Your Gwinnett county real estate tax records images are ready. Gwinnett county real estate tax records are a topic that is being searched for and liked by netizens today. You can Find and Download the Gwinnett county real estate tax records files here. Download all royalty-free photos and vectors.

If you’re looking for gwinnett county real estate tax records images information linked to the gwinnett county real estate tax records keyword, you have pay a visit to the right site. Our site frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

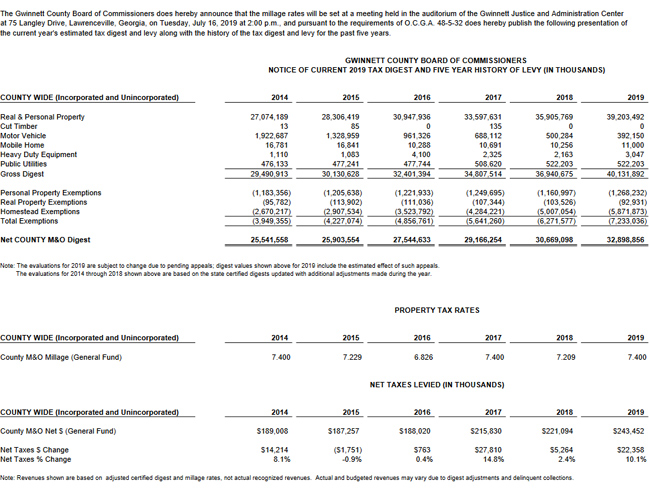

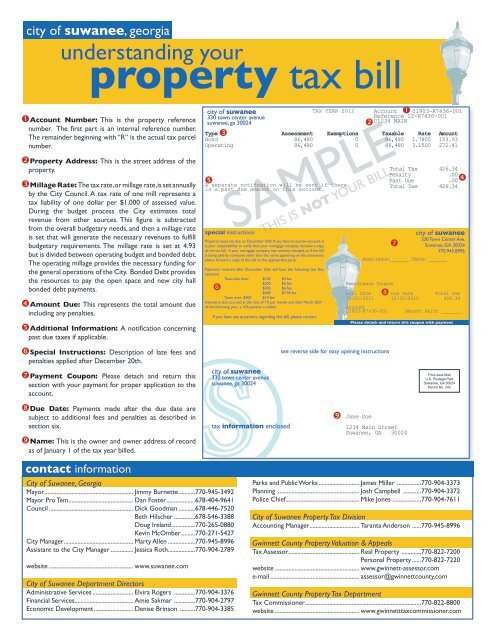

Gwinnett County Real Estate Tax Records. Lawrenceville GA 30245. It also may indicate who is responsible for any outstanding taxes not paid at closing. The document required as proof of transfer of tax liability is generally called an Acknowledgment and Receipt of Settlement Statement This document may state that the taxes were prorated based on the estimated amounts prior to the release or receipt of the actual tax bill. Search Gwinnett County property tax and assessment records through GIS maps.

William Wilborn Discovered In Maryland Compiled Marriage Index 1634 1777 Marriage Sarah Wood Family History From pinterest.com

William Wilborn Discovered In Maryland Compiled Marriage Index 1634 1777 Marriage Sarah Wood Family History From pinterest.com

SEE Detailed property tax report for 4544 Lakefaire Ct Gwinnett County GA. The State Revenue Commissioner is responsible for ensuring that property in Georgia is assessed uniformly and equally between and within the counties. The median property tax on a 19420000 house is 194200 in Gwinnett County. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Voter Registration and Elections. They are maintained by various government offices in Gwinnett County Georgia State and at the Federal.

Gwinnett County Property Records are real estate documents that contain information related to real property in Gwinnett County Georgia.

Gwinnett County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Gwinnett County Georgia. Search Gwinnett County property tax and assessment records through GIS maps. Recorders Court handles traffic citations that are written by the Gwinnett County Police Department Gwinnett County Sheriffs Department Georgia Department of Driver Services and the Georgia Department of Transportation. It also may indicate who is responsible for any outstanding taxes not paid at closing. Click on the name of the owner underlined in. Gwinnett County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Gwinnett County Georgia.

Source: houselogic.com

Source: houselogic.com

Recorders Court handles traffic citations that are written by the Gwinnett County Police Department Gwinnett County Sheriffs Department Georgia Department of Driver Services and the Georgia Department of Transportation. Click on the. Your Parcel Number example. The State Revenue Commissioner is responsible for ensuring that property in Georgia is assessed uniformly and equally between and within the counties. It also may indicate who is responsible for any outstanding taxes not paid at closing.

Source: pinterest.com

Source: pinterest.com

R8001 001 or R8001 A 001 OR Property Owner Name OR Property Address. 8 days ago County Property Tax Facts Gwinnett Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. The median property tax on a 19420000 house is 203910 in the United States. SEE Detailed property tax report for 4544 Lakefaire Ct Gwinnett County GA. Gwinnett County Property Records are real estate documents that contain information related to real property in Gwinnett County Georgia.

Source: pinterest.com

Source: pinterest.com

Steps to search for additional property information and sales in your neighborhood. Steps to search for additional property information and sales in your neighborhood. Click on the. The following process is used to apply for all homestead exemptions. Click on the Search box.

Source: pl.pinterest.com

Source: pl.pinterest.com

Georgia does not have a statewide property tax. Enter information and click Search. SEE Detailed property tax report for 4544 Lakefaire Ct Gwinnett County GA. Gwinnett County Property Records are real estate documents that contain information related to real property in Gwinnett County Georgia. Search Gwinnett County property tax and assessment records through GIS maps.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Recorders Court handles traffic citations that are written by the Gwinnett County Police Department Gwinnett County Sheriffs Department Georgia Department of Driver Services and the Georgia Department of Transportation. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Verify the information is correct then click the blue Parcel. They are maintained by various government offices in Gwinnett County Georgia State and at the Federal.

Source: friedberger-burgfest.de

Source: friedberger-burgfest.de

Click on the name of the owner underlined in. The tax for recording the note is at the rate of 150 for each. Enter information and click Search. These records can include Gwinnett County property tax assessments and assessment challenges appraisals and income taxes. Voter Registration and Elections.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Click on the name of the owner underlined in. Enter one of the following in the search box above. Enter information and click Search. Click on the Search box. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note.

Source: easyknock.com

Source: easyknock.com

The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. The median property tax on a 19420000 house is 194200 in Gwinnett County. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. 8 days ago County Property Tax Facts Gwinnett Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Gwinnett County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Gwinnett County Georgia.

Source: pinterest.com

Source: pinterest.com

Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska. Houses 3 days ago Deeds and Land Records The Superior Court Clerks duties include recording all Gwinnett County real estate deeds plats condominium floor plans Uniform Commercial Code Filings General Execution Docket and Lien filings Military Discharges Partnerships and Physicians License providing an index and images of all. Your Parcel Number example. Gwinnett County Courts - Deeds and Land Records. Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska.

Source: friedberger-burgfest.de

Source: friedberger-burgfest.de

SEE Detailed property tax report for 4544 Lakefaire Ct Gwinnett County GA. The Superior Court Clerks duties include recording all Gwinnett County real estate deeds plats condominium floor plans Uniform Commercial Code Filings General Execution Docket and Lien filings Military Discharges Partnerships and Physicians License providing an. The median property tax on a 19420000 house is 203910 in the United States. The State Revenue Commissioner is responsible for ensuring that property in Georgia is assessed uniformly and equally between and within the counties. Click on the Search box.

Source: kevindcampbell.ca

Source: kevindcampbell.ca

SEE Detailed property tax report for 4544 Lakefaire Ct Gwinnett County GA. The median property tax on a 19420000 house is 161186 in Georgia. Recorders Court handles traffic citations that are written by the Gwinnett County Police Department Gwinnett County Sheriffs Department Georgia Department of Driver Services and the Georgia Department of Transportation. The median property tax on a 19420000 house is 194200 in Gwinnett County. It also may indicate who is responsible for any outstanding taxes not paid at closing.

Source: in.pinterest.com

Source: in.pinterest.com

Voter Registration and Elections. The State Revenue Commissioner is responsible for ensuring that property in Georgia is assessed uniformly and equally between and within the counties. The tax for recording the note is at the rate of 150 for each. The following process is used to apply for all homestead exemptions. Pay your citation by phone at 1-877-794-0988.

Source: friedberger-burgfest.de

Source: friedberger-burgfest.de

Assessor Records Gwinnett County Tax Assessor 75 Langley Drive Lawrenceville GA 30045. The tax for recording the note is at the rate of 150 for each. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Enter one of the following in the search box above. Search Gwinnett County property tax and assessment records through GIS maps.

Source: pinterest.com

Source: pinterest.com

The State Revenue Commissioner is responsible for ensuring that property in Georgia is assessed uniformly and equally between and within the counties. SEE Detailed property tax report for 4544 Lakefaire Ct Gwinnett County GA. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. Search Gwinnett County property tax and assessment records through GIS maps. Gwinnett County Courts - Deeds and Land Records.

Source: fair-assessments.com

Source: fair-assessments.com

These records can include Gwinnett County property tax assessments and assessment challenges appraisals and income taxes. SEE Detailed property tax report for 4544 Lakefaire Ct Gwinnett County GA. The document required as proof of transfer of tax liability is generally called an Acknowledgment and Receipt of Settlement Statement This document may state that the taxes were prorated based on the estimated amounts prior to the release or receipt of the actual tax bill. The median property tax on a 19420000 house is 194200 in Gwinnett County. Click on the Search box.

Source: pinterest.com

Source: pinterest.com

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Pay your citation by phone at 1-877-794-0988. The median property tax on a 19420000 house is 161186 in Georgia. Enter one of the following in the search box above. 8 days ago County Property Tax Facts Gwinnett Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days.

Source: tiotrepelnoli.gq

Source: tiotrepelnoli.gq

Enter information and click Search. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The median property tax on a 19420000 house is 194200 in Gwinnett County. R8001 001 or R8001 A 001 OR Property Owner Name OR Property Address. Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska.

Source: pinterest.com

Source: pinterest.com

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Steps to search for additional property information and sales in your neighborhood. Recorders Court handles traffic citations that are written by the Gwinnett County Police Department Gwinnett County Sheriffs Department Georgia Department of Driver Services and the Georgia Department of Transportation. The median property tax on a 19420000 house is 161186 in Georgia. Enter information and click Search.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title gwinnett county real estate tax records by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.