Your Horry county real estate taxes images are available in this site. Horry county real estate taxes are a topic that is being searched for and liked by netizens now. You can Get the Horry county real estate taxes files here. Find and Download all free images.

If you’re looking for horry county real estate taxes pictures information linked to the horry county real estate taxes topic, you have come to the right blog. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

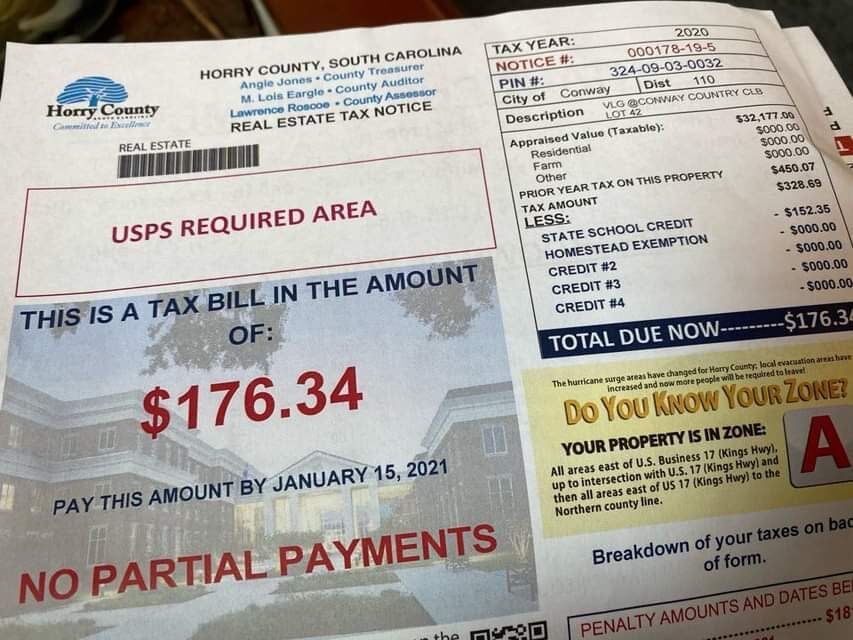

Horry County Real Estate Taxes. The median property tax also known as real estate tax in Horry County is 69600 per year based on a median home value of 17010000 and a median effective property tax rate of 041 of property value. Georgetown and Horry County have several different mill levy rates based on specific areas. Market Value The propertys appraised value is the propertys market value and represents the amount for which it can be expected to sell on the open market with a willing buyer and a willing seller. How to Compute Real Estate Tax Millage Rates Horry Georgetown County South Carolina Millage Rates May Not Be Current Taxable Value x04 Primary Residence Assessed Value x Millage Rate per your District Gross Tax Assessed Value x1049 School Credit Tax Credit.

The median property tax on a 17010000 house is 69741 in Horry County The median property tax on a 17010000 house is 85050 in South Carolina The median property tax on a 17010000 house is 178605 in the United States. These records can include Horry County property tax assessments and assessment challenges appraisals and income taxes. Maintain inventory of all real estate in Horry County depicting land ownership boundaries along with data records showing ownerships. If delinquent taxes are owed current bills cannot be accepted online or by phone. These formulas will give you an estimate on your real estate taxes in Horry County South Carolina. Determine approximately 82 of the countys property tax base.

If delinquent taxes are owed current bills cannot be accepted online or by phone.

Convenience Fees will apply when paying online or pay by phone. Horry County collects on average 041 of. Maintain inventory of all real estate in Horry County depicting land ownership boundaries along with data records showing ownerships. 6 South Carolina residents enjoy property taxes that are almost comically cheap in comparison to what they were paying up North. Horry County collects on average 041 of a propertys assessed fair market value as property tax. Tax payments must be remitted by January 15th of the following year to avoid late fees and penalties.

Tax Rates for Horry SC Sales Taxes. Determine approximately 82 of the countys property tax base. Full-time South Carolina residents enjoy a 4 assessment rate. Convenience Fees will apply when paying online or pay by phone. Horry County Property Tax Payments Annual Horry County South Carolina Median Property Taxes 652 887 Median Property Taxes Mortgage 707 1031 Median Property Taxes No.

![]() Source: acerealtysc.com

Source: acerealtysc.com

Tax Rates for Horry SC Sales Taxes. Real property taxes include land houses buildings and mobile homes. Horry County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Horry County South Carolina. Credit Card A 235 convenience fee will be charged for the use of credit cards. Millage Rate X Assessment Ratio X Value Tax Credits Property Tax.

Source: myhorrynews.com

Source: myhorrynews.com

Welcome to the Horry County Tax Payment Website. Tax Rates in Horry County SC Browse the Horry County SC sales tax rate on our Tax Rates database and learn more about high income and inflation adjustments. Convenience Fees will apply when paying online or pay by phone. Tax Rates for Horry SC Sales Taxes. Folks who need to pay their Horry County property taxes wont have to wait in long end-of-the-year lines.

Source: wmbfnews.com

Source: wmbfnews.com

Millage Rate X Assessment Ratio X Value Tax Credits Property Tax. Tax Rates for Horry SC Sales Taxes. Horry County South Carolina Property Taxes - 2021 2 days ago The median property tax in Horry County South Carolina is 696 per year for a home worth the median value of 170100. Real property taxes include land houses buildings and mobile homes. Horry County collects on average 041 of.

Source: wmbfnews.com

Source: wmbfnews.com

1301 2nd Ave Ste 1C09. Property tax in Horry County is an ad valorem tax based on property value. The median property tax on a 17010000 house is 69741 in Horry County The median property tax on a 17010000 house is 85050 in South Carolina The median property tax on a 17010000 house is 178605 in the United States. Millage Rate X Assessment Ratio X Value Tax Credits Property Tax. Horry County Property Tax Payments Annual Horry County South Carolina Median Property Taxes 652 887 Median Property Taxes Mortgage 707 1031 Median Property Taxes No.

Source:

Source:

Horry and Georgetown County Property Tax Information In Horry and Georgetown County real property tax notices are dispersed in the month of October. Georgetown and Horry County have several different mill levy rates based on specific areas. 1301 2nd Ave Ste 1C09. How to Compute Real Estate Tax Millage Rates Horry Georgetown County South Carolina Millage Rates May Not Be Current Taxable Value x04 Primary Residence Assessed Value x Millage Rate per your District Gross Tax Assessed Value x1049 School Credit Tax Credit. Horry County South Carolina Property Taxes - 2021 2 days ago The median property tax in Horry County South Carolina is 696 per year for a home worth the median value of 170100.

Source: pinterest.com

Source: pinterest.com

Horry County collects on average 041 of a propertys assessed fair market value as property tax. Property tax in Horry County is an ad valorem tax based on property value. Tax payments must be remitted by January 15th of the following year to avoid late fees and penalties. Georgetown and Horry County have several different mill levy rates based on specific areas. Convenience Fees will apply when paying online or pay by phone.

Source: postandcourier.com

Source: postandcourier.com

For additional information you can reach the Horry County Tax Assessors office at. Horry County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Horry County South Carolina. Millage Rate X Assessment Ratio X Value Tax Credits Property Tax. Tax payments must be remitted by January 15th of the following year to avoid late fees and penalties. These formulas will give you an estimate on your real estate taxes in Horry County South Carolina.

Source: myrtlebeachrealestategroup.com

Source: myrtlebeachrealestategroup.com

Appraise and list all real property for taxation that is located in Horry County excepting real property that is assessed by the Department of Revenue. Credit Card A 235 convenience fee will be charged for the use of credit cards. Appraise and list all real property for taxation that is located in Horry County excepting real property that is assessed by the Department of Revenue. Tax Rates in Horry County SC Browse the Horry County SC sales tax rate on our Tax Rates database and learn more about high income and inflation adjustments. Tax Rates for Horry SC Sales Taxes.

Source: pinterest.com

Source: pinterest.com

Tax payments must be remitted by January 15th of the following year to avoid late fees and penalties. Horry County collects on average 041 of a propertys assessed fair market value as property tax. The median property tax also known as real estate tax in Horry County is 69600 per year based on a median home value of 17010000 and a median effective property tax rate of 041 of property value. Tax payments must be remitted by January 15th of the following year to avoid late fees and penalties. Horry and Georgetown County Property Tax Information In Horry and Georgetown County real property tax notices are dispersed in the month of October.

Source: pinterest.com

Source: pinterest.com

Tax Rates in Horry County SC Browse the Horry County SC sales tax rate on our Tax Rates database and learn more about high income and inflation adjustments. Real property taxes include land houses buildings and mobile homes. Folks who need to pay their Horry County property taxes wont have to wait in long end-of-the-year lines. The millage rate is set by elected officials. Horry County Treasurers office.

Source: zillow.com

Source: zillow.com

Real property taxes include land houses buildings and mobile homes. Bills can sometimes slip our minds but this property tax bill is. If delinquent taxes are owed current bills cannot be accepted online or by phone. Full-time South Carolina residents enjoy a 4 assessment rate. 1301 2nd Ave Ste 1C09.

Source: realtor.com

Source: realtor.com

Appraise and list all real property for taxation that is located in Horry County excepting real property that is assessed by the Department of Revenue. Determine approximately 82 of the countys property tax base. These formulas will give you an estimate on your real estate taxes in Horry County South Carolina. The millage rate is set by elected officials. How to Compute Real Estate Tax Millage Rates Horry Georgetown County South Carolina Millage Rates May Not Be Current Taxable Value x04 Primary Residence Assessed Value x Millage Rate per your District Gross Tax Assessed Value x1049 School Credit Tax Credit.

Millage Rate X Assessment Ratio X Value Tax Credits Property Tax. Folks who need to pay their Horry County property taxes wont have to wait in long end-of-the-year lines. Property tax in Horry County is an ad valorem tax based on property value. Convenience Fees will apply when paying online or pay by phone. Tax payments must be remitted by January 15th of the following year to avoid late fees and penalties.

Source: pinterest.com

Source: pinterest.com

Horry County Treasurers office. Bills can sometimes slip our minds but this property tax bill is. Folks who need to pay their Horry County property taxes wont have to wait in long end-of-the-year lines. Horry County collects on average 041 of. Millage Rate X Assessment Ratio X Value Tax Credits Property Tax.

Source: pinterest.com

Source: pinterest.com

Credit Card A 235 convenience fee will be charged for the use of credit cards. These records can include Horry County property tax assessments and assessment challenges appraisals and income taxes. Horry County South Carolina Property Taxes - 2021 2 days ago The median property tax in Horry County South Carolina is 696 per year for a home worth the median value of 170100. The county treasurers office on Friday announced a temporary program that will allow. Tax Rates in Horry County SC Browse the Horry County SC sales tax rate on our Tax Rates database and learn more about high income and inflation adjustments.

Source: zillow.com

Source: zillow.com

Convenience Fees will apply when paying online or pay by phone. Convenience Fees will apply when paying online or pay by phone. Horry County collects on average 041 of. Horry County Property Tax Payments Annual Horry County South Carolina Median Property Taxes 652 887 Median Property Taxes Mortgage 707 1031 Median Property Taxes No. The millage rate is set by elected officials.

Source: in.pinterest.com

Source: in.pinterest.com

1301 2nd Ave Ste 1C09. The median property tax also known as real estate tax in Horry County is 69600 per year based on a median home value of 17010000 and a median effective property tax rate of 041 of property value. Determine approximately 82 of the countys property tax base. Horry County collects on average 041 of. Market Value The propertys appraised value is the propertys market value and represents the amount for which it can be expected to sell on the open market with a willing buyer and a willing seller.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title horry county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.