Your Henrico county real estate tax rate images are available in this site. Henrico county real estate tax rate are a topic that is being searched for and liked by netizens today. You can Get the Henrico county real estate tax rate files here. Download all royalty-free vectors.

If you’re searching for henrico county real estate tax rate pictures information related to the henrico county real estate tax rate keyword, you have come to the right blog. Our website always provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

Henrico County Real Estate Tax Rate. 804 205-3501 Mon Fri 8 am 5 pm. There are five districts within the County that have additional rates which. Henrico County Va Real Estate Tax Bill 7 days ago Real Estate - Henrico County Virginia. The median property tax also known as real estate tax in Henrico County is 176200 per year based on a median home value of 23000000 and a median.

9306 Ashford Rd Henrico Va 23229 Realtor Com From realtor.com

9306 Ashford Rd Henrico Va 23229 Realtor Com From realtor.com

You can also safely and securely view your bill online consolidate your tax bills into one online account set up notifications and reminders to be sent to your email or mobile phone schedule payments create an online wallet and pay with one click using creditdebit or your checking account. Henrico County is ranked 1151st of the 3143 counties for property taxes as a. There are five districts within the County that have additional rates which range. For businesses with gross receipts of 400000 or more the rate is usually 20 per 100 of gross receipts or 15 per 100 for contractors. The median property tax in Henrico County Virginia is 1762 per year for a home worth the median value of 230000. Tangible Personal Property Tax Tax Rate.

Tax Rates Real Estate Property Information Spouses of Soldiers Killed In Action Disabled Veterans Real Estate Tax Exemption E-Mail inquiries to Jason Hughes at hug123henricous.

Henrico County Va Real Estate Tax Bill 7 days ago Real Estate - Henrico County Virginia. 087 per 10000 of the assessed value. 8 days ago I. Henrico County collects on average 077 of a propertys assessed fair market value as property tax. For businesses with gross receipts of 400000 or more the rate is usually 20 per 100 of gross receipts or 15 per 100 for contractors. Henrico County Va Real Estate Tax Bill 7 days ago Real Estate - Henrico County Virginia.

Source: chesterfieldobserver.com

Source: chesterfieldobserver.com

REAL ESTATE TAX Real estate in Henrico County is assessed at 100 of market value and taxed at 87 per 100 of assessed value. The median property tax in Henrico County Virginia is 1762 per year for a home worth the median value of 230000. For more information please call 804 501-4310. 804 205-3501 Mon Fri 8 am 5 pm. Henrico County collects relatively high property taxes and is.

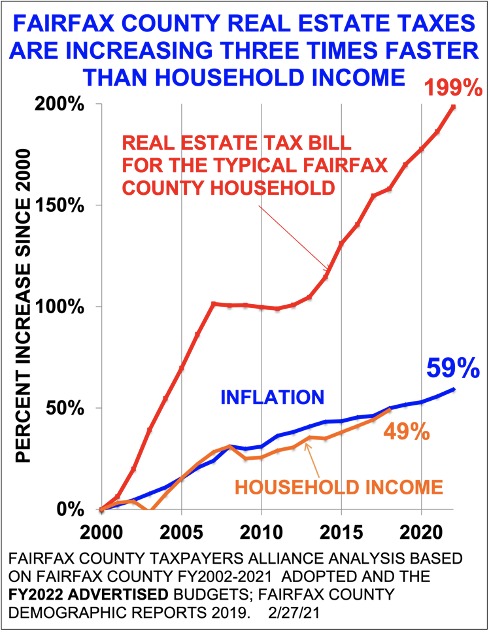

Source: fcta.org

Source: fcta.org

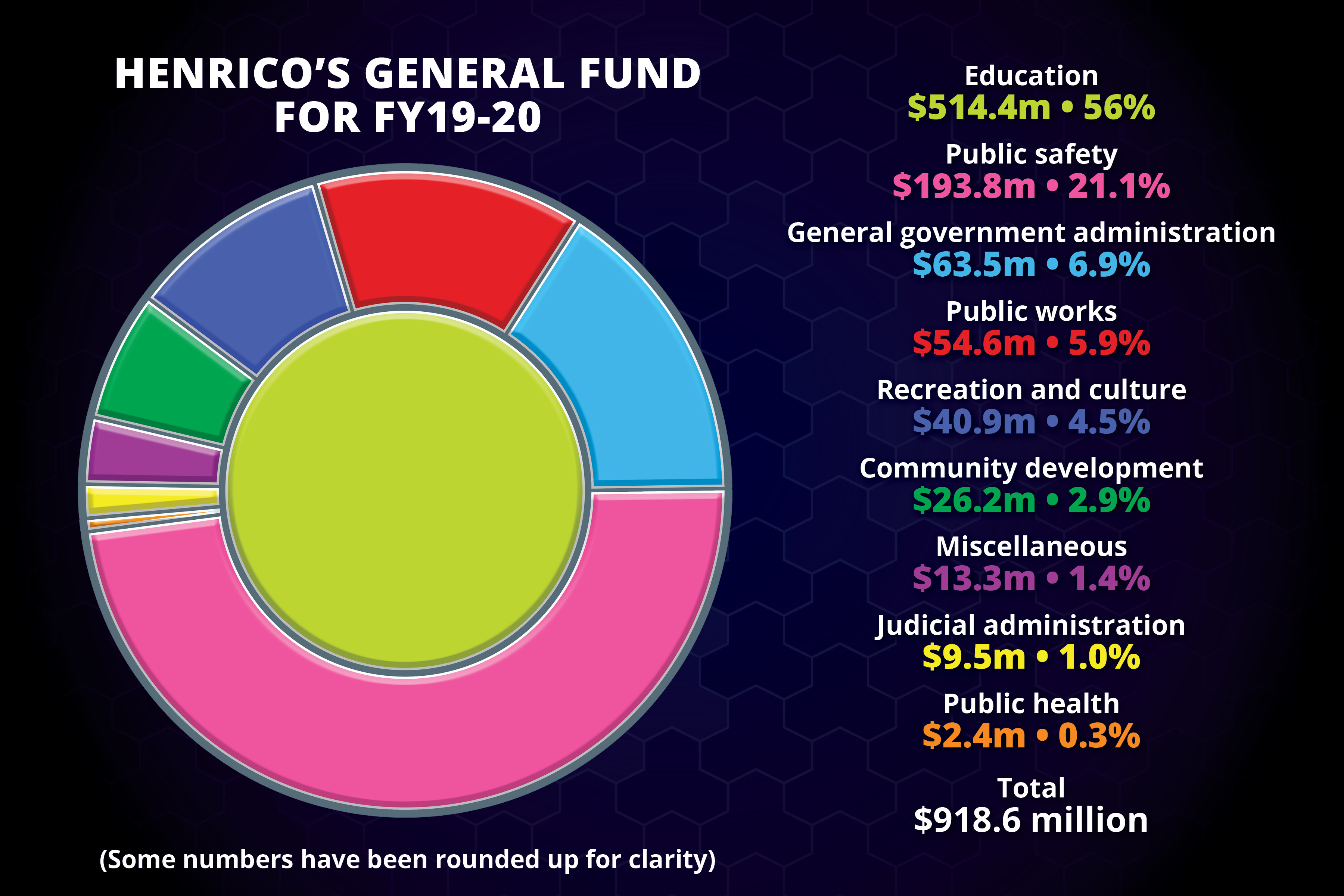

Henrico schools operations line. The median property tax in Henrico County Virginia is 1762 per year for a home worth the median value of 230000. The Real Estate tax rate is 087 per 10000 of the assessed value. 350 per 10000 o Please take our brief online survey on how Henrico County communicates with you. Henrico County collects relatively high property taxes and is.

When must the short term rental property tax return be filed and when must the tax be paid. There are five districts within the County that have additional rates which. Henrico County collects on average 077 of a propertys assessed fair market value as property tax. Henrico County is ranked 1151st of the 3143 counties for property taxes as a. The tax rate is 1 percent charged to the consumer at the time of rental payment.

There are five districts within the County that have additional rates which range. There are five districts within the County that have additional rates which range. Non-confidential real estate assessment records are public information under Virginia law and Internet display of non-confidential property information is specifically authorized by Virginia Code 581-31222. REAL ESTATE TAX Real estate in Henrico County is assessed at 100 of market value and taxed at 87 per 100 of assessed value. Henrico County Va Real Estate Tax Bill 7 days ago Real Estate - Henrico County Virginia.

Source: henricocitizen.com

Source: henricocitizen.com

Henrico schools operations line. The median property tax in Henrico County Virginia is 1762 per year for a home worth the median value of 230000. 350 per 10000 o Tangible Personal Property Tax Tax Rate. Henrico County is ranked 1151st of the 3143 counties for property taxes as a. Houses 6 days ago The median property tax also known as real estate tax in Henrico County is 176200 per year based on a median home value of 23000000 and a median effective property tax rate of 077 of property.

Source: henrico.us

Source: henrico.us

8 days ago I. For more information please call 804 501-4310. Henrico County Va Real Estate Tax Bill 7 days ago Real Estate - Henrico County Virginia. 804 205-3501 Mon Fri 8 am 5 pm. You can also safely and securely view your bill online consolidate your tax bills into one online account set up notifications and reminders to be sent to your email or mobile phone schedule payments create an online wallet and pay with one click using creditdebit or your checking account.

804 501-5655 Mon Fri 8 am 430 pm. You can also safely and securely view your bill online consolidate your tax bills into one online account set up notifications and reminders to be sent to your email or mobile phone schedule payments create an online wallet and pay with one click using creditdebit or your checking account. For more information please call 804 501-4310. The tax rate is 1 percent charged to the consumer at the time of rental payment. 804 205-3501 Mon Fri 8 am 5 pm.

Source: smartasset.com

Source: smartasset.com

There are five districts within the County that have additional rates which range. The tax rate is 1 percent charged to the consumer at the time of rental payment. For additional information please visit the Finance Department Revenue Division website or call 804 501-7329. Houses 6 days ago The median property tax also known as real estate tax in Henrico County is 176200 per year based on a median home value of 23000000 and a median effective property tax rate of 077 of property. While the Real Estate Division has worked to ensure that the assessment data contained herein is accurate Henrico County assumes no.

Henrico County now offers paperless personal property and real estate tax bills. You can also safely and securely view your bill online consolidate your tax bills into one online account set up notifications and reminders to be sent to your email or mobile phone schedule payments create an online wallet and pay with one click using creditdebit or your checking account. 804 501-5655 Mon Thu 830 am 400 pm. 804 501-5655 Mon Fri 8 am 430 pm. For additional information please visit the Finance Department Revenue Division website or call 804 501-7329.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Henrico schools operations line. The Real Estate tax rate is 087 per 10000 of the assessed value. Henrico schools operations line. Henrico County now offers paperless personal property and real estate tax bills. 804 501-5655 Mon Fri 8 am 430 pm.

Source: baconsrebellion.com

Source: baconsrebellion.com

Tangible Personal Property Tax Tax Rate. Henrico County collects on average 077 of a propertys assessed fair market value as property tax. You can also safely and securely view your bill online consolidate your tax bills into one online account set up notifications and reminders to be sent to your email or mobile phone schedule payments create an online wallet and pay with one click using creditdebit or your checking account. 804 205-3501 Mon Fri 8 am 5 pm. Tax Rates Real Estate Property Information Spouses of Soldiers Killed In Action Disabled Veterans Real Estate Tax Exemption E-Mail inquiries to Jason Hughes at hug123henricous.

Source: realtor.com

Source: realtor.com

Henrico County Real Estate Tax 10 days ago Houses 5 days ago The median property tax also known as real estate tax in Henrico County is 176200 per year based on a median home value of 23000000 and a median effective property tax rate of 077 of property value. Tax Rates Real Estate Property Information Spouses of Soldiers Killed In Action Disabled Veterans Real Estate Tax Exemption E-Mail inquiries to Jason Hughes at hug123henricous. Non-confidential real estate assessment records are public information under Virginia law and Internet display of non-confidential property information is specifically authorized by Virginia Code 581-31222. 8 days ago I. Henrico County Real Estate Tax 10 days ago Houses 5 days ago The median property tax also known as real estate tax in Henrico County is 176200 per year based on a median home value of 23000000 and a median effective property tax rate of 077 of property value.

Source: richmond.com

Source: richmond.com

The Real Estate tax rate is 087 per 10000 of the assessed value. The median property tax also known as real estate tax in Henrico County is 176200 per year based on a median home value of 23000000 and a median. The average yearly property tax paid by Henrico County residents amounts to about 23 of their yearly income. When must the short term rental property tax return be filed and when must the tax be paid. There are five districts within the County that have additional rates which.

Source: loudounnow.com

Source: loudounnow.com

Find Henrico County Real Estate Tax Rates sold homes homes for sale real estate house for rent. Tax Rate The Real Estate tax rate is 087 per 10000 of the assessed value. Henrico County collects relatively high property taxes and is. For additional information please visit the Finance Department Revenue Division website or call 804 501-7329. Tax Rates Real Estate Property Information Spouses of Soldiers Killed In Action Disabled Veterans Real Estate Tax Exemption E-Mail inquiries to Jason Hughes at hug123henricous.

Source: annandjohnvandersyde.com

Source: annandjohnvandersyde.com

The Real Estate tax rate is 087 per 10000 of the assessed value. For additional information please visit the Finance Department Revenue Division website or call 804 501-7329. Tax Rate The Real Estate tax rate is 087 per 10000 of the assessed value. Henrico County Va Real Estate Tax Bill 7 days ago Real Estate - Henrico County Virginia. Find Henrico County Real Estate Tax Rates sold homes homes for sale real estate house for rent.

350 per 10000 o Tangible Personal Property Tax Tax Rate. Henrico County is ranked 1151st of the 3143 counties for property taxes as a. Henrico schools operations line. Henrico County Va Real Estate Tax Bill 7 days ago Real Estate - Henrico County Virginia. View County operational changes due to Covid-19.

Source: realtor.com

Source: realtor.com

For more information please call 804 501-4310. Henrico general government operations line. 350 per 10000 o Tangible Personal Property Tax Tax Rate. 350 per 10000 o Please take our brief online survey on how Henrico County communicates with you. The amount of tax relief is based upon the total dollars from the Commonwealth divided by the total tax of all qualifying vehicles in the County.

Source: taberbain.com

Source: taberbain.com

The amount of tax relief is based upon the total dollars from the Commonwealth divided by the total tax of all qualifying vehicles in the County. 804 205-3501 Mon Fri 8 am 5 pm. Henrico general government operations line. The median property tax also known as real estate tax in Henrico County is 176200 per year based on a median home value of 23000000 and a median. Henrico schools operations line.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title henrico county real estate tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.