Your Hillsborough county fl real estate taxes images are ready. Hillsborough county fl real estate taxes are a topic that is being searched for and liked by netizens now. You can Download the Hillsborough county fl real estate taxes files here. Download all free images.

If you’re looking for hillsborough county fl real estate taxes images information linked to the hillsborough county fl real estate taxes keyword, you have come to the ideal blog. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

Hillsborough County Fl Real Estate Taxes. These records can include Hillsborough County property tax assessments and assessment challenges appraisals and income taxes. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. Hillsborough County collects on average 109 of a propertys assessed fair. Hillsborough County Tax Collector Nancy C.

The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. City of Tampa up to 50000 Unincorporated Hillsborough County up to 50000 and Temple Terrace up to 25000. Millan reminds Hillsborough County constituents that 2020 property and tangible taxes are due by end of March. Hillsborough County Tax Collector Nancy C. The municipalities in Hillsborough County who have an ordinance allowing the exemption to apply on the taxes levied to that municipality are.

Your online resource to search property taxes tax certificates business tax receipts hunting and fishing license information and driver license status.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. HCPA Employment Opportunities PROPERTY OWNER BILL OF RIGHTS. The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County. These records can include Hillsborough County property tax assessments and assessment challenges appraisals and income taxes. Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. The median property tax on a 19890000 house is 192933 in Florida.

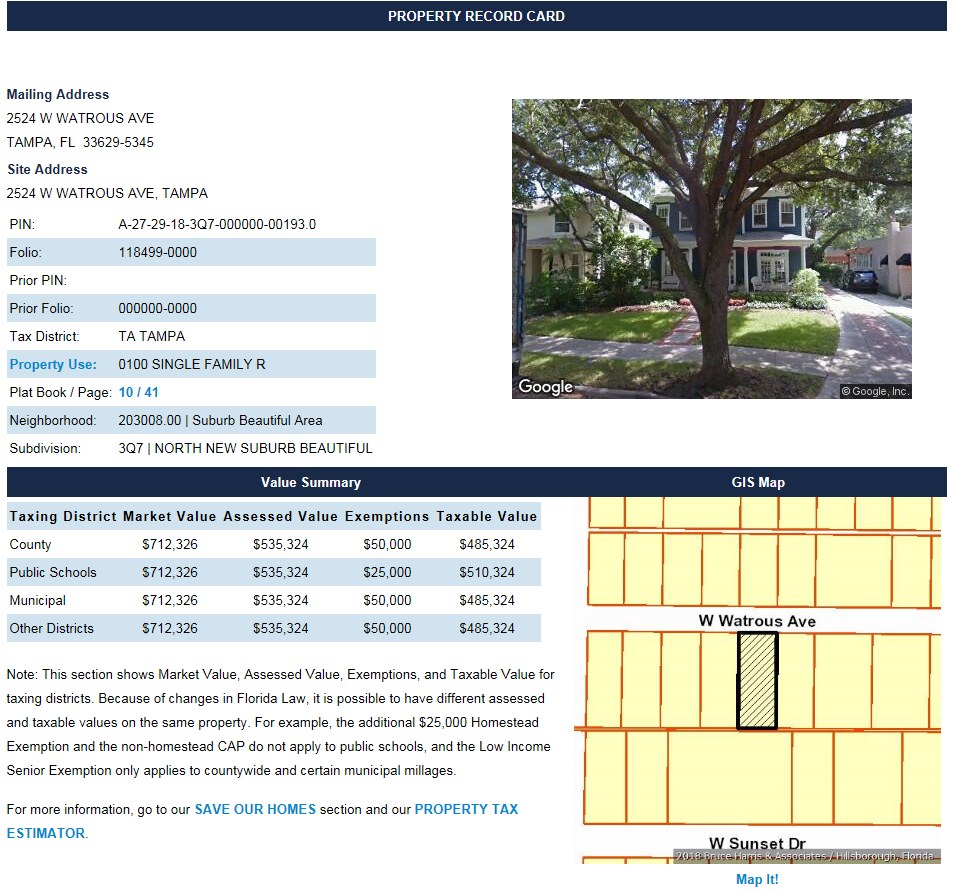

Source: tampabaytitle.com

Source: tampabaytitle.com

They are a valuable tool for the real estate. The Hillsborough County Sales Tax is collected by the merchant on all qualifying sales made within Hillsborough County. Millan reminds Hillsborough County property owners that 2020 property and tangible taxes are due by March 31st to avoid penalty. They are a valuable tool for the real estate. Millan reminds Hillsborough County constituents that 2020 property and tangible taxes are due by end of March.

Source: hillstax.org

Source: hillstax.org

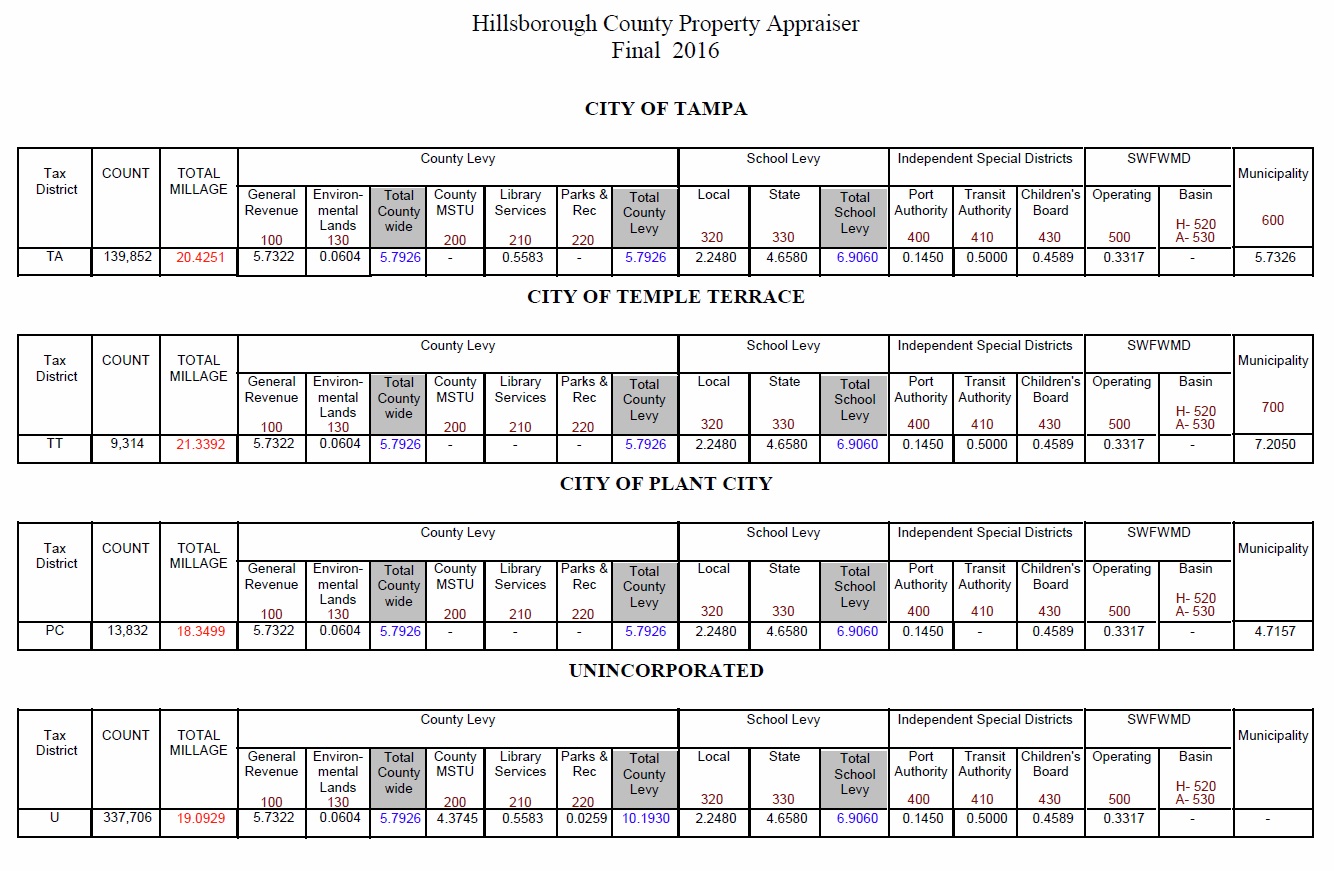

Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities. The Hillsborough County Sales Tax is collected by the merchant on all qualifying sales made within Hillsborough County. The median property tax also known as real estate tax in Hillsborough County is 216800 per year based on a median home value of 19890000 and a median effective property tax. The Hillsborough County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Hillsborough County local sales taxesThe local sales tax consists of a 100 county sales tax. Millan reminds Hillsborough County property owners that 2020 property and tangible taxes are due by March 31st to avoid penalty.

Source: mysuperbhome.com

Source: mysuperbhome.com

This includes real estate and tangible personal property the equipment machinery and fixtures of businesses. Hillsborough County Tax Collector Welcome to our online records search center. The median property tax on a 19890000 house is 208845 in the United States. Your online resource to search property taxes tax certificates business tax receipts hunting and fishing license information and driver license status. Hillsborough County Tax Collector Nancy C.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Hillsborough County collects on average 109 of a propertys assessed fair. Your online resource to search property taxes tax certificates business tax receipts hunting and fishing license information and driver license status. Hillsborough County - Real Estate. Hillsborough County Property Records are real estate documents that contain information related to real property in Hillsborough County Florida. The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County.

The Hillsborough County Sales Tax is collected by the merchant on all qualifying sales made within Hillsborough County. You will be able to download the tax roll submit request files and submit payment files via the web. Millan reminds Hillsborough County constituents that 2020 property and tangible taxes are due by end of March. Hillsborough County Property Records are real estate documents that contain information related to real property in Hillsborough County Florida. The median property tax on a 19890000 house is 216801 in Hillsborough County.

The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County. The median property tax on a 19890000 house is 208845 in the United States. The municipalities in Hillsborough County who have an ordinance allowing the exemption to apply on the taxes levied to that municipality are. 109 of home value Yearly median tax in Hillsborough County The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900. The Property Appraiser establishes the taxable value of real estate property.

Source: hillstax.org

Source: hillstax.org

The median property tax also known as real estate tax in Hillsborough County is 216800 per year based on a median home value of 19890000 and a median effective property tax. Once the homeowner qualifies and receives the Senior Citizen exemption a renewal notice to the homeowner is sent as a reminder to. These records can include Hillsborough County property tax assessments and assessment challenges appraisals and income taxes. Millan reminds Hillsborough County constituents that 2020 property and tangible taxes are due by end of March. The Property Appraiser establishes the taxable value of real estate property.

Hillsborough County Tax Collector Nancy C. Once the homeowner qualifies and receives the Senior Citizen exemption a renewal notice to the homeowner is sent as a reminder to. The Hillsborough County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Hillsborough County local sales taxesThe local sales tax consists of a 100 county sales tax. In an effort to provide you and our mutual customers with a convenient and efficient property tax payment solution the Hillsborough County Tax Collectors office have partnered with Grant Street Group to utilize Escrow Express for the upcoming real estate and tangible personal property tax collection cycle. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Source: hillstax.org

Source: hillstax.org

Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities. The municipalities in Hillsborough County who have an ordinance allowing the exemption to apply on the taxes levied to that municipality are. This includes real estate and tangible personal property the equipment machinery and fixtures of businesses. Certain types of Tax Records are available to the general public while some Tax. The Hillsborough County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Hillsborough County local sales taxesThe local sales tax consists of a 100 county sales tax.

Source: tampabayhomes4sale.net

Source: tampabayhomes4sale.net

Your online resource to search property taxes tax certificates business tax receipts hunting and fishing license information and driver license status. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. Hillsborough County Tax Collector Nancy C. Hillsborough County Property Records are real estate documents that contain information related to real property in Hillsborough County Florida. The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County.

Source: mysuperbhome.com

Source: mysuperbhome.com

Certain types of Tax Records are available to the general public while some Tax. The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County. The municipalities in Hillsborough County who have an ordinance allowing the exemption to apply on the taxes levied to that municipality are. These records can include Hillsborough County property tax assessments and assessment challenges appraisals and income taxes. If you are responsible for remitting property tax.

Source: hillstax.org

Source: hillstax.org

Hillsborough County collects on average 109 of a propertys assessed fair. Hillsborough County Tax Collector Welcome to our online records search center. Once the homeowner qualifies and receives the Senior Citizen exemption a renewal notice to the homeowner is sent as a reminder to. Your online resource to search property taxes tax certificates business tax receipts hunting and fishing license information and driver license status. The Property Appraiser establishes the taxable value of real estate property.

Source: hillsboroughcounty.org

Source: hillsboroughcounty.org

These records can include Hillsborough County property tax assessments and assessment challenges appraisals and income taxes. They are a valuable tool for the real estate. Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities. The median property tax on a 19890000 house is 216801 in Hillsborough County. The Hillsborough County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Hillsborough County local sales taxesThe local sales tax consists of a 100 county sales tax.

Source: floridaforboomers.com

Source: floridaforboomers.com

Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The median property tax on a 19890000 house is 216801 in Hillsborough County. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. The Hillsborough County Sales Tax is collected by the merchant on all qualifying sales made within Hillsborough County.

Source: propertyappraisers.us

Source: propertyappraisers.us

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. The Hillsborough County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Hillsborough County local sales taxesThe local sales tax consists of a 100 county sales tax. The municipalities in Hillsborough County who have an ordinance allowing the exemption to apply on the taxes levied to that municipality are. They are maintained by various government offices in Hillsborough County Florida State and at the Federal level. Once the homeowner qualifies and receives the Senior Citizen exemption a renewal notice to the homeowner is sent as a reminder to.

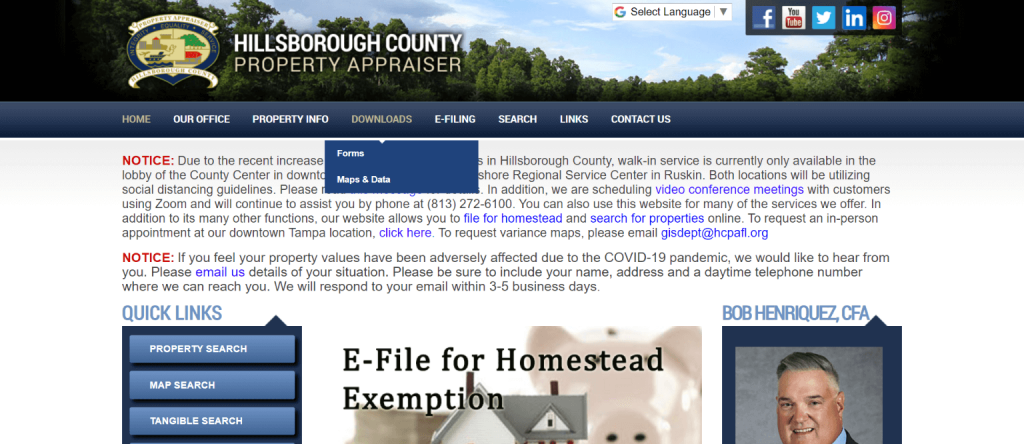

Source: hcpafl.org

Source: hcpafl.org

HCPA Employment Opportunities PROPERTY OWNER BILL OF RIGHTS. The Property Appraiser establishes the taxable value of real estate property. Millan reminds Hillsborough County constituents that 2020 property and tangible taxes are due by end of March. The Hillsborough County Sales Tax is collected by the merchant on all qualifying sales made within Hillsborough County. Certain types of Tax Records are available to the general public while some Tax.

Source: hcpafl.org

Source: hcpafl.org

Hillsborough County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Hillsborough County Florida. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Taxes are normally payable beginning November 1 of that year. Millan reminds Hillsborough County constituents that 2020 property and tangible taxes are due by end of March. Hillsborough County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Hillsborough County Florida.

Source: propertyappraisers.us

Source: propertyappraisers.us

Millan reminds Hillsborough County constituents that 2020 property and tangible taxes are due by end of March. You will be able to download the tax roll submit request files and submit payment files via the web. The median property tax on a 19890000 house is 192933 in Florida. 109 of home value Yearly median tax in Hillsborough County The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900. The median property tax on a 19890000 house is 208845 in the United States.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hillsborough county fl real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.