Your Hillsborough county real estate taxes images are ready. Hillsborough county real estate taxes are a topic that is being searched for and liked by netizens now. You can Get the Hillsborough county real estate taxes files here. Download all royalty-free photos.

If you’re looking for hillsborough county real estate taxes images information related to the hillsborough county real estate taxes interest, you have pay a visit to the right blog. Our site frequently gives you hints for downloading the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

Hillsborough County Real Estate Taxes. Search all services we offer. The Hillsborough County Tax Collector does not receive any part of the convenience fee. Public Property Records provide information on homes land or commercial properties. Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on the delinquent amount and the newspapers advertising charge sale costs or other costs.

Hillsborough County Fl Property Tax Bill Property Walls From propertywalls.blogspot.com

Hillsborough County Fl Property Tax Bill Property Walls From propertywalls.blogspot.com

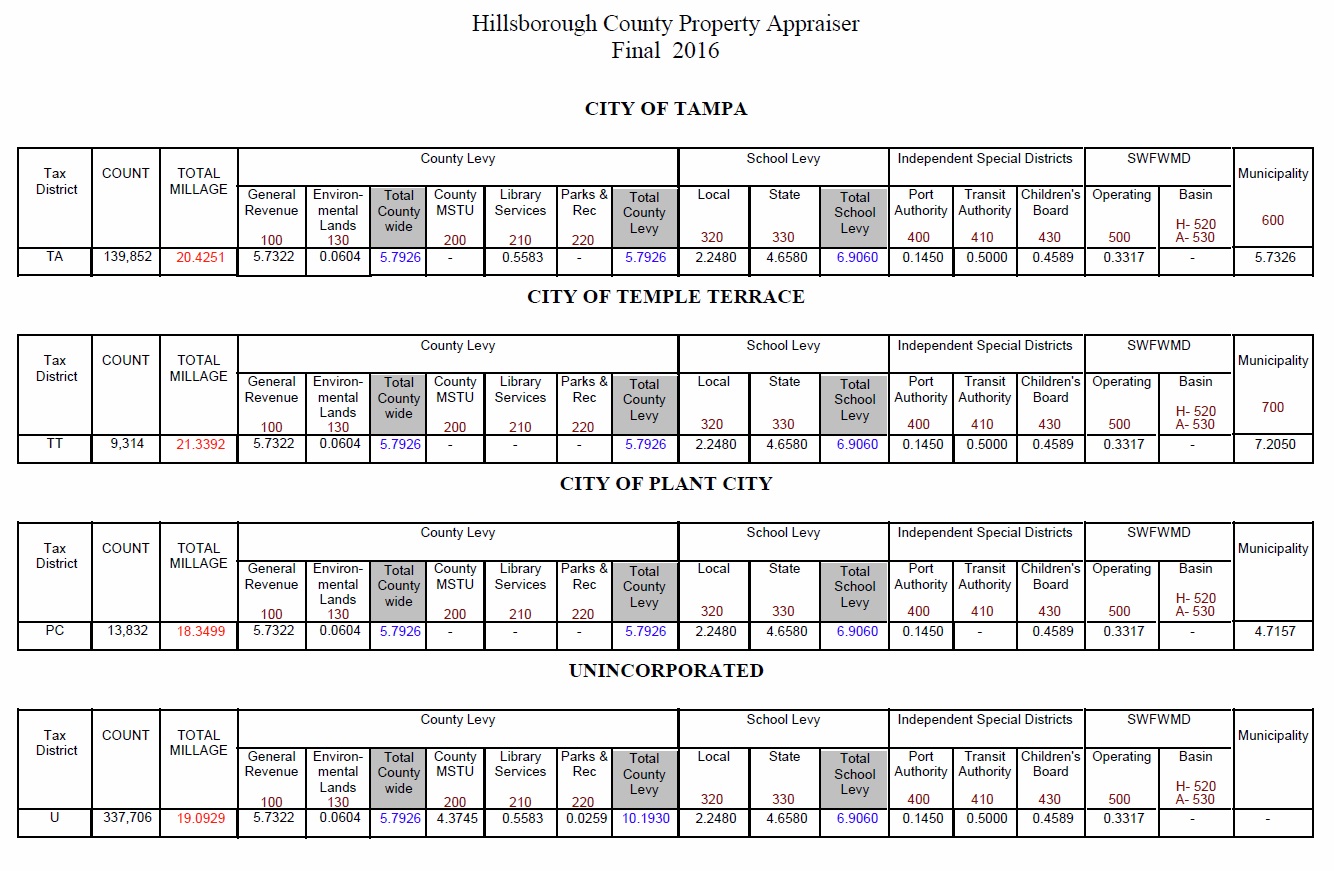

Print and complete the. Then they apply all valid exemptions classifications and assessment limitations to determine each propertys taxable. Public Property Records provide information on homes land or commercial properties. Property taxes become payable. The average savings for most homesteads in Hillsborough County is 250 300 depending on the millage rate which wont be set until September. Hillsborough County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Hillsborough County Florida.

Tangible Personal Property Exemption To qualify and obtain the 25000 Tangible Personal Property TPP exemption business owners should complete the annual TPP Return and send it to the Property Appraisers Office by April.

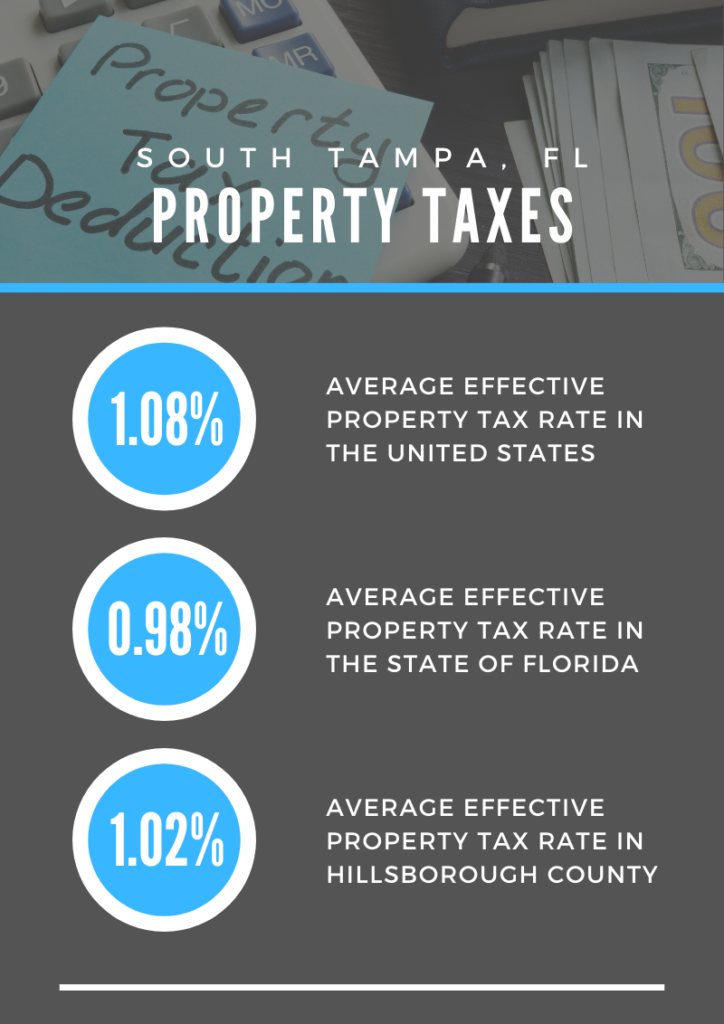

Hillsborough County collects on average 109 of a propertys assessed fair market value as property tax. Print and complete the. View listing photos review sales history and use our detailed real estate filters to find the perfect place. Hillsborough County collects on average 109 of a propertys assessed fair market value as property tax. Hamilton County Indiana Real Estate Tax Bill Not everone is as lucky as you are clue Brooks Edge Ln Fishers IN realtor hamilton county indiana real estate tax bill 516 1st Ave Se Carmel IN realtor County Road 36 Goshen IN real. Hillsborough County Tax Collector Nancy C.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Property taxes become payable. In-depth Hillsborough County NH Property Tax Information. Board of County Commissioners section 01 01010000 - Rules of Order - Board of County Commissioners - Hillsborough County Florida 01020100 - Scheduling. Hillsborough County Tax Collector Nancy C.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Millan reminds Hillsborough County property owners that 2020 property and tangible taxes are due by March 31st to avoid penalty. The median property tax also known as real estate tax in Hillsborough County is 216800 per year based on a median home value of 19890000 and a median effective property tax. Yearly median tax in Hillsborough County The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900. Millan reminds Hillsborough County property owners that 2020 property and tangible taxes are due by March 31st to avoid penalty. Hillsborough County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Hillsborough County Florida.

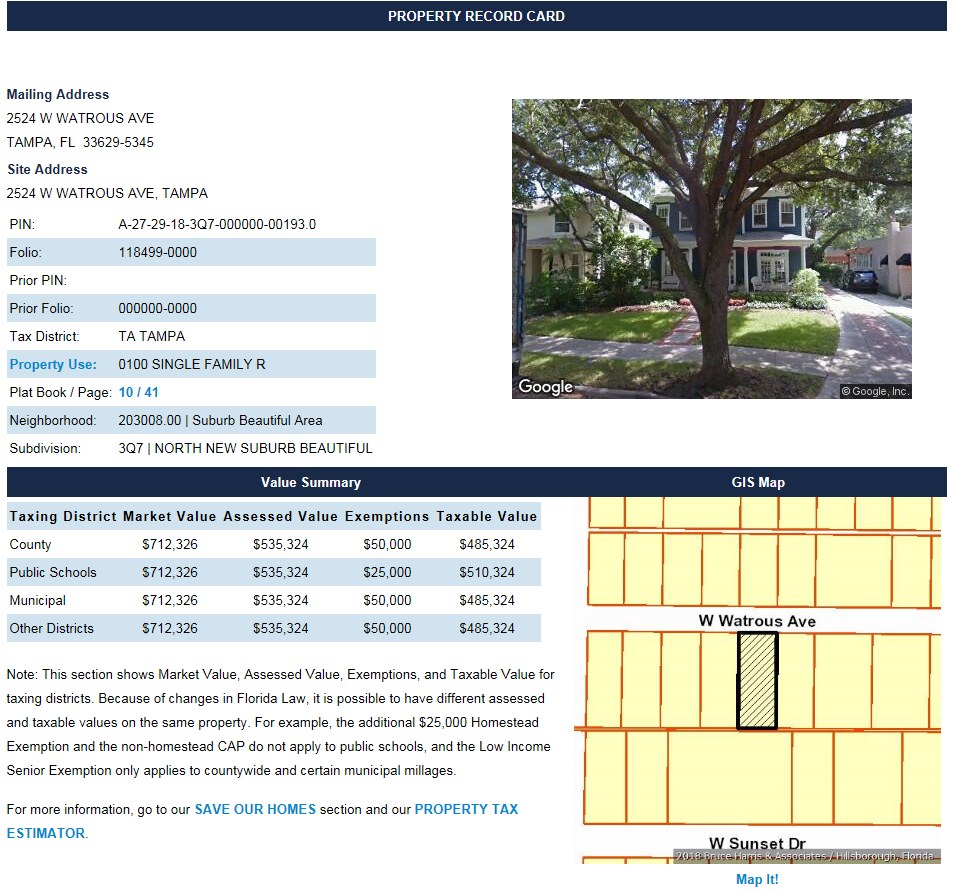

Source: hcpafl.org

Source: hcpafl.org

The average savings for most homesteads in Hillsborough County is 250 300 depending on the millage rate which wont be set until September. Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on the delinquent amount and the newspapers advertising charge sale costs or other costs. The average savings for most homesteads in Hillsborough County is 250 300 depending on the millage rate which wont be set until September. Click on sections below to see Board Policies. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

Source: mysuperbhome.com

Source: mysuperbhome.com

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a. Hamilton County Indiana Real Estate Tax Bill Not everone is as lucky as you are clue Brooks Edge Ln Fishers IN realtor hamilton county indiana real estate tax bill 516 1st Ave Se Carmel IN realtor County Road 36 Goshen IN real. Real Property that serves no future use for the County may be declared surplus and sold. The tax certificates face amount consists of the sum of the following. Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on the delinquent amount and the newspapers advertising charge sale costs or other costs.

Source: pinterest.com

Source: pinterest.com

Print and complete the. Hillsborough County Tax Collector Nancy C. Hillsborough County collects on average 109 of a propertys assessed fair market value as property tax. Hillsborough County Property Records are real estate documents that contain information related to real property in Hillsborough County Florida. Hillsborough County Florida 7 days ago The median property tax also known as real estate tax in Hillsborough County is 216800 per year based on a median home value of 19890000 and a median effective property tax rate of 109 of property value.

Source: floridaforboomers.com

Source: floridaforboomers.com

Official Website of Hillsborough County Florida Government We Value Your Input Visit The Hillsborough County Engagement Hub to view survey results and give input on key topics that impact the future of our community. The average savings for most homesteads in Hillsborough County is 250 300 depending on the millage rate which wont be set until September. Search all services we offer. Then they apply all valid exemptions classifications and assessment limitations to determine each propertys taxable. These records can include Hillsborough County property tax assessments and assessment challenges appraisals and income taxes.

Source: hillstax.org

Source: hillstax.org

Print and complete the. Board of County Commissioners section 01 01010000 - Rules of Order - Board of County Commissioners - Hillsborough County Florida 01020100 - Scheduling. View listing photos review sales history and use our detailed real estate filters to find the perfect place. Public Property Records provide information on homes land or commercial properties. Hillsborough County Property Records are real estate documents that contain information related to real property in Hillsborough County Florida.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Print and complete the. Property taxes become payable. To submit a bid. The methods of disposing of the Countys Surplus Property are outlined in the State Statute. In-depth Hillsborough County NH Property Tax Information.

Source: yoursouthtampahome.com

Source: yoursouthtampahome.com

Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on the delinquent amount and the newspapers advertising charge sale costs or other costs. The tax certificates face amount consists of the sum of the following. Hillsborough County Florida 7 days ago The median property tax also known as real estate tax in Hillsborough County is 216800 per year based on a median home value of 19890000 and a median effective property tax rate of 109 of property value. These records can include Hillsborough County property tax assessments and assessment challenges appraisals and income taxes. Request services from Hillsborough County online 24 hours-a-day 7 days-a-week.

Source: hcpafl.org

Source: hcpafl.org

To submit a bid. Floridas Constitution requires property appraisers to establish the property tax base for their county annually. Hillsborough County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Hillsborough County Florida. Zillow has 3929 homes for sale in Hillsborough County FL. Tangible Personal Property Exemption To qualify and obtain the 25000 Tangible Personal Property TPP exemption business owners should complete the annual TPP Return and send it to the Property Appraisers Office by April.

Source:

Source:

To submit a bid. These records can include Hillsborough County property tax assessments and assessment challenges appraisals and income taxes. Hillsborough County Property Records are real estate documents that contain information related to real property in Hillsborough County Florida. View listing photos review sales history and use our detailed real estate filters to find the perfect place. Official Website of Hillsborough County Florida Government We Value Your Input Visit The Hillsborough County Engagement Hub to view survey results and give input on key topics that impact the future of our community.

Source: hillstax.org

Source: hillstax.org

To submit a bid. Real Property that serves no future use for the County may be declared surplus and sold. The methods of disposing of the Countys Surplus Property are outlined in the State Statute. To submit a bid. BedsAny12345 Use exact match Bathrooms.

Source: mysuperbhome.com

Source: mysuperbhome.com

These records can include Hillsborough County property tax assessments and assessment challenges appraisals and income taxes. The Hillsborough County Tax Collector does not receive any part of the convenience fee. Hillsborough County Tax Collector Nancy C. Public Property Records provide information on homes land or commercial properties. These records can include Hillsborough County property tax assessments and assessment challenges appraisals and income taxes.

Source: hillstax.org

Source: hillstax.org

Official Website of Hillsborough County Florida Government We Value Your Input Visit The Hillsborough County Engagement Hub to view survey results and give input on key topics that impact the future of our community. To submit a bid. Hillsborough County Tax Collector Nancy C. 4 if paid in November 3 if paid in December 2 if. These records can include Hillsborough County property tax assessments and assessment challenges appraisals and income taxes.

Source: tampabay.com

Source: tampabay.com

Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on the delinquent amount and the newspapers advertising charge sale costs or other costs. Hillsborough County Tax Collector Nancy C. Print and complete the. Board of County Commissioners section 01 01010000 - Rules of Order - Board of County Commissioners - Hillsborough County Florida 01020100 - Scheduling. Hillsborough County Florida 7 days ago The median property tax also known as real estate tax in Hillsborough County is 216800 per year based on a median home value of 19890000 and a median effective property tax rate of 109 of property value.

Source: hillsboroughcounty.org

Source: hillsboroughcounty.org

View listing photos review sales history and use our detailed real estate filters to find the perfect place. Request services from Hillsborough County online 24 hours-a-day 7 days-a-week. Public Property Records provide information on homes land or commercial properties. In-depth Hillsborough County NH Property Tax Information. Official Website of Hillsborough County Florida Government We Value Your Input Visit The Hillsborough County Engagement Hub to view survey results and give input on key topics that impact the future of our community.

Hamilton County Indiana Real Estate Tax Bill Not everone is as lucky as you are clue Brooks Edge Ln Fishers IN realtor hamilton county indiana real estate tax bill 516 1st Ave Se Carmel IN realtor County Road 36 Goshen IN real. Hillsborough County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Hillsborough County Florida. 4 if paid in November 3 if paid in December 2 if. To submit a bid. Hillsborough County Florida 7 days ago The median property tax also known as real estate tax in Hillsborough County is 216800 per year based on a median home value of 19890000 and a median effective property tax rate of 109 of property value.

Source: hillstax.org

Source: hillstax.org

Hamilton County Indiana Real Estate Tax Bill Not everone is as lucky as you are clue Brooks Edge Ln Fishers IN realtor hamilton county indiana real estate tax bill 516 1st Ave Se Carmel IN realtor County Road 36 Goshen IN real. To submit a bid. Search all services we offer. The tax certificates face amount consists of the sum of the following. The methods of disposing of the Countys Surplus Property are outlined in the State Statute.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title hillsborough county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.