source: homeatlanta.com

Source: homeatlanta.com

If you have questions do not hesitate to contact our office. All parcels in appeal will be billed at 85 of the assessed value listed on your assessment notice or 100 of the last approved assessed value. To process an online payment please use the link above. SEE Detailed property tax report for 1082 Cohwy 125 Fulton County NY. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Source: fultoncountytaxes.org

Source: fultoncountytaxes.org

In-depth Fulton County IN Property Tax Information. Search for Tax Bill. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. However you may elect to be billed at 100 of the current years assessed value instead. Payments by mail can be made by check certified funds or money order and mailed to.

Source: zillow.com

Source: zillow.com

The assessed value is 40 of the fair market value. Fulton County Property Tax Payments Annual Fulton County Indiana Median Property Taxes 559 1164 Median Property Taxes Mortgage 531 1233 Median Property Taxes. Calculating property taxes for Fulton County Non-owner occupied homes. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Fulton County IN Map.

Source: fultoncountyny.gov

Source: fultoncountyny.gov

About the Fulton County Tax Collector The Fulton County Tax Collector located in Salem Arkansas is responsible for financial transactions including issuing Fulton County tax bills collecting personal and real property tax payments. After entering your information click Search. Fulton County collects on average 103 of. Fulton County IN Map. In New York State the real property tax is a tax based on the value of real property.

Source: atlanta.curbed.com

Source: atlanta.curbed.com

Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Fulton County collects on average 103 of. Please DO NOT send cash through the mail. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Fulton County IN Map.

Source: truesquarefinancial.com

Source: truesquarefinancial.com

Box 128 Johnstown NY 12095. To search for a tax bill select your property type personal property or real estate then select the information you want to enter. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Second in the support and mentoring of the local assessment community. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fulton county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.