Your Historical real estate appreciation chart images are ready in this website. Historical real estate appreciation chart are a topic that is being searched for and liked by netizens now. You can Download the Historical real estate appreciation chart files here. Download all free photos.

If you’re looking for historical real estate appreciation chart pictures information related to the historical real estate appreciation chart topic, you have visit the right blog. Our website always gives you hints for refferencing the highest quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

Historical Real Estate Appreciation Chart. The graph represent a seasonally adjusted long term valuation trends and may not immediately reflect short term market fluctuations. Meaning if the average condo will run you 500000 the average detached should cost around 1000000. Between 2013 and 2016 the detached housing craze hit. The current level of housing starts as of March 2021 is 173900 thousand homes.

Investment Analysis Of Greek Real Estate Market From globalpropertyguide.com

Investment Analysis Of Greek Real Estate Market From globalpropertyguide.com

Another reason to know the rate is that you might not want to be tied to your home for 30 years. Commercial Real Estate Vacancies. Then plug in historical CPI values from aboveThe CPI for Housing was 30792 in the year 1967 and 270653 in 2020. Meaning if the average condo will run you 500000 the average detached should cost around 1000000. Even in locations where prices traditionally have been lower this is the case. Twice since 1953 the average price of a GTA home has surged around 35 per cent annually including the all-time high of 36 per cent in 1987 on an unadjusted basis.

What will be most interesting is seeing what happens over the next couple of quarters.

Historical Real Estate Appreciation Chart. Mar 2020 Apr 2021 Mar 2022. In 2016 the average price increased 173 per cent to 729922 according to TREB. Through the second quarter of 2018 the multifamily yield spread stands at 276 bps which is much more in line with the historical average of 330 bps. In New Mexico for example in 1940 the median home price was only 6800. Muths version of the monocentric model also points out that real estate assets involve housing capital as well as the elasticity of substitution between capital and land.

Source: cityobservatory.org

Source: cityobservatory.org

For much of our history thats where the multiple was. For much of our history thats where the multiple was. From 1968 to 2009 the average rate of appreciation for existing homes increased around 54 per year. Historical Real Estate Appreciation ChartHouses 3 months ago Housing price history from 1967 through 2020Homes Details. The current level of housing starts as of March 2021 is 173900 thousand homes.

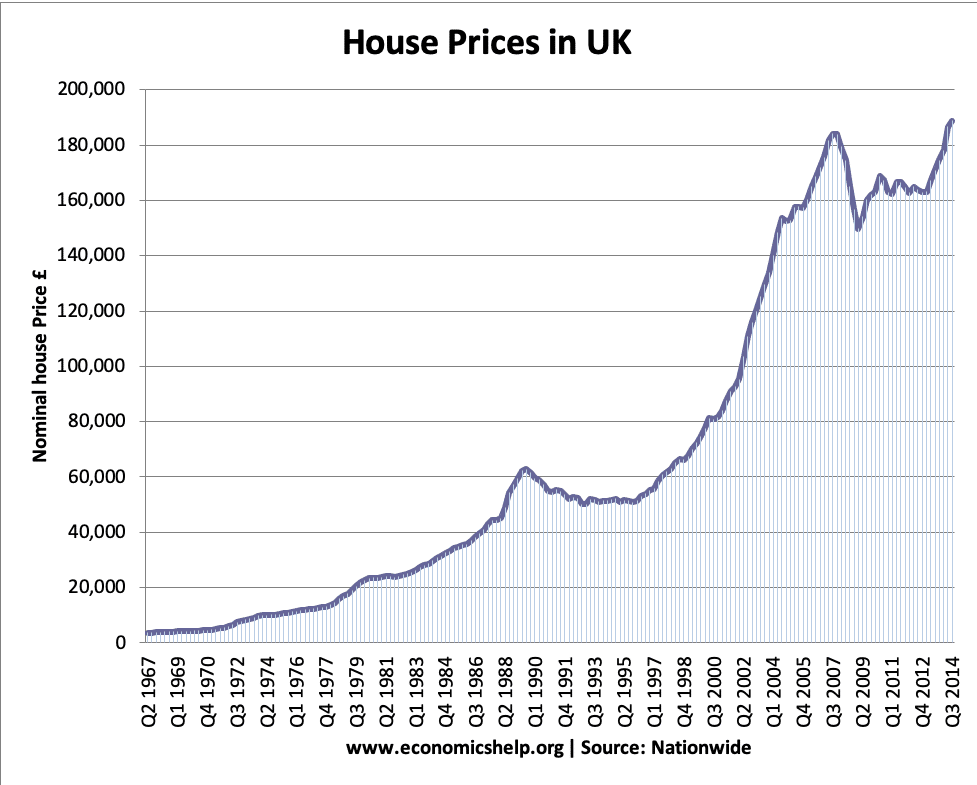

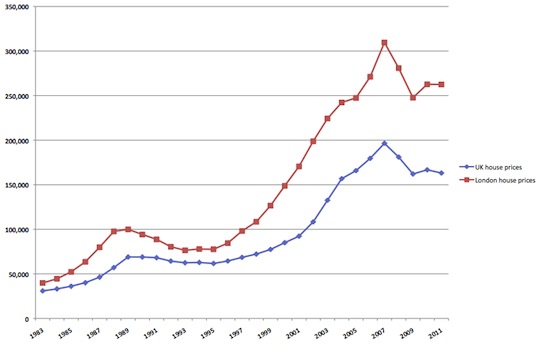

Source: economicshelp.org

Source: economicshelp.org

Through the second quarter of 2018 the multifamily yield spread stands at 276 bps which is much more in line with the historical average of 330 bps. 6 Meanwhile the SP 500 averaged an. Between 2013 and 2016 the detached housing craze hit. The graph represents a 365-day running median for Toronto. No surprise about the stratospheric run up in 2004 2005.

Source: pinterest.com

Source: pinterest.com

In 2016 apartment rents were 246 above the 2008 peak and up 37 from 2015. Between 2013 and 2016 the detached housing craze hit. Meaning if the average condo will run you 500000 the average detached should cost around 1000000. Even in locations where prices traditionally have been lower this is the case. For much of our history thats where the multiple was.

Source: longtermtrends.net

Source: longtermtrends.net

Through the second quarter of 2018 the multifamily yield spread stands at 276 bps which is much more in line with the historical average of 330 bps. Bureau of Labor real estate appreciation by city. As always note that market appreciation and depreciation rates can vary widely by county. Louis shows historical prices for 30-year fixed-rate mortgages starting in 1971. Half of the 19th century.

For much of our history thats where the multiple was. Bureau of Labor real estate appreciation by city. Comparatively weve returned to a landscape where monetary policy is the ultimate influencer of cap rates. By property type figures from the Canadian Real Estate Association. If you are interested in raw monthly real estate market statistics and.

Source: urbancondospaces.com

Source: urbancondospaces.com

Interesting to me was the three full years of negative appreciation from 1988 1990. 270653 30792 100000 87898086 Therefore according to US. This chart from the Federal Reserve Bank of St. So how does this play out for real estate prices. Muths version of the monocentric model also points out that real estate assets involve housing capital as well as the elasticity of substitution between capital and land.

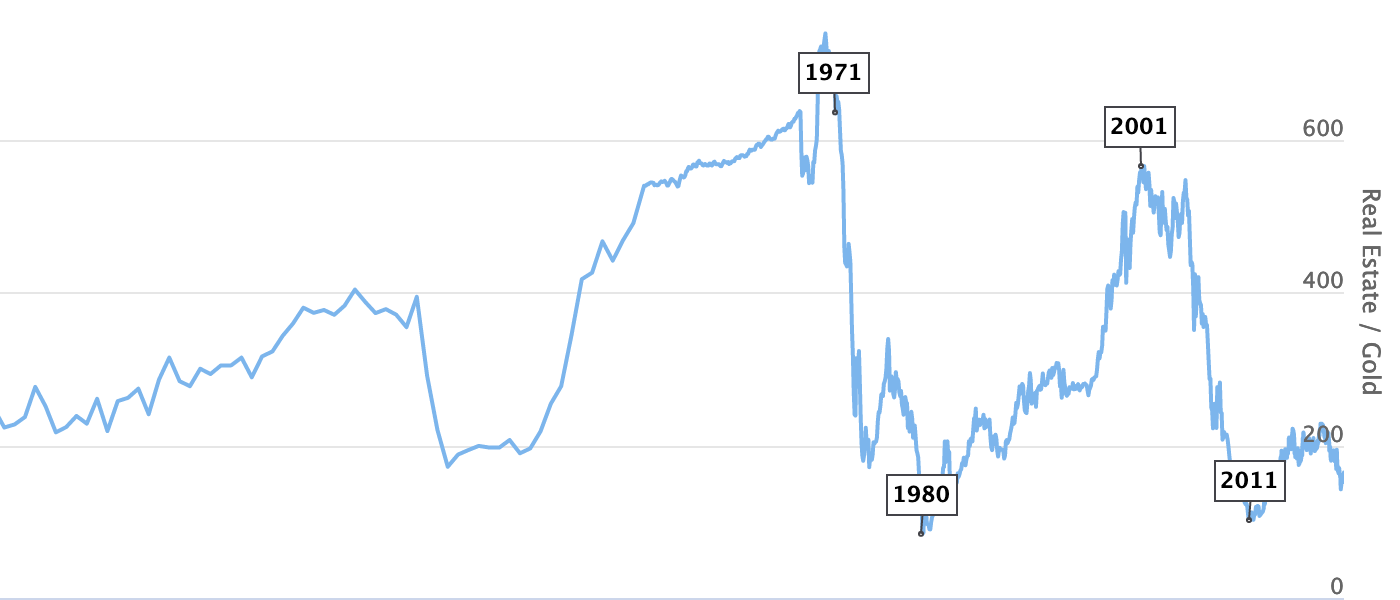

Source: pricedingold.com

Source: pricedingold.com

This chart from the Federal Reserve Bank of St. Then plug in historical CPI values from aboveThe CPI for Housing was 30792 in the year 1967 and 270653 in 2020. Between 2013 and 2016 the detached housing craze hit. 6 Meanwhile the SP 500 averaged an. So how does this play out for real estate prices.

Through the second quarter of 2018 the multifamily yield spread stands at 276 bps which is much more in line with the historical average of 330 bps. Housing Starts Historical Chart. Then plug in historical CPI values from aboveThe CPI for Housing was 30792 in the year 1967 and 270653 in 2020. This chart from the Federal Reserve Bank of St. The typical home value of homes in the United States is 276717.

Even in locations where prices traditionally have been lower this is the case. Then plug in historical CPI values from aboveThe CPI for Housing was 30792 in the year 1967 and 270653 in 2020. In the last quarter of 2020 house prices increased 281 221 inflation-adjusted. Muths version of the monocentric model also points out that real estate assets involve housing capital as well as the elasticity of substitution between capital and land. Mar 2020 Apr 2021 Mar 2022.

Source: globalpropertyguide.com

Source: globalpropertyguide.com

Data Rental rates have continued to grow with average asking rents exceeding the previous peak for certain property types especially apartments. We know of only one systematic study on longer-term changes in. What will be most interesting is seeing what happens over the next couple of quarters. In the last quarter of 2020 house prices increased 281 221 inflation-adjusted. Houses 6 days ago Historical Real Estate Appreciation Chart.

Source: globalpropertyguide.com

Source: globalpropertyguide.com

This chart from the Federal Reserve Bank of St. Historical Real Estate Appreciation Chart. The typical home value of homes in the United States is 276717. This value is seasonally adjusted and only includes the middle price tier of homes. Even in locations where prices traditionally have been lower this is the case.

Source: globalpropertyguide.com

Source: globalpropertyguide.com

No surprise about the stratospheric run up in 2004 2005. This value is seasonally adjusted and only includes the middle price tier of homes. This is the 12th straight year of house price growth following y-o-y rises of 195 in 2019 251 in 2018 892 in 2017 and 1225 in 2016. United States home values have gone up 106 over the past year and Zillow predicts they will rise 104 in the next year. One percentage point makes quite a difference.

Source: pinterest.com

Source: pinterest.com

Comparatively weve returned to a landscape where monetary policy is the ultimate influencer of cap rates. This is the 12th straight year of house price growth following y-o-y rises of 195 in 2019 251 in 2018 892 in 2017 and 1225 in 2016. Another reason to know the rate is that you might not want to be tied to your home for 30 years. Meaning if the average condo will run you 500000 the average detached should cost around 1000000. In the last quarter of 2020 house prices increased 281 221 inflation-adjusted.

Source: pinterest.com

Source: pinterest.com

Another reason to know the rate is that you might not want to be tied to your home for 30 years. 817 Zeilen Below I provide and graph historical monthly median single-family home values in the. For much of our history thats where the multiple was. Interesting to me was the three full years of negative appreciation from 1988 1990. United States home values have gone up 106 over the past year and Zillow predicts they will rise 104 in the next year.

Source: monevator.com

Source: monevator.com

As always note that market appreciation and depreciation rates can vary widely by county. The graph represent a seasonally adjusted long term valuation trends and may not immediately reflect short term market fluctuations. We know of only one systematic study on longer-term changes in. Then plug in historical CPI values from aboveThe CPI for Housing was 30792 in the year 1967 and 270653 in 2020. As always note that market appreciation and depreciation rates can vary widely by county.

Source: jparsons.net

Source: jparsons.net

For much of our history thats where the multiple was. In New Mexico for example in 1940 the median home price was only 6800. In the last quarter of 2020 house prices increased 281 221 inflation-adjusted. Then plug in historical CPI values from aboveThe CPI for Housing was 30792 in the year 1967 and 270653 in 2020. The typical home value of homes in the United States is 276717.

Source: jparsons.net

Source: jparsons.net

Houses 6 days ago Historical Real Estate Appreciation Chart. By property type figures from the Canadian Real Estate Association. 6 Meanwhile the SP 500 averaged an. From 1968 to 2009 the average rate of appreciation for existing homes increased around 54 per year. The graph represents a 365-day running median for Toronto.

By property type figures from the Canadian Real Estate Association. A 235k home becomes worth 570k at 3 appreciation after 30 years but it becomes worth a whopping 762k at 4 appreciation. In the last quarter of 2020 house prices increased 281 221 inflation-adjusted. In 2016 the average price increased 173 per cent to 729922 according to TREB. 6 Meanwhile the SP 500 averaged an.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title historical real estate appreciation chart by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.