Your Houston real estate market bubble images are ready in this website. Houston real estate market bubble are a topic that is being searched for and liked by netizens today. You can Find and Download the Houston real estate market bubble files here. Download all royalty-free photos.

If you’re looking for houston real estate market bubble pictures information related to the houston real estate market bubble keyword, you have come to the ideal blog. Our site frequently gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

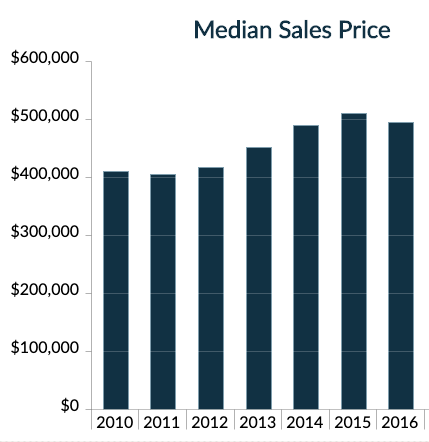

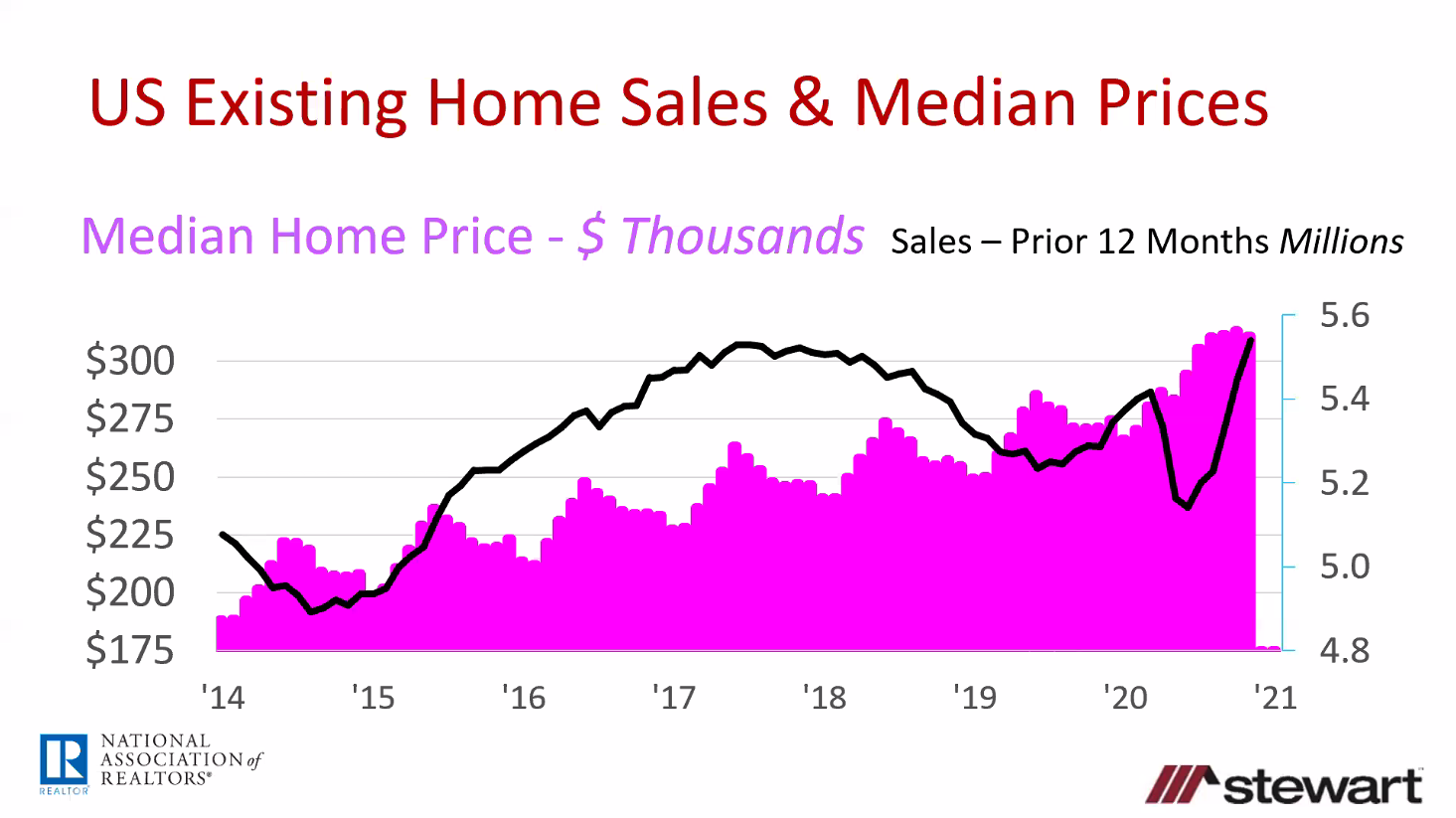

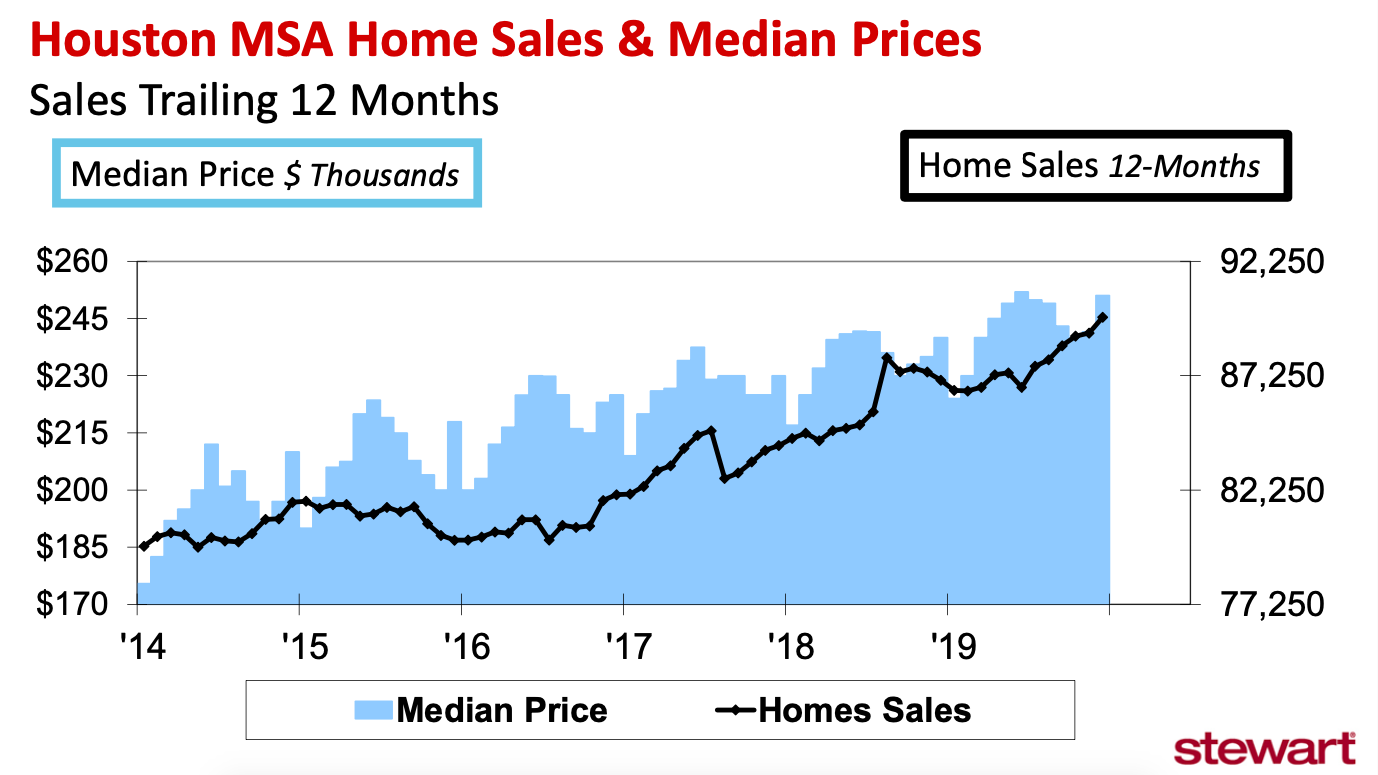

Houston Real Estate Market Bubble. A bubble in other words is. Heres a quick guide of the Bay Area real estate market for buyers sellers and everyone in-between. This might be one of the biggest bubbles of all time Rosenberg founder of Rosenberg Research Associates in Toronto said in an interview on BNN Bloomberg Television. According to current data of median home prices.

Is The Housing Market Going To Crash In 2020 Or Will It Continue To Rise Christine Labounty From christinelabounty.com

Is The Housing Market Going To Crash In 2020 Or Will It Continue To Rise Christine Labounty From christinelabounty.com

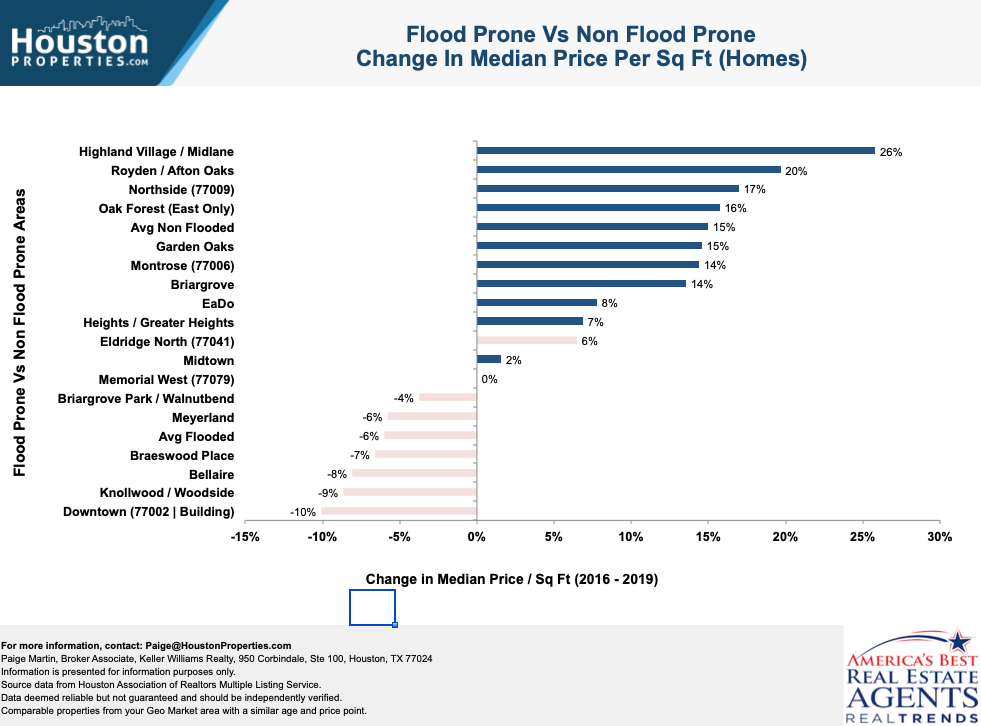

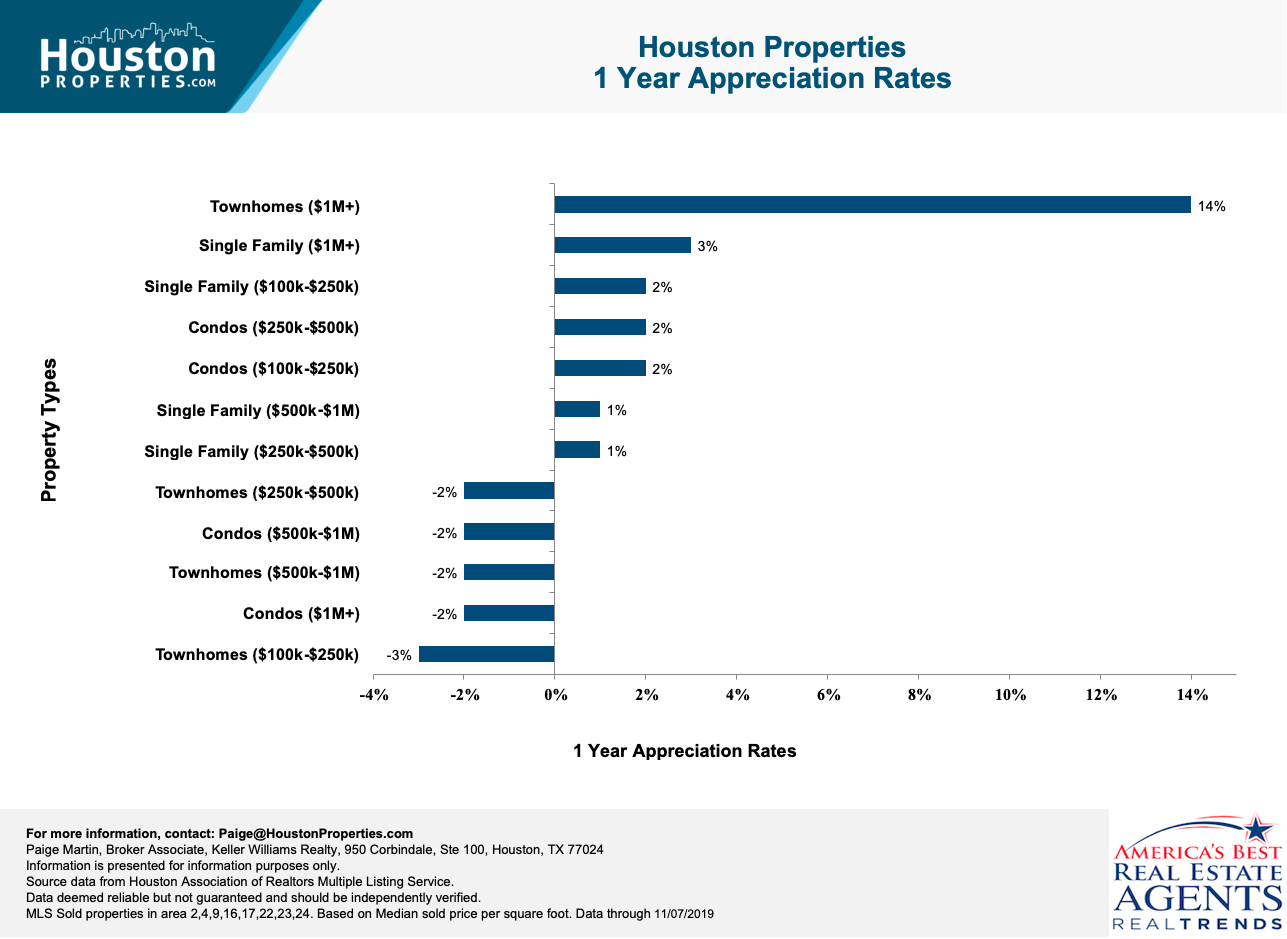

Our property investment analyst Ai predicts a positive trend in the near future and buying a house in Houston appears to. Average compensation for a Google engineer for instance is 150000 and households with two or more professional earners easily make multiples of median. Of course its been predicated on where mortgage rates are. And scoffs at the notion of a sustained housing recovery. Even during the Great Recession and housing bubble of 2008 rents did not decline they simply grew less quickly than they did previously. Different Neighborhoods Trend Differently.

Economists usually define a market bubble as a sudden rise in price based on obviously implausible or contradictory beliefs.

He says monetary and federal housing policy have created another housing bubble. The Houston real estate market ran much ahead of 2019s record pace. A few are starting to draw that similarity. The pandemic has put the Bay Area market in turmoil. Economists usually define a market bubble as a sudden rise in price based on obviously implausible or contradictory beliefs. What Is a Housing Bubble.

Source: wolfstreet.com

Source: wolfstreet.com

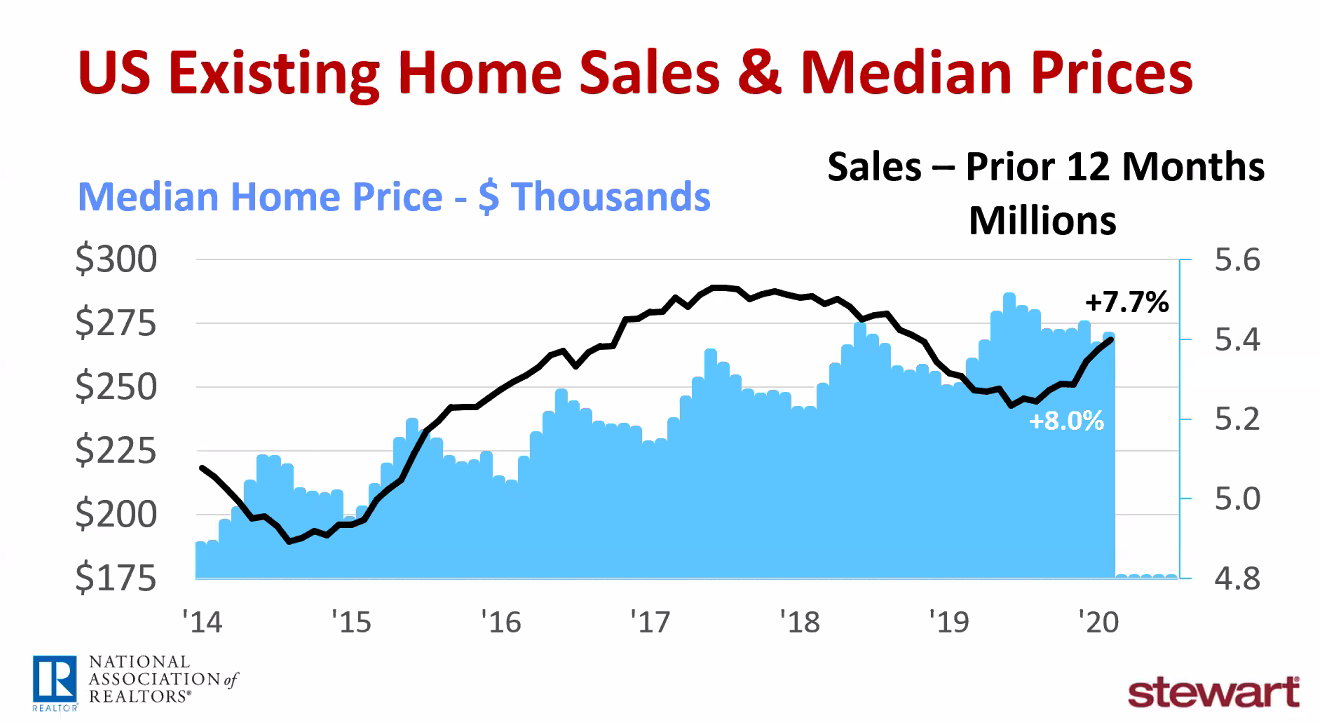

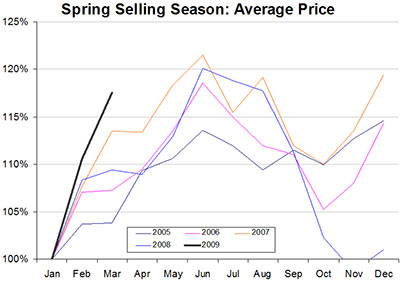

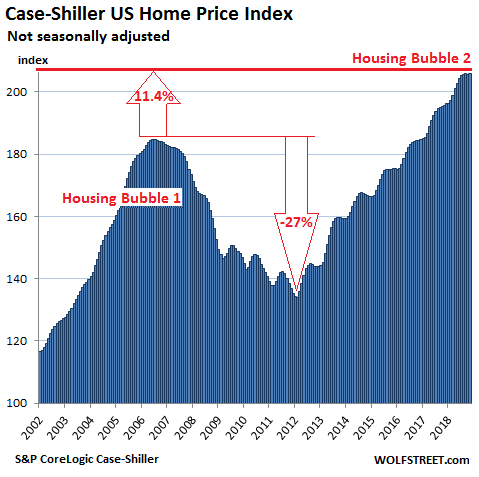

Housing prices peaked in early 2006 started to decline in 2006 and 2007 and reached new lows in 2012. Right now everyones anticipating and enjoying the bubble like euphoria throwing money at home ownership. What Is a Housing Bubble. See how showings new listings sales trended day by day during the lock down. Of course its been predicated on where mortgage rates are.

Source: houstonproperties.com

Source: houstonproperties.com

This might be one of the biggest bubbles of all time Rosenberg founder of Rosenberg Research Associates in Toronto said in an interview on BNN Bloomberg Television. By Nancy Sarnoff on March 25 2014 at 220 PM 12 Houston is one of 19 US. The United States housing bubble was a real estate bubble affecting over half of the US. Coming off a record year the Houston real estate market started 2020 in a sellers market. And many homeowners are wondering if they should sell their house.

Source: houstonproperties.com

Source: houstonproperties.com

Average compensation for a Google engineer for instance is 150000 and households with two or more professional earners easily make multiples of median. Our property investment analyst Ai predicts a positive trend in the near future and buying a house in Houston appears to. The United States housing bubble was a real estate bubble affecting over half of the US. Are we in a real estate bubble. A land boom is the of.

Source: houstonproperties.com

Source: houstonproperties.com

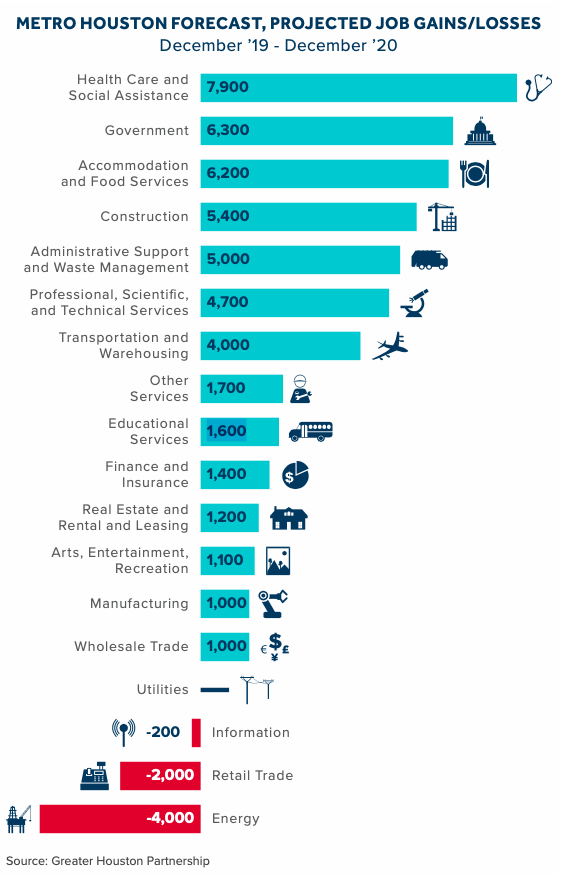

The average amount of days a home stays on market even shortened from an average of 59 days to 46 days. According to current data of median home prices. Global Financial Crisis Lesson 2. David Rosenberg says Canadas housing market in a huge bubble Back to video. Because real estate was deemed an essential service in Houston during the quarantine the housing market held up much better than other cities across the nation.

Source: wolfstreet.com

Source: wolfstreet.com

Average compensation for a Google engineer for instance is 150000 and households with two or more professional earners easily make multiples of median. By Nancy Sarnoff on March 25 2014 at 220 PM 12 Houston is one of 19 US. That is average for Massachusetts but consider the spread. Coming off a record year the Houston real estate market started 2020 in a sellers market. Even during the Great Recession and housing bubble of 2008 rents did not decline they simply grew less quickly than they did previously.

Source: seekingalpha.com

Source: seekingalpha.com

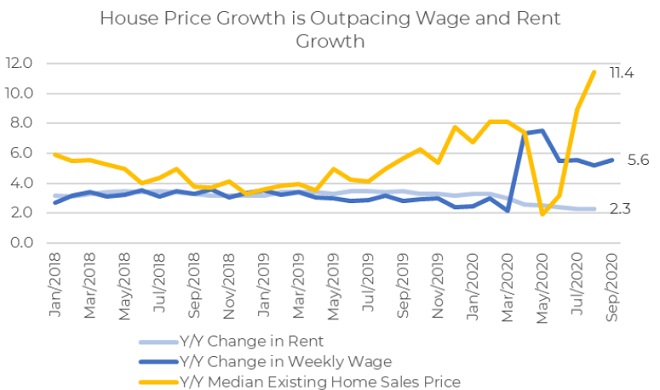

Houstons real estate prices and its market environment have been in a bullish cycle in the last 36 months. On average housing experts reported. Heres a quick guide of the Bay Area real estate market for buyers sellers and everyone in-between. According to local agents nothing stays on the market for long as buyers are buying homes at a fast pace by taking advantage of the record low mortgage rates. These bubbles are caused by a variety of factors including rising economic prosperity low interest rates wider mortgage product offerings and easy to access credit.

Source: christinelabounty.com

Source: christinelabounty.com

The pandemic has put the Bay Area market in turmoil. The Kendall Square median household income in 2018 was 75314. He says monetary and federal housing policy have created another housing bubble. Our property investment analyst Ai predicts a positive trend in the near future and buying a house in Houston appears to. Coming off a record year the Houston real estate market started 2020 in a sellers market.

Source: renardrealtygroup.com

Source: renardrealtygroup.com

The pandemic has put the Bay Area market in turmoil. Coming off a record year the Houston real estate market started 2020 in a sellers market. Forces that make a housing. Heres a quick guide of the Bay Area real estate market for buyers sellers and everyone in-between. Global Financial Crisis Lesson 2.

Source: houstonproperties.com

Source: houstonproperties.com

In a recession and real estate bubble some homeowners end up becoming renters which fuels demand. A housing bubble or real estate bubble is a run-up in housing prices fueled by demand speculation and exuberant spending to the point of collapse. Of course its been predicated on where mortgage rates are. In a recession and real estate bubble some homeowners end up becoming renters which fuels demand. This Dallas-area real estate brokers Twitter feed is terrifying.

Source: houstonproperties.com

Source: houstonproperties.com

A real estate bubble or property bubble or housing bubble for residential markets is a type of economic bubble that occurs periodically in local or global real estate markets and typically follow a land boom. By Nancy Sarnoff on March 25 2014 at 220 PM 12 Houston is one of 19 US. Heres a quick guide of the Bay Area real estate market for buyers sellers and everyone in-between. When even someone who sell houses says theyre not worth their prices buckle up. A few are starting to draw that similarity.

Source: houstonproperties.com

Source: houstonproperties.com

The United States housing bubble was a real estate bubble affecting over half of the US. A bubble in other words is. The average amount of days a home stays on market even shortened from an average of 59 days to 46 days. Are we in a real estate bubble. Global Financial Crisis Lesson 2.

Source: activerain.com

Source: activerain.com

The average amount of days a home stays on market even shortened from an average of 59 days to 46 days. Right now everyones anticipating and enjoying the bubble like euphoria throwing money at home ownership. Houstons real estate market is so strong now that 20-35 dip would create a balanced market Global Financial Crisis Lesson 1. That is average for Massachusetts but consider the spread. These bubbles are caused by a variety of factors including rising economic prosperity low interest rates wider mortgage product offerings and easy to access credit.

Source: houstonproperties.com

Source: houstonproperties.com

Houstons real estate prices and its market environment have been in a bullish cycle in the last 36 months. Global Financial Crisis Lesson 2. These bubbles are caused by a variety of factors including rising economic prosperity low interest rates wider mortgage product offerings and easy to access credit. A real estate bubble or property bubble or housing bubble for residential markets is a type of economic bubble that occurs periodically in local or global real estate markets and typically follow a land boom. Our property investment analyst Ai predicts a positive trend in the near future and buying a house in Houston appears to.

Source: swamplot.com

Source: swamplot.com

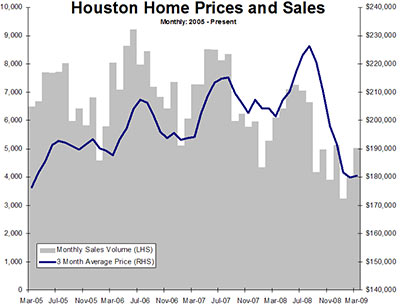

By Nancy Sarnoff on March 25 2014 at 220 PM 12 Houston is one of 19 US. According to current data of median home prices. According to local agents nothing stays on the market for long as buyers are buying homes at a fast pace by taking advantage of the record low mortgage rates. Is Houston headed for a real estate bubble. A real estate bubble or property bubble or housing bubble for residential markets is a type of economic bubble that occurs periodically in local or global real estate markets and typically follow a land boom.

Source: houstonproperties.com

Source: houstonproperties.com

What Is a Housing Bubble. On average housing experts reported. Average compensation for a Google engineer for instance is 150000 and households with two or more professional earners easily make multiples of median. What Is a Housing Bubble. Houston isnt likely headed into a housing bubble.

Source: swamplot.com

Source: swamplot.com

Are we in a real estate bubble. Are we in a real estate bubble. The median home value at the end of 2015. The slowdown in Dallas-Fort Worths housing market may be worse than at first glance. Right now everyones anticipating and enjoying the bubble like euphoria throwing money at home ownership.

Source: benzinga.com

Source: benzinga.com

Housing prices peaked in early 2006 started to decline in 2006 and 2007 and reached new lows in 2012. Are we in a real estate bubble. Houstons real estate market is so strong now that 20-35 dip would create a balanced market Global Financial Crisis Lesson 1. These bubbles are caused by a variety of factors including rising economic prosperity low interest rates wider mortgage product offerings and easy to access credit. Of course its been predicated on where mortgage rates are.

Source: gordcollins.com

Source: gordcollins.com

Global Financial Crisis Lesson 2. According to current data of median home prices. Sales of preowned single-family homes dropped 1 percent annually in August in all of North Texas according to the latest numbers from the Real Estate Center at Texas AM University. In a recession and real estate bubble some homeowners end up becoming renters which fuels demand. Our property investment analyst Ai predicts a positive trend in the near future and buying a house in Houston appears to.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title houston real estate market bubble by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.