Your How is real estate commission calculated in the philippines images are ready. How is real estate commission calculated in the philippines are a topic that is being searched for and liked by netizens now. You can Get the How is real estate commission calculated in the philippines files here. Download all free photos.

If you’re looking for how is real estate commission calculated in the philippines pictures information connected with to the how is real estate commission calculated in the philippines keyword, you have pay a visit to the ideal site. Our website always provides you with suggestions for seeing the maximum quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

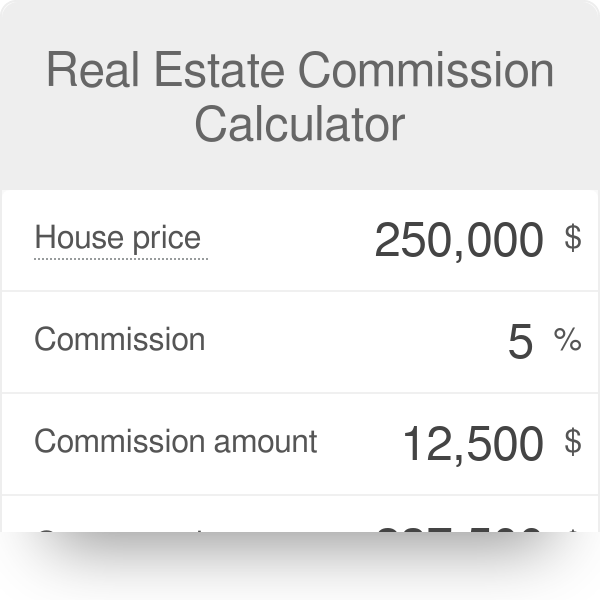

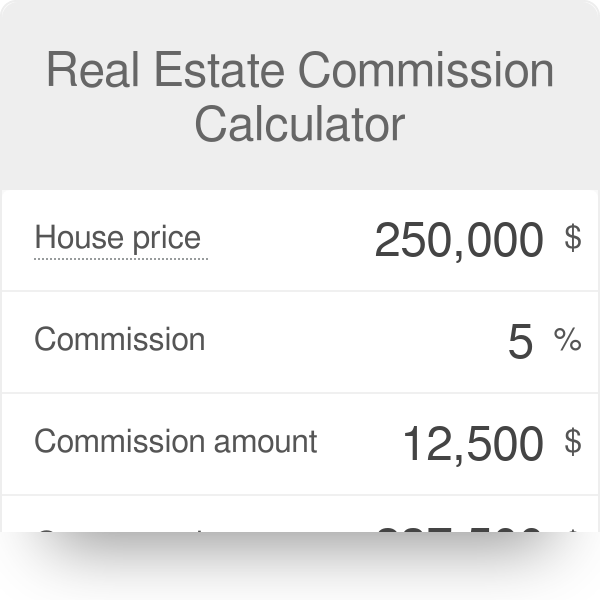

How Is Real Estate Commission Calculated In The Philippines. You need a knowledgeable and dependable partner who will look out for you so that you can rest assured that no problems will arise in the future regarding your transaction. Most if not all real estate transactions involve considerable amounts of money. Transfer Tax - 05 of the selling price. The seller pays the corresponding amount upon closing to their agent who will then share the.

La2ml4b7nsmx0m From

La2ml4b7nsmx0m From

Im not sure if this is fair but shes asking for one months rent for the first year and another months rent for the 2nd year and she asked to get the same for the. In the Philippines the common commission rates for brokers are 3 to 6 while agents usually get 2 to 3 at least thats what I often see from other real estate brokers and agents. The typical rate of a Philippines Real Estate Broker is from 3-5 of the selling price of the real estate property commission. In the Philippines the common commission rates for brokers are 3 to 6 while agents usually get 2 to 3. The majority of real estate agents will usually take around 5-6 from every successful home sale they make. C x Metro Manila RPT rate 2 Php56000 The total basic real.

So whether you are buying a property or selling yours you need someone who will make sure everything is done properly and legally so that you are protected.

Now that we have the total assessed value of the property we multiply it by the applicable real property tax rate to get the tax amount to be paid by Jesus Gulapa. Specifically the range for real estate brokers is between 3 and 6 while for real estate agents it is between 2 and 3 percent. Usually when hiring a real estate agent their fees cover the cost of Advertising the property their service fee Real Estate commission The average Real Estate agent commission in Australia varies depending on which state or area you live in. According to Jake Loria licensed real estate broker and founder of The Real Estate Group Philippines all the aforementioned requirements indeed make the transfer of land titles one of the most burdensome processes in local real estate. The typical rate of a Philippines Real Estate Broker is from 3-5 of the selling price of the real estate property commission. This means No Sale No Commission.

Source: pinterest.com

Source: pinterest.com

Advantages of earned income 1. Unpaid real estate taxes due if any. Higher commissions are possible but the typical rate is 5. In the Philippines licensed real estate brokers usually get three 3 to six 6 percent commission. Remember I am also a licensed real estate broker.

Source: profitwell.com

Source: profitwell.com

In the Philippines the common commission rates for brokers are 3 to 6 while agents usually get 2 to 3 at least thats what I often see from other real estate brokers and agents. While buyers and sellers can set agreements and embark on paying the taxes and fees and having the documents processed themselves Loria suggests utilizing. The typical rate of a Philippines Real Estate Broker is from 3-5 of the selling price of the real estate property commission. Real estate commissions are the fees you pay to your real estate agent for their services. There shall be an imposed rate of six percent 6 based on the value of such NET ESTATE determined as of the time of death of decedent composed of all properties real or personal tangible or intangible less allowable deductions.

Source: pinterest.com

Source: pinterest.com

Transfer Tax - 05 of the selling price. The average combined real estate agent commission is 35 to 5 of the total selling price which is then split between the buyers and sellers agents. Regional areas the lowest is about 16 and the highest can be about 4 or higher. 8424 If the Net Estate is. Now that we have the total assessed value of the property we multiply it by the applicable real property tax rate to get the tax amount to be paid by Jesus Gulapa.

Source: pinterest.com

Source: pinterest.com

Real estate commissions are the fees you pay to your real estate agent for their services. Im not sure if this is fair but shes asking for one months rent for the first year and another months rent for the 2nd year and she asked to get the same for the. You need a knowledgeable and dependable partner who will look out for you so that you can rest assured that no problems will arise in the future regarding your transaction. The buyers portion is usually fixed at 25 HST and the sellers portion is variable depending on the rate negotiated. The BUYER pays for the cost of Registration.

Source: pinterest.com

Source: pinterest.com

Remember I am also a licensed real estate broker. There are no rules truly set in stone when when it comes to what percentage of the price of a home sale is to be paid to the selling broker and in the Philippines the common amount is between 2 and 6 percent. While there are some real estate agents who will charge a flat fee for their services most charge a percentage of the sales price of the home once the deal is done. The seller pays the corresponding amount upon closing to their agent who will then share the. The average combined real estate agent commission is 35 to 5 of the total selling price which is then split between the buyers and sellers agents.

Source: co.pinterest.com

Source: co.pinterest.com

Transfer Tax - 05 of the selling price. The buyers portion is usually fixed at 25 HST and the sellers portion is variable depending on the rate negotiated. For purposes of prescribing real property values the Commissioner is authorized to divide the Philippines into different zones or areas and shall upon consultation with competent appraisers both from the private and public sectors determine the fair market value of real properties located in each zone or area. Hi I just want to ask how much do I have to pay the real estate agent who found this tenant for me. Usually when hiring a real estate agent their fees cover the cost of Advertising the property their service fee Real Estate commission The average Real Estate agent commission in Australia varies depending on which state or area you live in.

Source: pinterest.com

Source: pinterest.com

Transfer Tax - 05 of the selling price. That exact percentage varies. The typical rate of a Philippines Real Estate Broker is from 3-5 of the selling price of the real estate property commission. Unpaid real estate taxes due if any. The BUYER pays for the cost of Registration.

Source: pinterest.com

Source: pinterest.com

Another way to get earned income in real estate would be through commissions. An estate tax is calculated by first determining the value of the deceaseds net estate or net value. Remember I am also a licensed real estate broker. The typical rate of a Philippines Real Estate Broker is from 3-5 of the selling price of the real estate property commission. While there are some real estate agents who will charge a flat fee for their services most charge a percentage of the sales price of the home once the deal is done.

Source: pinterest.com

Source: pinterest.com

8424 If the Net Estate is. Regional areas the lowest is about 16 and the highest can be about 4 or higher. In the Philippines the common commission rates for brokers are 3 to 6 while agents usually get 2 to 3 at least thats what I often see from other real estate brokers and agents. Im not sure if this is fair but shes asking for one months rent for the first year and another months rent for the 2nd year and she asked to get the same for the. The buyers portion is usually fixed at 25 HST and the sellers portion is variable depending on the rate negotiated.

Source: pinterest.com

Source: pinterest.com

In BC buyer and seller real estate agents charge a graduated commission based on the transaction value that usually ranges between 3 to 4 for the first 100000 of a propertys price and between 1 to 2 for the remaining total. Remember I am also a licensed real estate broker. Unpaid real estate taxes due if any. Advantages of earned income 1. Im not sure if this is fair but shes asking for one months rent for the first year and another months rent for the 2nd year and she asked to get the same for the.

Source: pinterest.com

Source: pinterest.com

Im not sure if this is fair but shes asking for one months rent for the first year and another months rent for the 2nd year and she asked to get the same for the. The agents who are under the brokers get two 2 to three 3 percent commission. 8424 If the Net Estate is. The BUYER pays for the cost of Registration. The seller pays the corresponding amount upon closing to their agent who will then share the.

Source: rentspree.com

Source: rentspree.com

The buyers portion is usually fixed at 25 HST and the sellers portion is variable depending on the rate negotiated. Hi I just want to ask how much do I have to pay the real estate agent who found this tenant for me. Most if not all real estate transactions involve considerable amounts of money. Usually when hiring a real estate agent their fees cover the cost of Advertising the property their service fee Real Estate commission The average Real Estate agent commission in Australia varies depending on which state or area you live in. D Real Property Tax.

Source: profitwell.com

Source: profitwell.com

An estate tax is calculated by first determining the value of the deceaseds net estate or net value. For purposes of prescribing real property values the Commissioner is authorized to divide the Philippines into different zones or areas and shall upon consultation with competent appraisers both from the private and public sectors determine the fair market value of real properties located in each zone or area. An estate tax is calculated by first determining the value of the deceaseds net estate or net value. The buyers portion is usually fixed at 25 HST and the sellers portion is variable depending on the rate negotiated. Im not sure if this is fair but shes asking for one months rent for the first year and another months rent for the 2nd year and she asked to get the same for the.

Source: pinterest.com

Source: pinterest.com

In the Philippines licensed real estate brokers usually get three 3 to six 6 percent commission. Most if not all real estate transactions involve considerable amounts of money. You need a knowledgeable and dependable partner who will look out for you so that you can rest assured that no problems will arise in the future regarding your transaction. While buyers and sellers can set agreements and embark on paying the taxes and fees and having the documents processed themselves Loria suggests utilizing. Hi I just want to ask how much do I have to pay the real estate agent who found this tenant for me.

Source: rentspree.com

Source: rentspree.com

At closing when the home buyer and seller shake hands sign contracts and exchange funds the real estate agent is entitled to their piece of the pie otherwise known as the commission. There are no rules truly set in stone when when it comes to what percentage of the price of a home sale is to be paid to the selling broker and in the Philippines the common amount is between 2 and 6 percent. The agents who are under the brokers get two 2 to three 3 percent commission. In the Philippines licensed real estate brokers usually get three 3 to six 6 percent commission. Gross EstateValue Allowed Deductions Net Estate x 6 Estate Tax Rate Estate Due Republic Act No.

Source:

Source:

While buyers and sellers can set agreements and embark on paying the taxes and fees and having the documents processed themselves Loria suggests utilizing. The majority of real estate agents will usually take around 5-6 from every successful home sale they make. In the Philippines the common commission rates for brokers are 3 to 6 while agents usually get 2 to 3. For purposes of prescribing real property values the Commissioner is authorized to divide the Philippines into different zones or areas and shall upon consultation with competent appraisers both from the private and public sectors determine the fair market value of real properties located in each zone or area. But theres a downside if you rely on earned income only.

Source: rentspree.com

Source: rentspree.com

Im not sure if this is fair but shes asking for one months rent for the first year and another months rent for the 2nd year and she asked to get the same for the. Transfer Tax - 05 of the selling price. The buyers portion is usually fixed at 25 HST and the sellers portion is variable depending on the rate negotiated. Effective January 1 1998 up to December 31 2017 RA No. Remember I am also a licensed real estate broker.

Source: commissiontrac.com

Source: commissiontrac.com

Effective January 1 1998 up to December 31 2017 RA No. But theres a downside if you rely on earned income only. Most if not all real estate transactions involve considerable amounts of money. Im not sure if this is fair but shes asking for one months rent for the first year and another months rent for the 2nd year and she asked to get the same for the. Now that we have the total assessed value of the property we multiply it by the applicable real property tax rate to get the tax amount to be paid by Jesus Gulapa.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how is real estate commission calculated in the philippines by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.