Your How does depreciation work in real estate images are available in this site. How does depreciation work in real estate are a topic that is being searched for and liked by netizens now. You can Find and Download the How does depreciation work in real estate files here. Get all royalty-free photos and vectors.

If you’re looking for how does depreciation work in real estate pictures information related to the how does depreciation work in real estate interest, you have come to the ideal blog. Our site always provides you with suggestions for viewing the highest quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

How Does Depreciation Work In Real Estate. At some point you may decide to sell your rental property. Key takeaways for commercial real estate depreciation. When you file your taxes rent and expenses get entered on a Schedule. Depreciation allows you to spread the tax benefit of qualifying expenses over the lifetime of whatever improvement youve made.

How To Calculate Depreciation On Rental Property From iqcalculators.com

How To Calculate Depreciation On Rental Property From iqcalculators.com

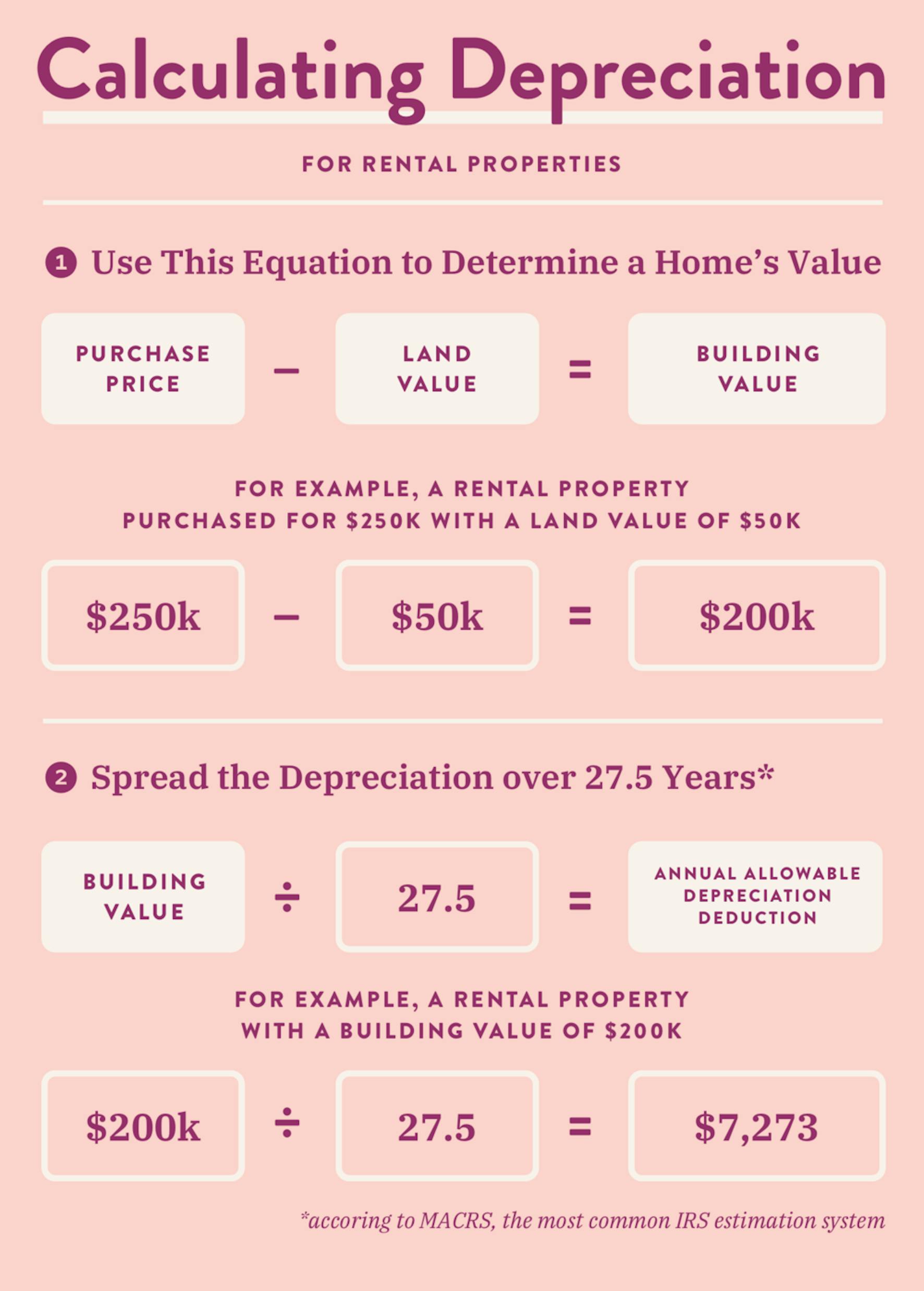

If you bought a house and it was worth 100000 but then the market has taken a downturn and all of a sudden things went downhill and now that house instead of being worth 100000 is now worth 50000. The basis of the property is its cost or the amount you paid in cash with a. While its always recommended that you work with a qualified tax accountant when calculating depreciation here are the basic steps. Simply put real estate investment property depreciation is a big benefit that helps to make it all worthwhile for investors. Depreciation occurs when the property has diminished in value due to time environment and damage. For example the value of the land will depreciate if the adjacent land was made into a.

There are many things that are figured into the value of your home.

Depreciation will play a role in the amount of taxes youll owe when you sell. Depreciation will play a role in the amount of taxes youll owe when you sell. But at a potentially reduced rate. To account for this the IRS allows individuals to allocate the cost of an asset over its life expectancy. Commercial real estate depreciation lets investors expense the cost of income producing property over time lower the amount of personal income tax paid and even roll over and defer the. You may have to pay it back later if you sell.

Source: realestate.com.au

Source: realestate.com.au

For example the value of the land will depreciate if the adjacent land was made into a. Its a tax deduction that lowers your income so if youre in the 24 tax bracket and deduct 5000 in depreciation on your rental. The govt just came up with the period of time. When used in the context of investment real estate Depreciation refers to an allocation of the propertys cost over its useful life. You have some limitations but the depr goes on your sch RII think and if if is 7000 it reduces your income by a like.

Source: trion-properties.com

Source: trion-properties.com

If you bought a house and it was worth 100000 but then the market has taken a downturn and all of a sudden things went downhill and now that house instead of being worth 100000 is now worth 50000. The govt just came up with the period of time. Because depreciation expenses lower your cost basis in the property they ultimately determine your gain or loss when you sell. The remaining is then depreciated over 27 and one half years. It is a great resource for lowering the taxable income that investors make from properties.

Source: youtube.com

Source: youtube.com

Commercial real estate depreciation lets investors expense the cost of income producing property over time lower the amount of personal income tax paid and even roll over and defer the. It is a great resource for lowering the taxable income that investors make from properties. The basis of the property is its cost or the amount you paid in cash with a. To account for this the IRS allows individuals to allocate the cost of an asset over its life expectancy. The govt just came up with the period of time.

Source: investopedia.com

Source: investopedia.com

But at a potentially reduced rate. Its a tax deduction that lowers your income so if youre in the 24 tax bracket and deduct 5000 in depreciation on your rental. You have some limitations but the depr goes on your sch RII think and if if is 7000 it reduces your income by a like. But at a potentially reduced rate. Understand Depreciation in Real Estate Investing - YouTube.

Source: fool.com

Source: fool.com

You may have to pay it back later if you sell. If playback doesnt. These will definitely include the current markets. Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl. How does depreciation recapture work on a rental property.

Source: biggerpockets.com

Source: biggerpockets.com

Simply put real estate investment property depreciation is a big benefit that helps to make it all worthwhile for investors. Determine the basis of the property. Depreciation saves you money by sheltering your real estate income from taxes on an annual basis. At some point you may decide to sell your rental property. Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl.

Source: retipster.com

Source: retipster.com

You have some limitations but the depr goes on your sch RII think and if if is 7000 it reduces your income by a like. Depreciation allows you to spread the tax benefit of qualifying expenses over the lifetime of whatever improvement youve made. The basis of the property is its cost or the amount you paid in cash with a. Because physical assets wear out over time the IRS allows for income tax deductions over time in order to account for the propertys loss of utility. When used in the context of investment real estate Depreciation refers to an allocation of the propertys cost over its useful life.

Source: extension.iastate.edu

Source: extension.iastate.edu

Depreciation occurs when the property has diminished in value due to time environment and damage. Because depreciation expenses lower your cost basis in the property they ultimately determine your. When you file your taxes rent and expenses get entered on a Schedule. These will definitely include the current markets. Separate the cost of land and buildings.

Source: bench.co

Source: bench.co

Instead of making the deduction in the year you purchase or improve your property the depreciation deduction is divided out across the. Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl. On real estate you buy and rent out the govt allows you to take a portion of depreciation each year of an equal amount. Depreciation is defined as a decrease in the value of your property over time. Instead of making the deduction in the year you purchase or improve your property the depreciation deduction is divided out across the.

Source: bmtqs.com.au

Source: bmtqs.com.au

You may have to pay it back later if you sell without exchanging. Depreciation allows you to spread the tax benefit of qualifying expenses over the lifetime of whatever improvement youve made. To account for this the IRS allows individuals to allocate the cost of an asset over its life expectancy. On real estate you buy and rent out the govt allows you to take a portion of depreciation each year of an equal amount. Depreciation however reduces your overall tax liability.

Source: investopedia.com

Source: investopedia.com

When used in the context of investment real estate Depreciation refers to an allocation of the propertys cost over its useful life. Depreciation however reduces your overall tax liability. On real estate you buy and rent out the govt allows you to take a portion of depreciation each year of an equal amount. Depreciation occurs when the property has diminished in value due to time environment and damage. These will definitely include the current markets.

Source: investopedia.com

Source: investopedia.com

Commercial real estate depreciation lets investors expense the cost of income producing property over time lower the amount of personal income tax paid and even roll over and defer the. There are many things that are figured into the value of your home. Its a tax deduction that lowers your income so if youre in the 24 tax bracket and deduct 5000 in depreciation on your rental. The IRS will demand that you pay a premium on that portion of your gain. Because depreciation expenses lower your cost basis in the property they ultimately determine your.

Source: wealthfit.com

Source: wealthfit.com

When used in the context of investment real estate Depreciation refers to an allocation of the propertys cost over its useful life. Depreciation allows you to spread the tax benefit of qualifying expenses over the lifetime of whatever improvement youve made. Determine the basis of the property. This benefit allows both residential rental property and commercial property owners to significantly reduce their taxes. Depreciation occurs when the property has diminished in value due to time environment and damage.

Source: voxeu.org

Source: voxeu.org

But at a potentially reduced rate. The basis of the property is its cost or the amount you paid in cash with a. If you dont know what depreciation means it just simply means the loss of value of an asset due to changes in the market condition or due to wear and tear. The IRS will demand that you pay a premium on that portion of your gain. If playback doesnt.

Source: wealthfit.com

Source: wealthfit.com

The concept behind real estate depreciation is actually pretty simple. When you file your taxes rent and expenses get entered on a Schedule. The IRS will demand that you pay a premium on that portion of your gain. Key takeaways for commercial real estate depreciation. Because physical assets wear out over time the IRS allows for income tax deductions over time in order to account for the propertys loss of utility.

Source: investopedia.com

Source: investopedia.com

When you file your taxes rent and expenses get entered on a Schedule. Its a tax deduction that lowers your income so if youre in the 24 tax bracket and deduct 5000 in depreciation on your rental. When used in the context of investment real estate Depreciation refers to an allocation of the propertys cost over its useful life. Depreciation will play a role in the amount of taxes youll owe when you sell. Because physical assets wear out over time the IRS allows for income tax deductions over time in order to account for the propertys loss of utility.

Source: stessa.com

Source: stessa.com

Its a tax deduction that lowers your income so if youre in the 24 tax bracket and deduct 5000 in depreciation on your rental. Depreciation saves you money by sheltering your real estate income from taxes on an annual basis. Understand Depreciation in Real Estate Investing. How does depreciation recapture work on a rental property. This is the price you pay for property less the land value.

Source: iqcalculators.com

Source: iqcalculators.com

Because depreciation expenses lower your cost basis in the property they ultimately determine your. Its a tax deduction that lowers your income so if youre in the 24 tax bracket and deduct 5000 in depreciation on your rental. On real estate you buy and rent out the govt allows you to take a portion of depreciation each year of an equal amount. You have some limitations but the depr goes on your sch RII think and if if is 7000 it reduces your income by a like. For example the value of the land will depreciate if the adjacent land was made into a.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how does depreciation work in real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.